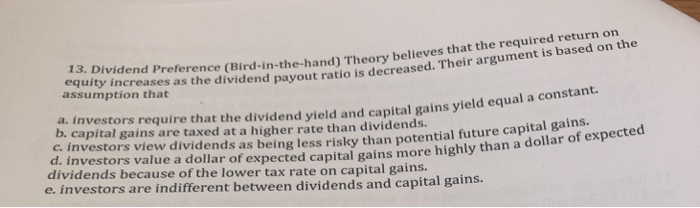

Question: Preference (Bird-in-the-hand) Theory believes that the required return on hat s the dividend payout ratio is decreased. Their argument is based on the 13. Dividend

Preference (Bird-in-the-hand) Theory believes that the required return on hat s the dividend payout ratio is decreased. Their argument is based on the 13. Dividend assumption that a. investors require that the dividend vield and capital gains yield equal a co b. capital gains are taxed at a higher rate than dividends. nstant. e investors view dividends as being less risky than potential future capita kfe d, Investors value a dollar of expected capital gains more highly than a llar or e. investors are indifferent between dividends and capital gains

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock