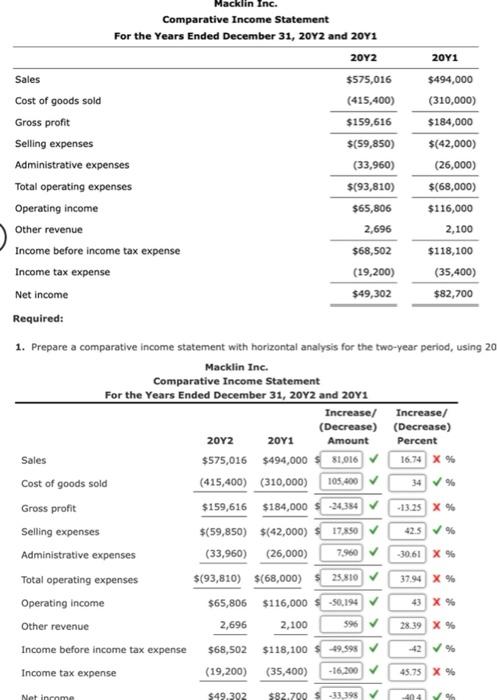

Question: Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a

Macklin Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 2012 20Y1 $575,016 $494,000 Sales Cost of goods sold (415,400) (310,000) Gross profit $159,616 $184,000 Selling expenses $(59,850) $(42,000) Administrative expenses (33,960) (26,000) Total operating expenses $(93,810) $(68,000) Operating income $65,806 $116,000 Other revenue 2,696 2,100 Income before income tax expense $68,502 $118,100 Income tax expense (19,200) (35,400) Net income $49,302 $82,700 Required: 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20 Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 Increase/ Increase/ (Decrease) (Decrease) 20Y2 20Y1 Amount Percent Sales $575,016 $494,000 81,016 16.74 X % Cost of goods sold (415,400) (310,000) 105,400 34% Gross profit $159,616 $184,000 -24,384 -13.25 X % Selling expenses 17,850 42.5% $(59,850) $(42,000) (33,960) (26,000) Administrative expenses 7,960 -30.61 X % Total operating expenses $(93,810) $(68,000) 25,810 37.94 X % Operating income $65,806 $116,000 -50,194 43 X % Other revenue 596 28.39 X % 2,696 2,100 $68,502 $118,100 $49.598 Income before income tax expense -42% Income tax expense (19,200) (35,400) -16,200 45.75 X % Net income $49,302 $82.700 $33,398 404 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts