Question: Prepare a contribution format income statement for Chipotle for 2017 . When preparing this statement: (1) include each line (with a dollar amount) from the

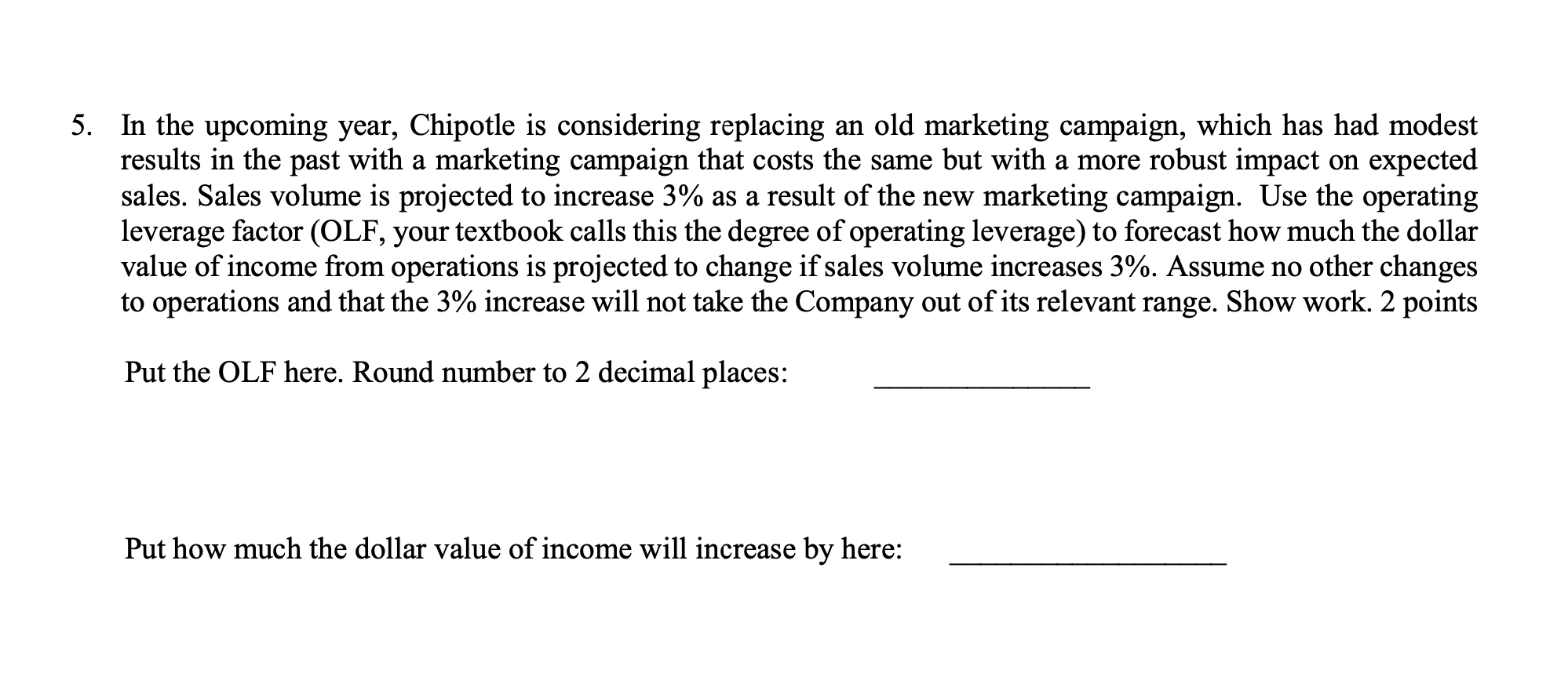

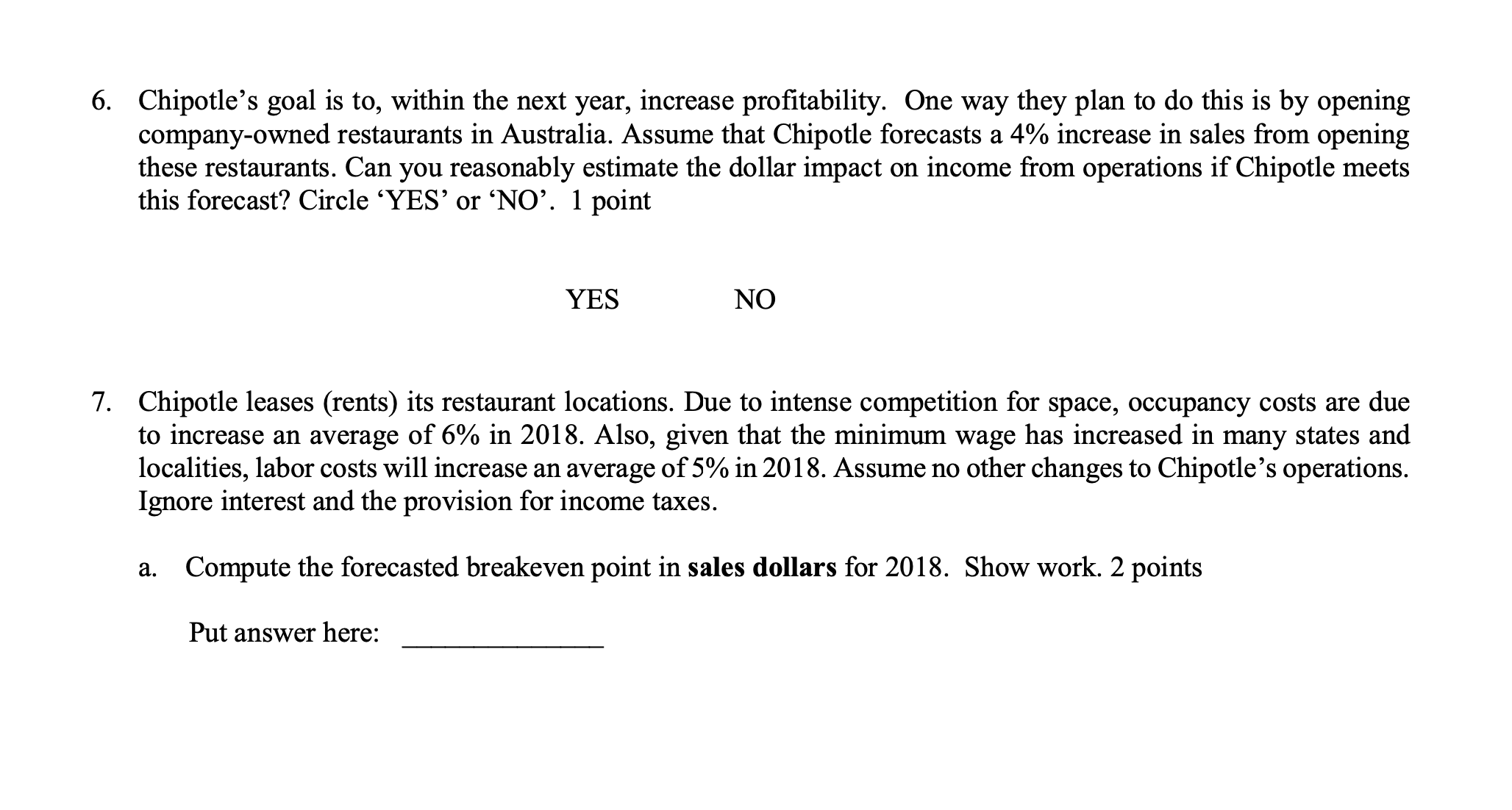

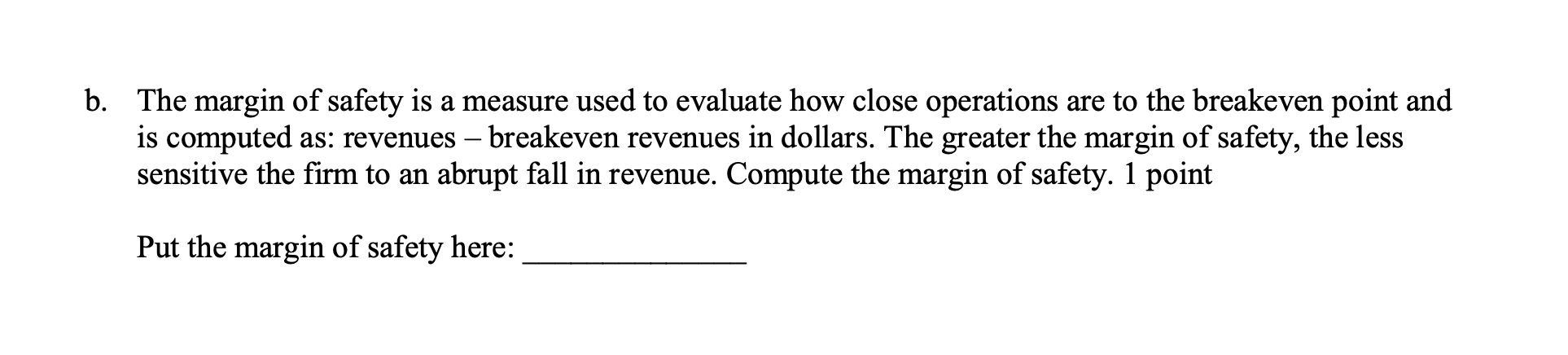

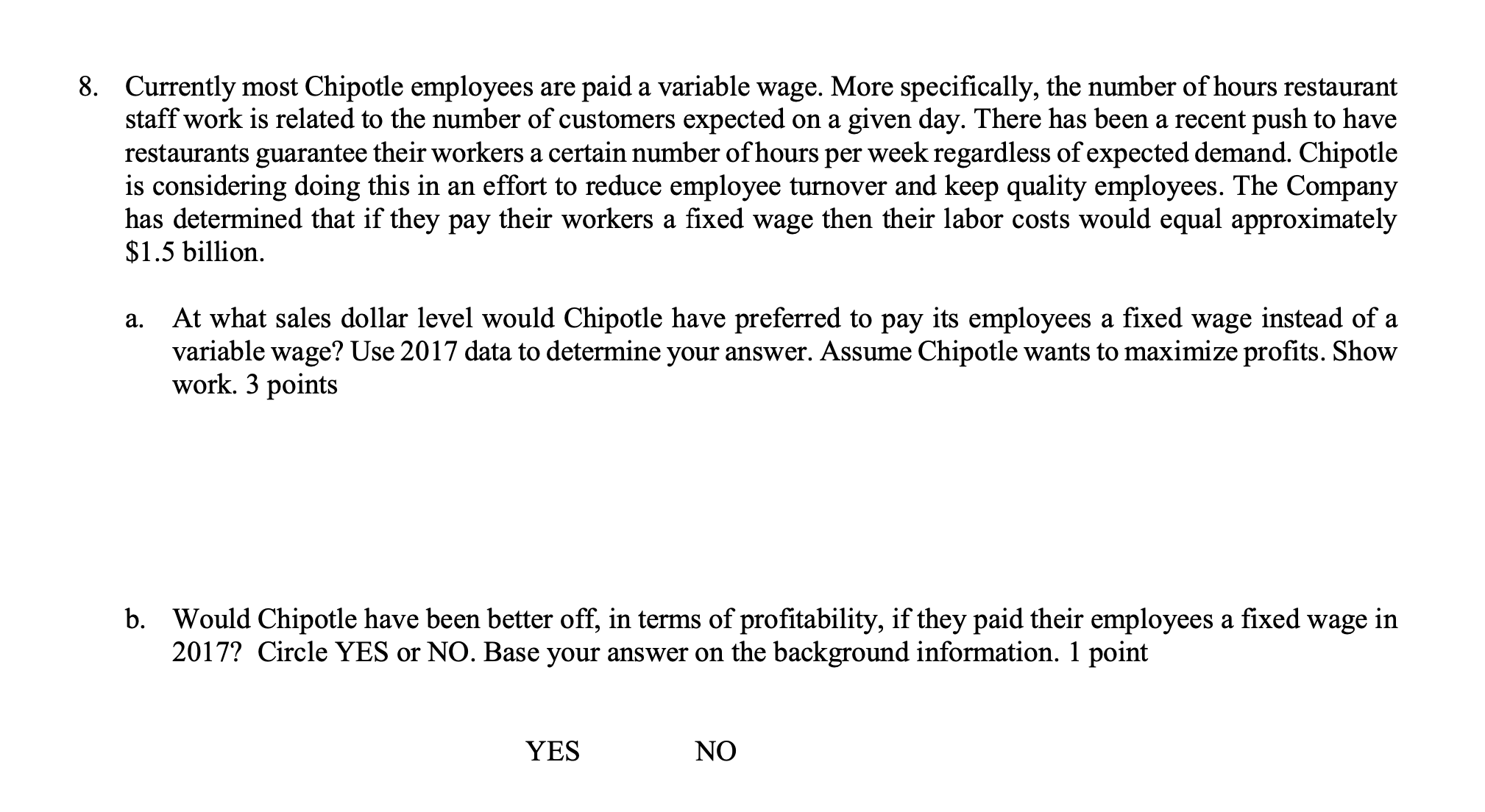

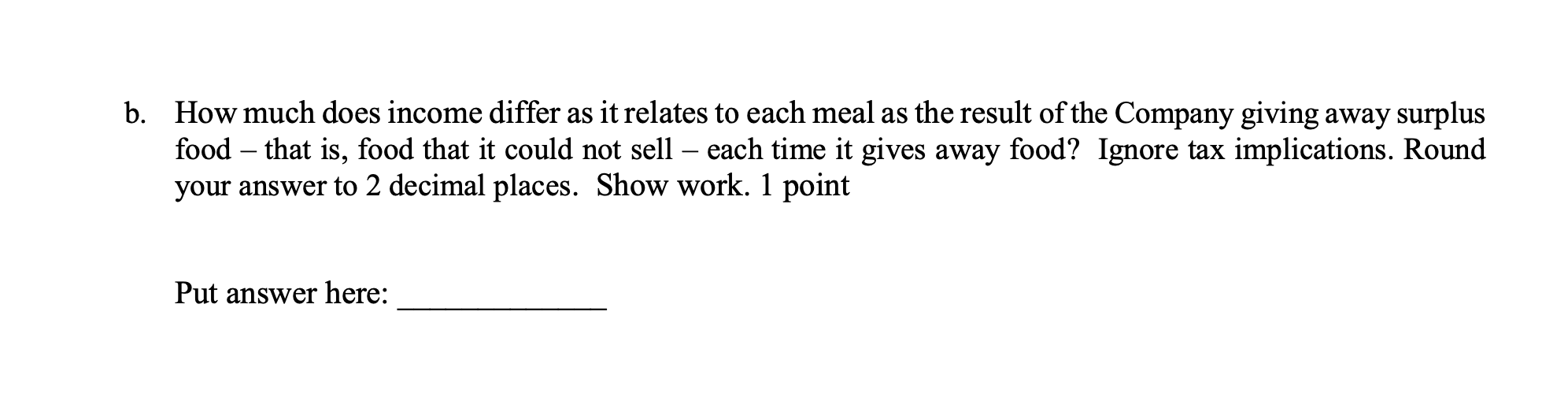

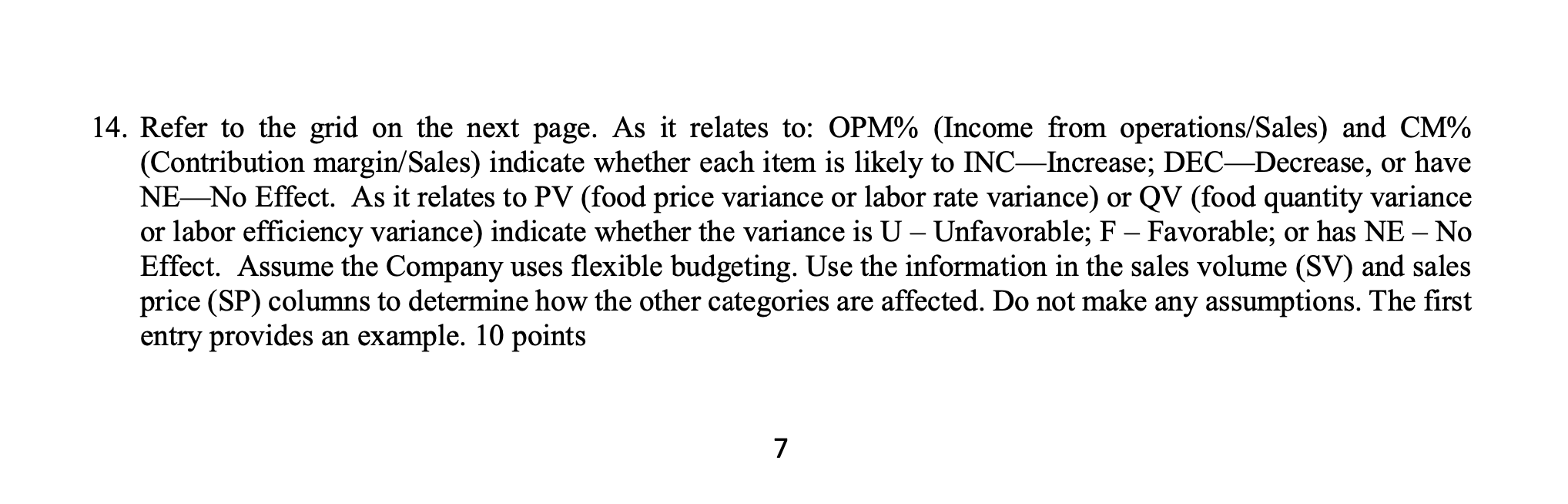

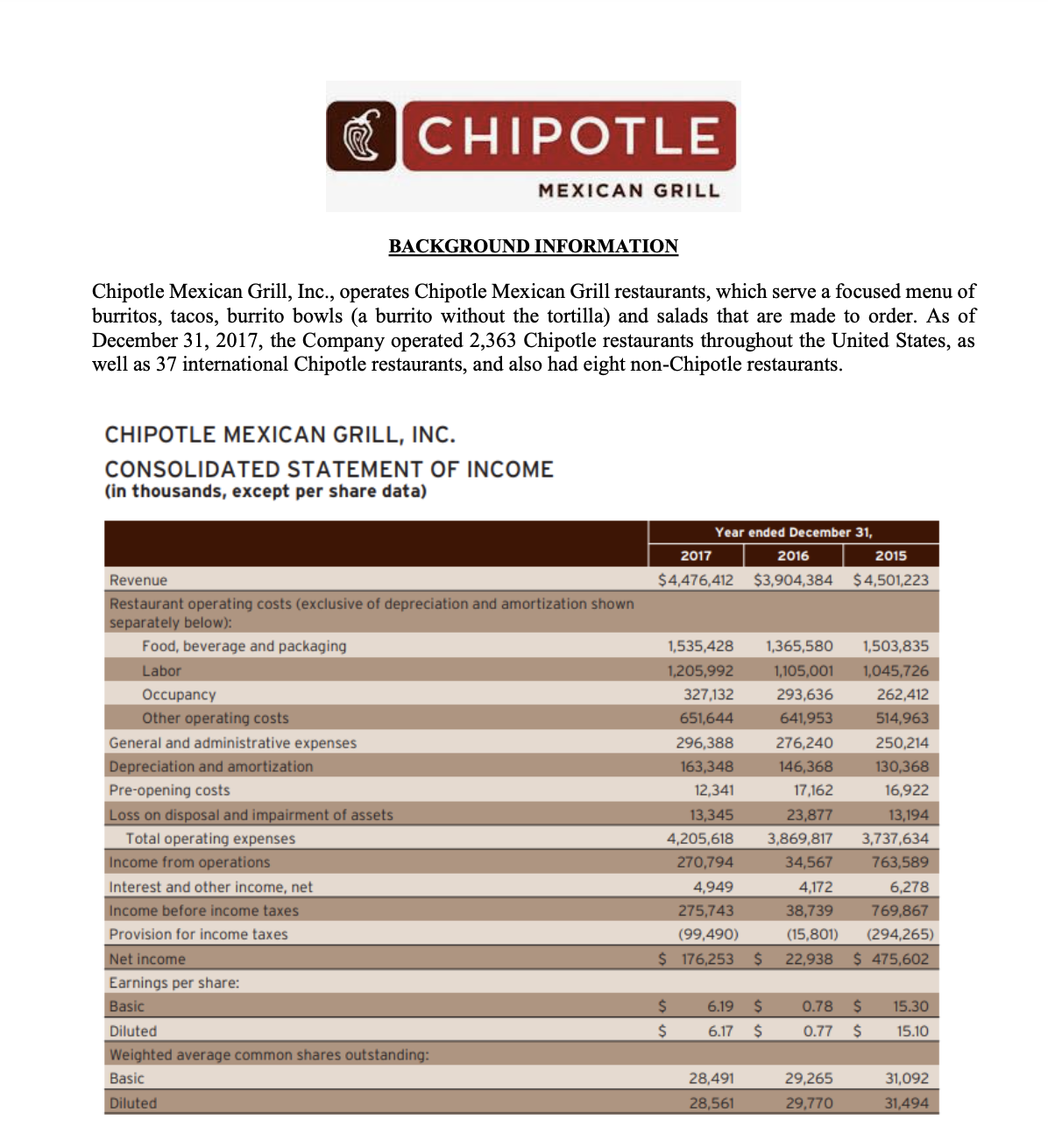

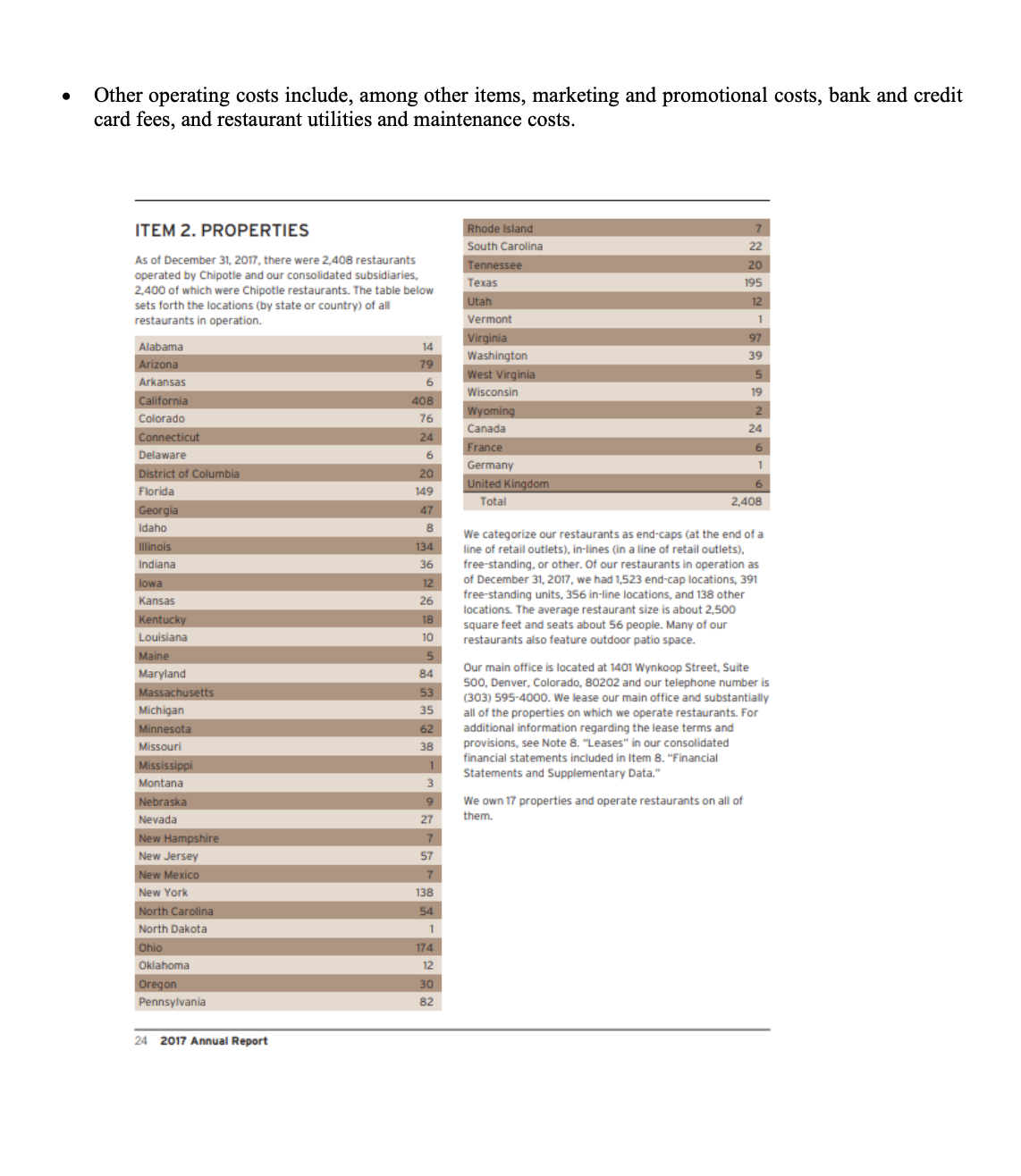

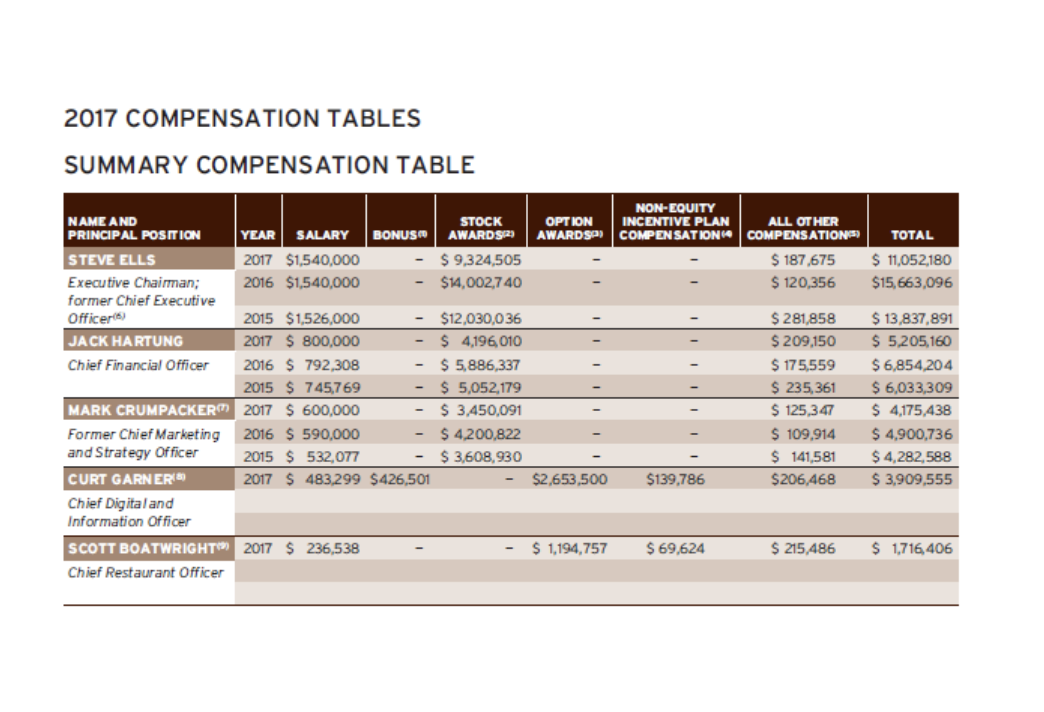

Prepare a contribution format income statement for Chipotle for 2017 . When preparing this statement: (1) include each line (with a dollar amount) from the income statement and (2) do not go below the income from operations line. More specifically, ignore interest (and other income) and the provision for income taxes. 5 points Refer to question 1. Did you classify other operating costs as a variable cost or a fixed cost? Explain why you classified it that way. Use the background information to support your answer. Limit your answer to 2 sentences or less. 2 points For this question only, assume that most of Chipotle's costs are variable. Provide one reason why this particular company organized itself so that operating leverage would be low. Your answer must include the phrase 'business risk'. Limit your answer to 3 sentences or less. 2 points 4. A customer visits a particular Chipotle location - such as the one at the Barracks Shopping Center-during a busy time of the day and has a bad experience. Said customer speaks to the manager about their experience and the manager compensates the customer for their inconvenience. The customer's bill is $12.00. Assume this happens in 2017. a. How much is the best estimate of the dollar amount that the manager can take off the bill without Chipotle losing money? In other words, compute how much the manager can remove from the bill so that restaurant is not worse off (in terms of profitability) due to the manager's decision to compensate the customer. Show work. Round your answer to 2 decimal places. 3 points Put how much the manager can take off the bill here: b. Assume the manager has three options to compensate the customer. They can: 1) take 50% off the bill; 2) give the customer a $20 gift card; history indicates that 60% of customers do not redeem gift cards; or 3) give the customer a free drink, which has a menu price of $1.50; the drink is not part of the original bill. Compute the cost to Chipotle for each option. Then rank which option the manager is most likely to choose 1 is the most likely and 3 is the least likely. Base your answer on financial considerations only. Show work and round answers to 2 decimal places. 5 points Note: This problem continues on the next page. Option #1 take 50% off the bill: Put cost here: Rank # Option #2$20 gift card: Put cost here: Rank# Option #3 Free beverage: Put cost here: Rank# In the upcoming year, Chipotle is considering replacing an old marketing campaign, which has had modest results in the past with a marketing campaign that costs the same but with a more robust impact on expected sales. Sales volume is projected to increase 3% as a result of the new marketing campaign. Use the operating leverage factor (OLF, your textbook calls this the degree of operating leverage) to forecast how much the dollar value of income from operations is projected to change if sales volume increases 3%. Assume no other changes to operations and that the 3% increase will not take the Company out of its relevant range. Show work. 2 points Put the OLF here. Round number to 2 decimal places: Put how much the dollar value of income will increase by here: 6. Chipotle's goal is to, within the next year, increase profitability. One way they plan to do this is by opening company-owned restaurants in Australia. Assume that Chipotle forecasts a 4% increase in sales from opening these restaurants. Can you reasonably estimate the dollar impact on income from operations if Chipotle meets this forecast? Circle 'YES' or 'NO'. 1 point YES NO 7. Chipotle leases (rents) its restaurant locations. Due to intense competition for space, occupancy costs are due to increase an average of 6% in 2018. Also, given that the minimum wage has increased in many states and localities, labor costs will increase an average of 5% in 2018 . Assume no other changes to Chipotle's operations. Ignore interest and the provision for income taxes. a. Compute the forecasted breakeven point in sales dollars for 2018. Show work. 2 points Put answer here: The margin of safety is a measure used to evaluate how close operations are to the breakeven point and is computed as: revenues - breakeven revenues in dollars. The greater the margin of safety, the less sensitive the firm to an abrupt fall in revenue. Compute the margin of safety. 1 point Put the margin of safety here: Currently most Chipotle employees are paid a variable wage. More specifically, the number of hours restaurant staff work is related to the number of customers expected on a given day. There has been a recent push to have restaurants guarantee their workers a certain number of hours per week regardless of expected demand. Chipotle is considering doing this in an effort to reduce employee turnover and keep quality employees. The Company has determined that if they pay their workers a fixed wage then their labor costs would equal approximately $1.5 billion. a. At what sales dollar level would Chipotle have preferred to pay its employees a fixed wage instead of a variable wage? Use 2017 data to determine your answer. Assume Chipotle wants to maximize profits. Show work. 3 points b. Would Chipotle have been better off, in terms of profitability, if they paid their employees a fixed wage in 2017? Circle YES or NO. Base your answer on the background information. 1 point The Chipotle locations in France do not get much business on Sundays. The CFO computes contribution margins for each day of the week and observes that contribution margins are negative on Sundays. The CFO is considering recommending to the CEO that Chipotle close restaurants in France on Sundays. The regional manager in charge of the restaurants in France tells the CFO that they should stay open on Sundays because doing so helps cover the restaurants' fixed costs. Circle YES if you agree or NO if you disagree with the regional manager and briefly explain your answer. 2 points YES NO Explanation: 10. Chipotle owns a chain of restaurants called ShopHouse Southeast Asian Kitchen. The restaurants have been open for a little less than three years and the Company has invested over $35 million in the restaurant chain. Chipotle's CFO is interviewing candidates for a controller position. The CFO asked the job candidate the following question and the job candidate provided the following answer. Provide one reason why the CFO is not impressed with the job candidate's answer. Assume the job candidate has access to financial information beyond what you have been provided in this exam. 1 point CFO's Question: "The ShopHouse Southeast Asian Kitchen chain is not performing well. We are considering closing all locations. Do you recommend we keep or close the chain?" Job candidate's answer: "I recommend keeping the restaurants open. Based on the financial information I have been provided, the Company has invested $35 in these restaurants and thus should work to recoup these costs." 1. Chipotle restaurants are divided into nine (9) regions and regional managers earn year-end bonuses based on the profitability of their regions. Included in General and Administrative expenses are $50 million of marketing expenses. Currently, the CFO allocates these marketing expenses to each region based on sales dollars generated. Thus, regions with higher sales are allocated more marketing costs. Assume you are a manager of a region that has an above average number of customers (when compared to other locations), and thus, sales for your location are above average. Also, assume that regional managers prefer more money to less. a. Use the concepts of cost allocation and product cost subsidization to convince the CFO why you think marketing costs allocated to your region are too high. Do not merely provide a definition of cost allocation or product cost subsidization when answering this question. Limit your answer to 4 sentences or less. 2 points b. Use the concept of relevant costs to convince the CFO that marketing expenses should not be allocated to any region to determine regional profitability, and therefore, bonuses. Do not merely provide a definition of relevant costs when answering this question. Limit your answer to 3 sentences or less. 2 points 12. The following questions relate to Steve Ells', CEO of Chipotle, pay. a. Is the CEO's pay mostly fixed or variable? Circle one. 1 point FIXED VARIABLE b. Does Chipotle's board compensate Steve Ells to primarily meet short-term or long-term goals set by the board of directors? Circle one. 1 point SHORT-TERM GOALS LONG-TERM GOALS 3. In 2011, the Company began the Chipotle Cultivate Foundation. Each day across most of their restaurants, they use food from their restaurants and donate it to local nonprofit feeding partners. Assume that in fiscal year 2017, the food donated are ingredients that could be used in a menu item that is priced at $6.50. The cost of the menu item is $4.89 and includes the following: $2.23 for food ingredients; $0.48 for leased space; $1.75 for labor costs; and $0.43 for other general and administrative costs. a. How much does income differ as it relates to each meal as the result of the Company giving away food it could otherwise sell each time it gives away food? Ignore tax implications. Round your answer to 2 decimal places. Show work. 2 points Put answer here: How much does income differ as it relates to each meal as the result of the Company giving away surplus food - that is, food that it could not sell - each time it gives away food? Ignore tax implications. Round your answer to 2 decimal places. Show work. 1 point Put answer here: 14. Refer to the grid on the next page. As it relates to: OPM\% (Income from operations/Sales) and CM% (Contribution margin/Sales) indicate whether each item is likely to INC-Increase; DEC-Decrease, or have NE-No Effect. As it relates to PV (food price variance or labor rate variance) or QV (food quantity variance or labor efficiency variance) indicate whether the variance is U - Unfavorable; F - Favorable; or has NE - No Effect. Assume the Company uses flexible budgeting. Use the information in the sales volume (SV) and sales price (SP) columns to determine how the other categories are affected. Do not make any assumptions. The first entry provides an example. 10 points BACKGROUND INFORMATION Chipotle Mexican Grill, Inc., operates Chipotle Mexican Grill restaurants, which serve a focused menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads that are made to order. As of December 31, 2017, the Company operated 2,363 Chipotle restaurants throughout the United States, as well as 37 international Chipotle restaurants, and also had eight non-Chipotle restaurants. CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENT OF INCOME (in thousands, except per share data) Other operating costs include, among other items, marketing and promotional costs, bank and credit card fees, and restaurant utilities and maintenance costs. ITEM 2. PROPERTIES As of December 31, 2017, there were 2,408 restaurants operated by Chipotle and our consolidated subsidiaries, We categorize our restaurants as end-caps (at the end of a line of retail outlets), in-lines (in a line of retail outlets), free-standing, or other. Of our restaurants in operation as of December 31, 2017, we had 1,523 end-cap locations, 391 free-standing units, 356 in-line locations, and 138 other locations. The average restaurant size is about 2,500 square feet and seats about 56 people. Many of our restaurants also feature outdoor patio space. Our main office is located at 1401 Wynkoop Street, Suite 500 , Denver, Colorado, 80202 and our telephone number is (303) 595-4000. We lease our main office and substantially all of the properties on which we operate restaurants. For additional information regarding the lease terms and provisions, see Note 8. "Leases" in our consolidated financial statements included in Item 8. Statements and Supplementary Data." We own 17 properties and operate restaurants on all of them. 2017 COMPENSATION TABLES SUMMARY COMPENSATION TABLE Prepare a contribution format income statement for Chipotle for 2017 . When preparing this statement: (1) include each line (with a dollar amount) from the income statement and (2) do not go below the income from operations line. More specifically, ignore interest (and other income) and the provision for income taxes. 5 points Refer to question 1. Did you classify other operating costs as a variable cost or a fixed cost? Explain why you classified it that way. Use the background information to support your answer. Limit your answer to 2 sentences or less. 2 points For this question only, assume that most of Chipotle's costs are variable. Provide one reason why this particular company organized itself so that operating leverage would be low. Your answer must include the phrase 'business risk'. Limit your answer to 3 sentences or less. 2 points 4. A customer visits a particular Chipotle location - such as the one at the Barracks Shopping Center-during a busy time of the day and has a bad experience. Said customer speaks to the manager about their experience and the manager compensates the customer for their inconvenience. The customer's bill is $12.00. Assume this happens in 2017. a. How much is the best estimate of the dollar amount that the manager can take off the bill without Chipotle losing money? In other words, compute how much the manager can remove from the bill so that restaurant is not worse off (in terms of profitability) due to the manager's decision to compensate the customer. Show work. Round your answer to 2 decimal places. 3 points Put how much the manager can take off the bill here: b. Assume the manager has three options to compensate the customer. They can: 1) take 50% off the bill; 2) give the customer a $20 gift card; history indicates that 60% of customers do not redeem gift cards; or 3) give the customer a free drink, which has a menu price of $1.50; the drink is not part of the original bill. Compute the cost to Chipotle for each option. Then rank which option the manager is most likely to choose 1 is the most likely and 3 is the least likely. Base your answer on financial considerations only. Show work and round answers to 2 decimal places. 5 points Note: This problem continues on the next page. Option #1 take 50% off the bill: Put cost here: Rank # Option #2$20 gift card: Put cost here: Rank# Option #3 Free beverage: Put cost here: Rank# In the upcoming year, Chipotle is considering replacing an old marketing campaign, which has had modest results in the past with a marketing campaign that costs the same but with a more robust impact on expected sales. Sales volume is projected to increase 3% as a result of the new marketing campaign. Use the operating leverage factor (OLF, your textbook calls this the degree of operating leverage) to forecast how much the dollar value of income from operations is projected to change if sales volume increases 3%. Assume no other changes to operations and that the 3% increase will not take the Company out of its relevant range. Show work. 2 points Put the OLF here. Round number to 2 decimal places: Put how much the dollar value of income will increase by here: 6. Chipotle's goal is to, within the next year, increase profitability. One way they plan to do this is by opening company-owned restaurants in Australia. Assume that Chipotle forecasts a 4% increase in sales from opening these restaurants. Can you reasonably estimate the dollar impact on income from operations if Chipotle meets this forecast? Circle 'YES' or 'NO'. 1 point YES NO 7. Chipotle leases (rents) its restaurant locations. Due to intense competition for space, occupancy costs are due to increase an average of 6% in 2018. Also, given that the minimum wage has increased in many states and localities, labor costs will increase an average of 5% in 2018 . Assume no other changes to Chipotle's operations. Ignore interest and the provision for income taxes. a. Compute the forecasted breakeven point in sales dollars for 2018. Show work. 2 points Put answer here: The margin of safety is a measure used to evaluate how close operations are to the breakeven point and is computed as: revenues - breakeven revenues in dollars. The greater the margin of safety, the less sensitive the firm to an abrupt fall in revenue. Compute the margin of safety. 1 point Put the margin of safety here: Currently most Chipotle employees are paid a variable wage. More specifically, the number of hours restaurant staff work is related to the number of customers expected on a given day. There has been a recent push to have restaurants guarantee their workers a certain number of hours per week regardless of expected demand. Chipotle is considering doing this in an effort to reduce employee turnover and keep quality employees. The Company has determined that if they pay their workers a fixed wage then their labor costs would equal approximately $1.5 billion. a. At what sales dollar level would Chipotle have preferred to pay its employees a fixed wage instead of a variable wage? Use 2017 data to determine your answer. Assume Chipotle wants to maximize profits. Show work. 3 points b. Would Chipotle have been better off, in terms of profitability, if they paid their employees a fixed wage in 2017? Circle YES or NO. Base your answer on the background information. 1 point The Chipotle locations in France do not get much business on Sundays. The CFO computes contribution margins for each day of the week and observes that contribution margins are negative on Sundays. The CFO is considering recommending to the CEO that Chipotle close restaurants in France on Sundays. The regional manager in charge of the restaurants in France tells the CFO that they should stay open on Sundays because doing so helps cover the restaurants' fixed costs. Circle YES if you agree or NO if you disagree with the regional manager and briefly explain your answer. 2 points YES NO Explanation: 10. Chipotle owns a chain of restaurants called ShopHouse Southeast Asian Kitchen. The restaurants have been open for a little less than three years and the Company has invested over $35 million in the restaurant chain. Chipotle's CFO is interviewing candidates for a controller position. The CFO asked the job candidate the following question and the job candidate provided the following answer. Provide one reason why the CFO is not impressed with the job candidate's answer. Assume the job candidate has access to financial information beyond what you have been provided in this exam. 1 point CFO's Question: "The ShopHouse Southeast Asian Kitchen chain is not performing well. We are considering closing all locations. Do you recommend we keep or close the chain?" Job candidate's answer: "I recommend keeping the restaurants open. Based on the financial information I have been provided, the Company has invested $35 in these restaurants and thus should work to recoup these costs." 1. Chipotle restaurants are divided into nine (9) regions and regional managers earn year-end bonuses based on the profitability of their regions. Included in General and Administrative expenses are $50 million of marketing expenses. Currently, the CFO allocates these marketing expenses to each region based on sales dollars generated. Thus, regions with higher sales are allocated more marketing costs. Assume you are a manager of a region that has an above average number of customers (when compared to other locations), and thus, sales for your location are above average. Also, assume that regional managers prefer more money to less. a. Use the concepts of cost allocation and product cost subsidization to convince the CFO why you think marketing costs allocated to your region are too high. Do not merely provide a definition of cost allocation or product cost subsidization when answering this question. Limit your answer to 4 sentences or less. 2 points b. Use the concept of relevant costs to convince the CFO that marketing expenses should not be allocated to any region to determine regional profitability, and therefore, bonuses. Do not merely provide a definition of relevant costs when answering this question. Limit your answer to 3 sentences or less. 2 points 12. The following questions relate to Steve Ells', CEO of Chipotle, pay. a. Is the CEO's pay mostly fixed or variable? Circle one. 1 point FIXED VARIABLE b. Does Chipotle's board compensate Steve Ells to primarily meet short-term or long-term goals set by the board of directors? Circle one. 1 point SHORT-TERM GOALS LONG-TERM GOALS 3. In 2011, the Company began the Chipotle Cultivate Foundation. Each day across most of their restaurants, they use food from their restaurants and donate it to local nonprofit feeding partners. Assume that in fiscal year 2017, the food donated are ingredients that could be used in a menu item that is priced at $6.50. The cost of the menu item is $4.89 and includes the following: $2.23 for food ingredients; $0.48 for leased space; $1.75 for labor costs; and $0.43 for other general and administrative costs. a. How much does income differ as it relates to each meal as the result of the Company giving away food it could otherwise sell each time it gives away food? Ignore tax implications. Round your answer to 2 decimal places. Show work. 2 points Put answer here: How much does income differ as it relates to each meal as the result of the Company giving away surplus food - that is, food that it could not sell - each time it gives away food? Ignore tax implications. Round your answer to 2 decimal places. Show work. 1 point Put answer here: 14. Refer to the grid on the next page. As it relates to: OPM\% (Income from operations/Sales) and CM% (Contribution margin/Sales) indicate whether each item is likely to INC-Increase; DEC-Decrease, or have NE-No Effect. As it relates to PV (food price variance or labor rate variance) or QV (food quantity variance or labor efficiency variance) indicate whether the variance is U - Unfavorable; F - Favorable; or has NE - No Effect. Assume the Company uses flexible budgeting. Use the information in the sales volume (SV) and sales price (SP) columns to determine how the other categories are affected. Do not make any assumptions. The first entry provides an example. 10 points BACKGROUND INFORMATION Chipotle Mexican Grill, Inc., operates Chipotle Mexican Grill restaurants, which serve a focused menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads that are made to order. As of December 31, 2017, the Company operated 2,363 Chipotle restaurants throughout the United States, as well as 37 international Chipotle restaurants, and also had eight non-Chipotle restaurants. CHIPOTLE MEXICAN GRILL, INC. CONSOLIDATED STATEMENT OF INCOME (in thousands, except per share data) Other operating costs include, among other items, marketing and promotional costs, bank and credit card fees, and restaurant utilities and maintenance costs. ITEM 2. PROPERTIES As of December 31, 2017, there were 2,408 restaurants operated by Chipotle and our consolidated subsidiaries, We categorize our restaurants as end-caps (at the end of a line of retail outlets), in-lines (in a line of retail outlets), free-standing, or other. Of our restaurants in operation as of December 31, 2017, we had 1,523 end-cap locations, 391 free-standing units, 356 in-line locations, and 138 other locations. The average restaurant size is about 2,500 square feet and seats about 56 people. Many of our restaurants also feature outdoor patio space. Our main office is located at 1401 Wynkoop Street, Suite 500 , Denver, Colorado, 80202 and our telephone number is (303) 595-4000. We lease our main office and substantially all of the properties on which we operate restaurants. For additional information regarding the lease terms and provisions, see Note 8. "Leases" in our consolidated financial statements included in Item 8. Statements and Supplementary Data." We own 17 properties and operate restaurants on all of them. 2017 COMPENSATION TABLES SUMMARY COMPENSATION TABLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts