Question: Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common

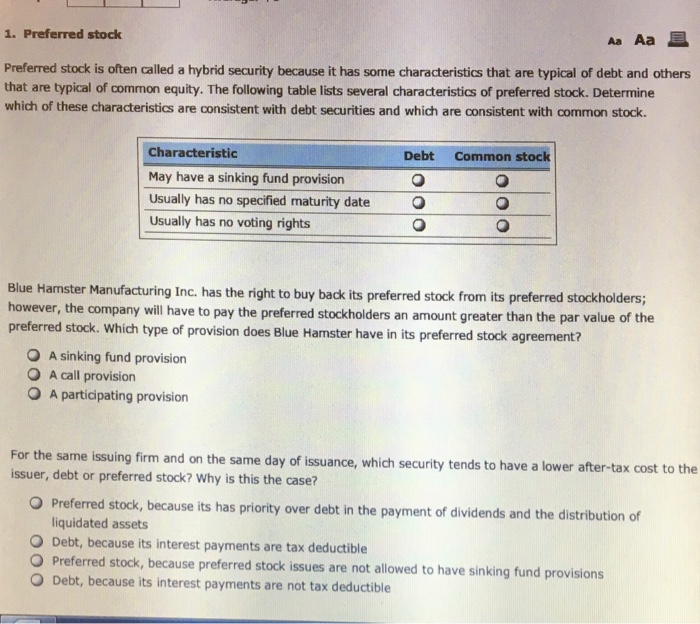

Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock. Blue Hamster Manufacturing Inc. has the right to buy back its preferred stock from its preferred stockholders; however, the company will have to pay the preferred stockholders an amount greater than the par value of the preferred stock. Which type of provision does Blue Hamster have in its preferred stock agreement? A sinking fund provision A call provision A participating provision For the same issuing firm and on the same day of issuance, which security tends to have a lower after-tax cost to the issuer, debt or preferred stock? Why is this the case? Preferred stock, because its has priority over debt in the payment of dividends and the distribution of liquidated assets Debt, because its interest payments are tax deductible Preferred stock, because preferred stock issues are not allowed to have sinking fund provisions Debt, because its interest payments are not tax deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts