Question: Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of equity.

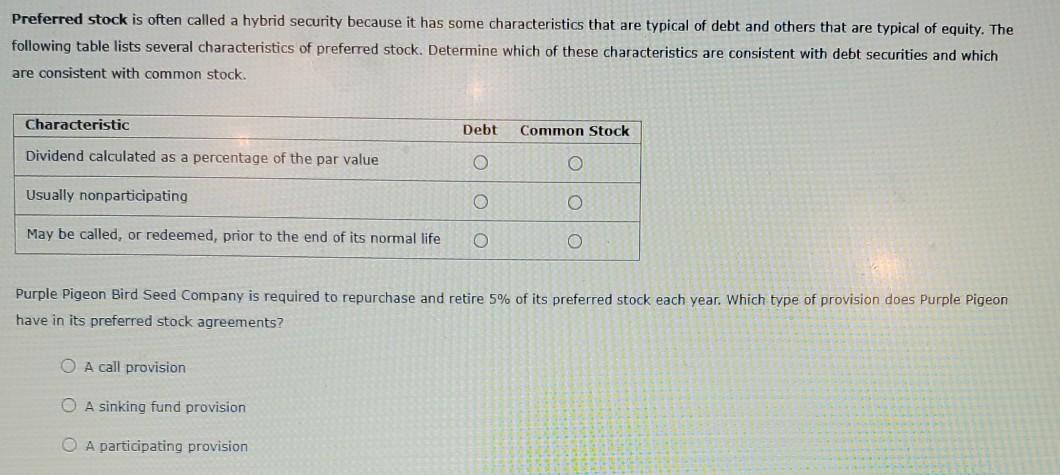

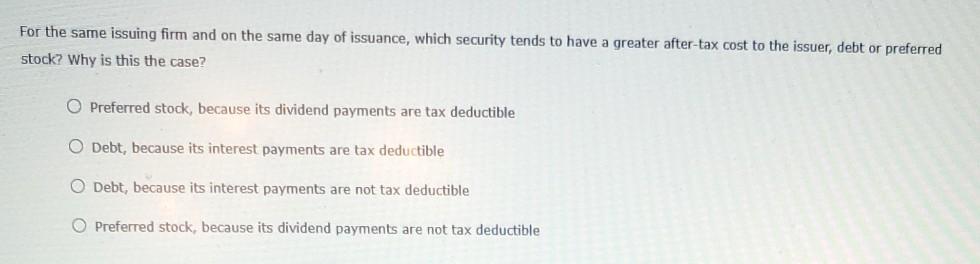

Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock. Characteristic Debt Common Stock Dividend calculated as a percentage of the par value O Usually nonparticipating May be called, or redeemed, prior to the end of its normal life Purple Pigeon Bird Seed Company is required to repurchase and retire 5% of its preferred stock each year. Which type of provision does Purple Pigeon have in its preferred stock agreements? O A call provision O A sinking fund provision O A participating provision For the same issuing firm and on the same day of issuance, which security tends to have a greater after-tax cost to the issuer, debt or preferred stock? Why is this the case? O Preferred stock, because its dividend payments are tax deductible O Debt, because its interest payments are tax deductible O Debt, because its interest payments are not tax deductible Preferred stock, because its dividend payments are not tax deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts