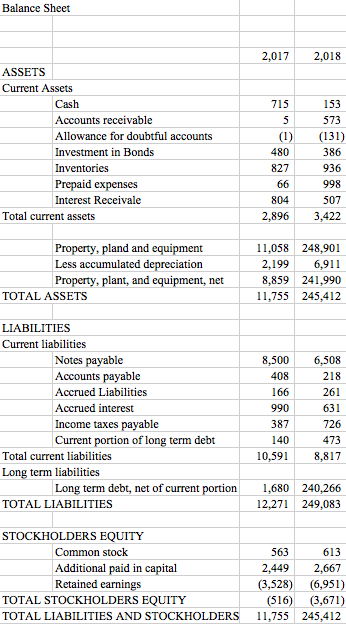

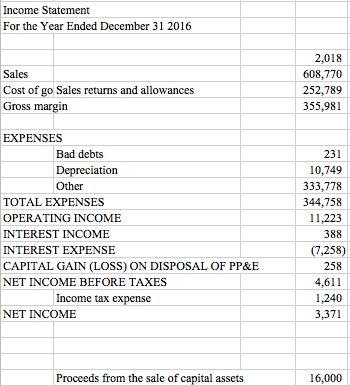

Question: Prepare a cash flow using the direct method. Also, prepare a schedule of the calculation of purchases of fixed assets. You must have ending cash

Prepare a cash flow using the direct method. Also, prepare a schedule of the calculation of purchases of fixed assets. You must have ending cash on the cash flow statement equal to cash on the balance sheet. Cash flow from operating activities on the face of the statement and the reconciliation must be the same.

Balance Sheet 2,017 2,018 ASSETS Current Assets 715 153 Accounts receivable Allowance for doubtful accounts Investment in Bonds Inventories Prepaid expenses Interest Receivale (1) (131) 386 936 998 Total current assets 2,896 3,422 Property, pland and equipment Less accumulated depreciation Property, plant, and equipment, net 11,058248,901 2,1996,911 8,859 241,990 11,755 245,412 TOTAL ASSETS LIABILITIES Current liabilities Notes payable Accounts payable Accrued Liabilities Accrued interest Income taxes payable Current portion of long term debt 8,500 ,508 218 261 631 166 387 140 473 10,5918,817 Total current liabilities Long term liabilities Long term debt, net of current portion 1,680 240,266 2,271 249,083 TOTAL LIABILITIES STOCKHOLDERS EQUITY 613 2,449 2,667 (3,528) (6,951) (516) (3,671) Common stock Additional paid in capital Retained earnings TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS 11,755245,412 Income Statement For the Year Ended December 31 2016 2,018 608,770 252,789 355,981 Sales Cost of go Sales returns and allowances Gross margin EXPENSES 231 10,749 333,778 344,758 11,223 388 7,258) 258 4,611 1,240 3,371 Bad debts Depreciation Other TOTAL EXPENSES OPERATING INCOME INTEREST INCOME INTEREST EXPENSE CAPITAL GAIN (LOSS) ON DISPOSAL OF PP&E NET INCOME BEFORE TAXES Income tax expense NET INCOME Proceeds from the sale of capital assets 16,000 Balance Sheet 2,017 2,018 ASSETS Current Assets 715 153 Accounts receivable Allowance for doubtful accounts Investment in Bonds Inventories Prepaid expenses Interest Receivale (1) (131) 386 936 998 Total current assets 2,896 3,422 Property, pland and equipment Less accumulated depreciation Property, plant, and equipment, net 11,058248,901 2,1996,911 8,859 241,990 11,755 245,412 TOTAL ASSETS LIABILITIES Current liabilities Notes payable Accounts payable Accrued Liabilities Accrued interest Income taxes payable Current portion of long term debt 8,500 ,508 218 261 631 166 387 140 473 10,5918,817 Total current liabilities Long term liabilities Long term debt, net of current portion 1,680 240,266 2,271 249,083 TOTAL LIABILITIES STOCKHOLDERS EQUITY 613 2,449 2,667 (3,528) (6,951) (516) (3,671) Common stock Additional paid in capital Retained earnings TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS 11,755245,412 Income Statement For the Year Ended December 31 2016 2,018 608,770 252,789 355,981 Sales Cost of go Sales returns and allowances Gross margin EXPENSES 231 10,749 333,778 344,758 11,223 388 7,258) 258 4,611 1,240 3,371 Bad debts Depreciation Other TOTAL EXPENSES OPERATING INCOME INTEREST INCOME INTEREST EXPENSE CAPITAL GAIN (LOSS) ON DISPOSAL OF PP&E NET INCOME BEFORE TAXES Income tax expense NET INCOME Proceeds from the sale of capital assets 16,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts