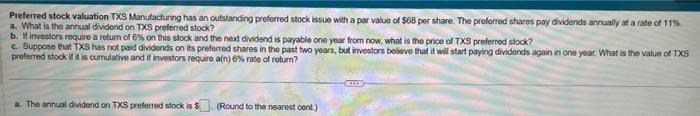

Question: Preferred stock valuation TXS Manulacturing has an outstancing preferred stock issue with a par value of $68 per share. The preforred shares pay dividends annually

Preferred stock valuation TXS Manulacturing has an outstancing preferred stock issue with a par value of \$68 per share. The preforred shares pay dividends annually at a rate of 11% a. What is the annual dividend on TXS preferred stock? b. Hf itwesiors roquire a retum of 6% on this slock and the neat dividend is payable one year from now, what is the price of TXS preferred stock? c. Suppose that TXS has not paid dividends on its preferred shares in the past two years, but invostors beleve that it will start paying dividends again in one year. What is the value of DeS preferred stock if it is cumulative and if investors requiro a(n) 6 w rate of roturn? a. The arnual dividend on TXS preferred stock is s (Rryund to the nearest cont)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts