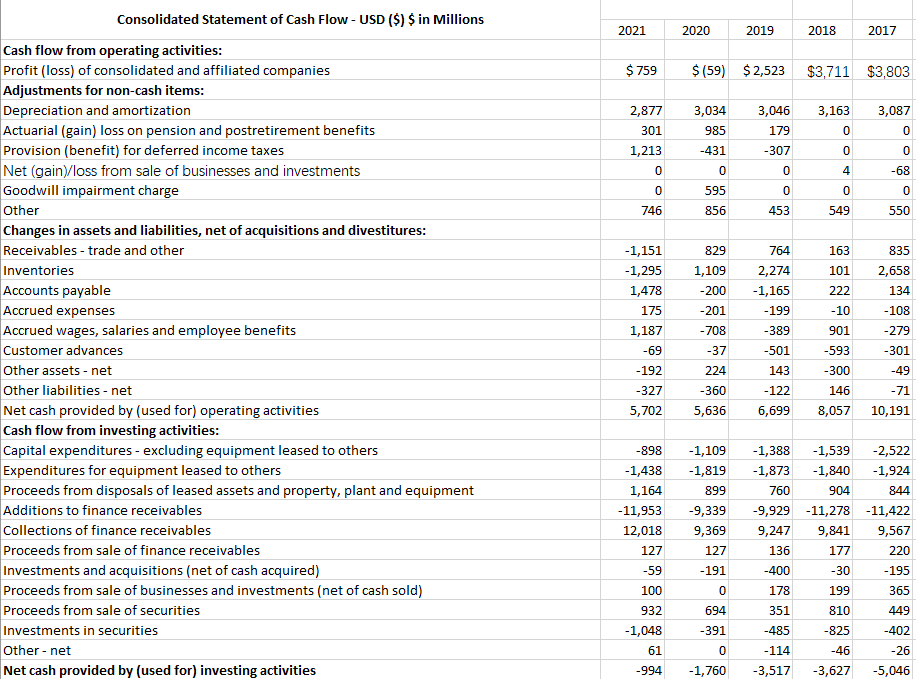

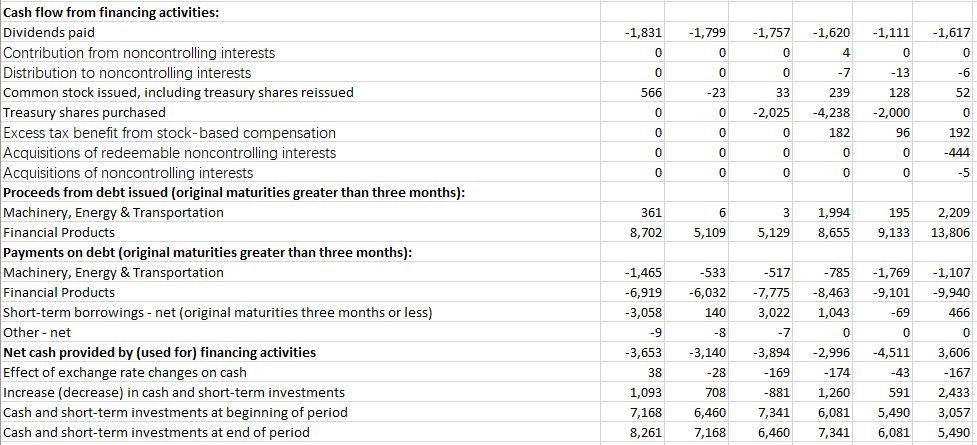

Question: Prepare a common-size cash flow statement using net sales as the common size and keep 2 decimal places in the percentage, (for example, 12.43%). Are

-

- Prepare a common-size cash flow statement using net sales as the common size and keep 2 decimal places in the percentage, (for example, 12.43%).

- Are depreciation expenses and capital expenditure significant components in the cash flow statement percentage-wise? Is that surprising?

- Percentage-wise is operating cash flowet sales higher than net income/sales?? Is that good?

- Do operating cash flows meet the needs of investment and distribution? Provide your comment(s) on the trend of the answer to this question.

Consolidated Statement of Cash Flow - USD (\$) \$ in Millions Cash flow from operating activities: Profit (loss) of consolidated and affiliated companies Adjustments for non-cash items: Cash flow from financing activities: Consolidated Statement of Cash Flow - USD (\$) \$ in Millions Cash flow from operating activities: Profit (loss) of consolidated and affiliated companies Adjustments for non-cash items: Cash flow from financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts