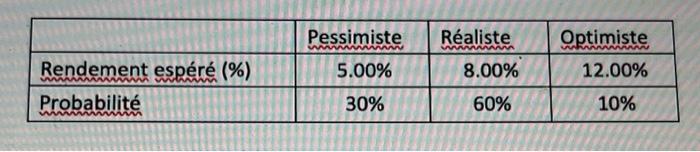

Question: Problem 3 (10 points) Looking ahead to next year, the expected returns for ABC Company stock, given different predictions and their respective probabilities, would be

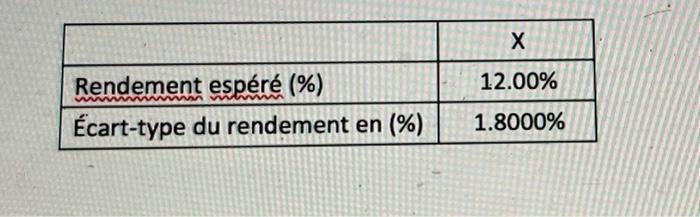

Pessimiste Raliste Optimiste WAN WAWAANAA www 5.00% 8.00% 12.00% Rendement espr (%) Probabilit 30% 60% 10% 12.00% Rendement espr (%) cart-type du rendement en (%) 1.8000%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts