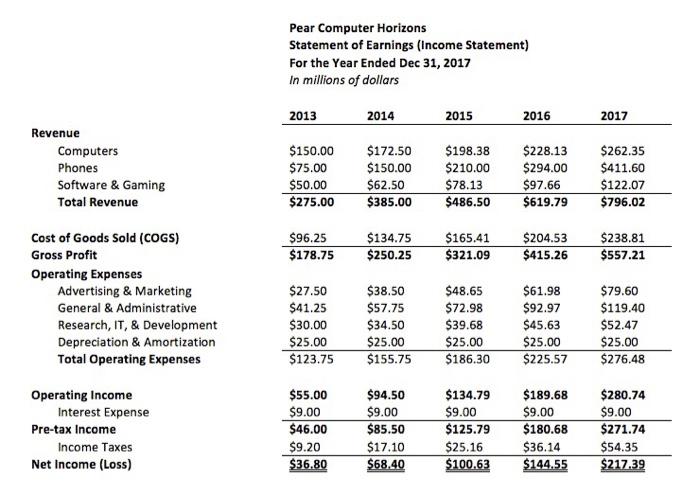

Question: Prepare a basic income statement forecast for the subsequent fiscal year, using a percentage of sales approach and using information included in the materials below

- Prepare a basic income statement forecast for the subsequent fiscal year, using a percentage of sales approach and using information included in the materials below to support assumptions that correspond for each revenue and expense. Each line item (e.g., marketing expenses) should have a note and an explanation on how it was calculated.

1. 2018 is expected to see a reduction in the rapid growth rate that PCH experienced over the last five years, as total sales are only expected to increase by 10% in 2018. 2. The phone segment is expected to be 50% of total 2018 sales, down from 51.7% in 2017. 3. Computers will maintain a similar share as a percentage of sales as in 2017, while the gaming & software segment is expected to increase to 17% of sales. 4. Material costs for aluminum, a key component in PCH computers, are expected to rise significantly in 2018, negatively impacting gross margin by 2%. 5. The depreciating Canadian dollar relative to other currencies is also expected to negatively impact gross margin by -1%. 6. Switching the material supplier will lead to a 1% increase in the cost of goods sold. 7.There is major uncertainty surrounding NAFTA and trade tariffs at the US border.So, suggestion is to include a 1% reduction in gross margin to incorporate this uncertainty. 8. Research and development (R&D) costs have traditionally been budgeted as 20% of computer sales. 9. Unfortunately, PCH's purchase of a virtual reality company a few years back was not as fruitful as anticipated. The virtual reality company was absorbed as a sub-division of the company, but it is now being divested to cut down on costs, leading to an expected $100M loss in 2018 from a write down of goodwill. 10. Equipment and licenses from that division are also being sold, with a $20M gain from the license sale mitigated by a $10M loss from the equipment sale. 11.The tax rate, depreciation, and interest rate for PCH are expected to be consistent with prior years. 12. PCH's long-term debt consists of ten-year bonds that do not mature into 2023. PCH also has a credit facility with $300M borrowing capacity that had no outstanding borrowings at the end of the fiscal year. Pear Computer Horizons Statement of Earnings (Income Statement) For the Year Ended Dec 31, 2017 In millions of dollars 2013 2014 2015 2016 2017 Revenue Computers Phones Software & Gaming Total Revenue $150.00 $75.00 $50.00 $275.00 $172.50 $150.00 $62.50 $385.00 $198.38 $210.00 $78.13 $486.50 $228.13 $294.00 $97.66 $619.79 $262.35 $411.60 $122.07 $796.02 $96.25 $178.75 $134.75 $250.25 $165.41 $321.09 $204.53 $415.26 $238.81 $557.21 Cost of Goods Sold (COGS) Gross Profit Operating Expenses Advertising & Marketing General & Administrative Research, IT, & Development Depreciation & Amortization Total Operating Expenses $27.50 $41.25 $30.00 $25.00 $123.75 $38.50 $57.75 $34.50 $25.00 $155.75 $48.65 $72.98 $39.68 $25.00 $186.30 $61.98 $92.97 $45.63 $25.00 $225.57 $79.60 $119.40 $52.47 $25.00 $276.48 Operating Income Interest Expense Pre-tax Income Income Taxes Net Income (Loss) $55.00 $9.00 $46.00 $9.20 $36.80 $94.50 $9.00 $85.50 $17.10 $68.40 $134.79 $9.00 $125.79 $25.16 $100.63 $189.68 $9.00 $180.68 $36.14 $144.55 $280.74 $9.00 $271.74 $54.35 $217,39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts