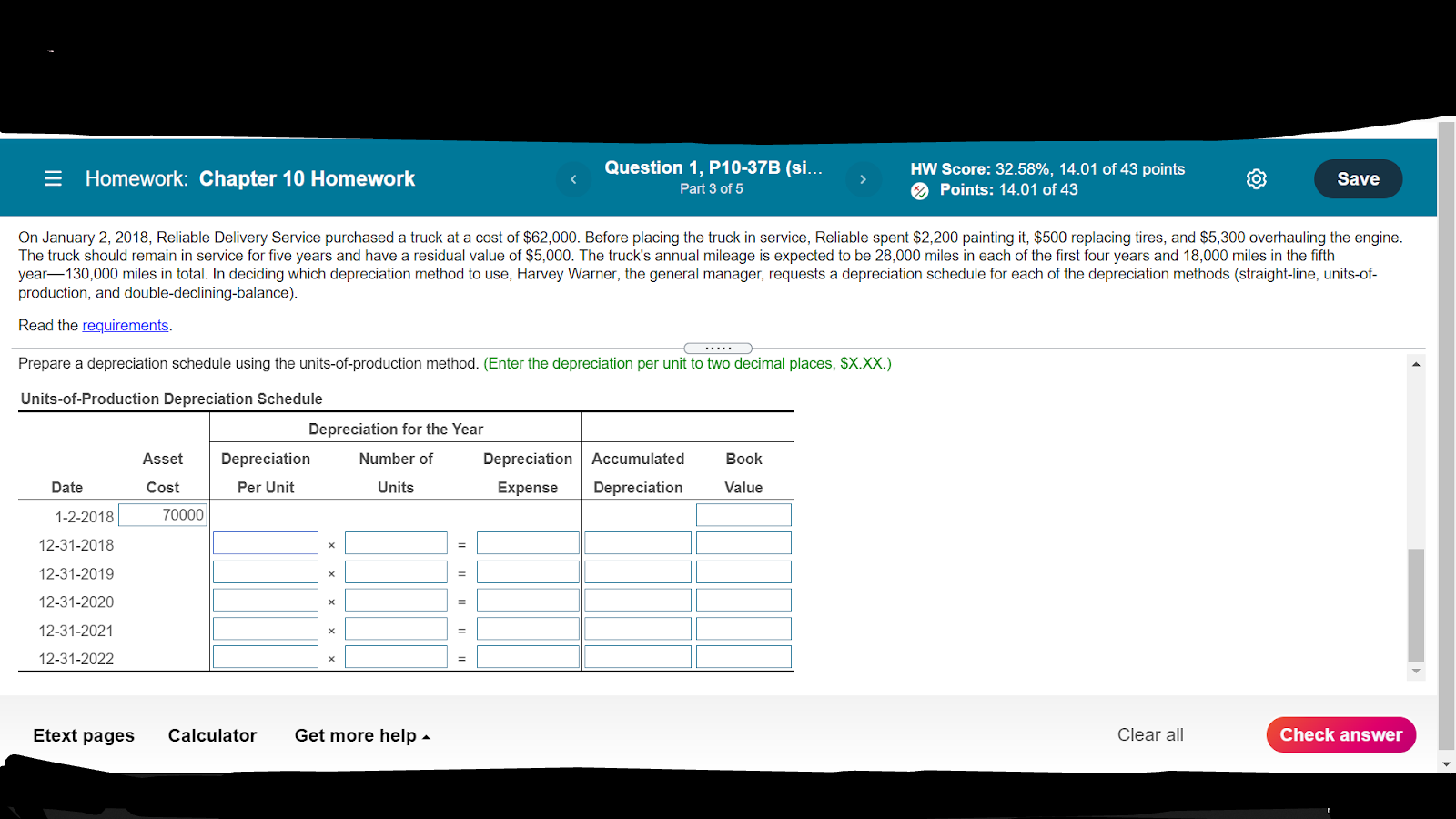

Question: Prepare a depreciation schedule using the unit-of-production method. (Enter the depreciation per unit to two decimal places, $X.XX.) = Homework: Chapter 10 Homework Question 1,

Prepare a depreciation schedule using the unit-of-production method. (Enter the depreciation per unit to two decimal places, $X.XX.)

= Homework: Chapter 10 Homework Question 1, P10-37B (Si... Part 3 of 5 HW Score: 32.58%, 14.01 of 43 points Points: 14.01 of 43 Save On January 2, 2018, Reliable Delivery Service purchased a truck at a cost of $62,000. Before placing the truck in service, Reliable spent $2,200 painting it, $500 replacing tires, and $5,300 overhauling the engine. The truck should remain in service for five years and have a residual value of $5,000. The truck's annual mileage is expected to be 28,000 miles in each of the first four years and 18,000 miles in the fifth year130,000 miles in total. In deciding which depreciation method to use, Harvey Warner, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of- production, and double-declining-balance). Read the requirements. Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, $X.XX.) Units-of-Production Depreciation Schedule Depreciation for the Year Asset Depreciation Number of Depreciation Accumulated Date Cost Per Unit Units Expense Depreciation 1-2-2018 70000 Book Value 12-31-2018 X 12-31-2019 12-31-2020 X 12-31-2021 12-31-2022 = Etext pages Calculator Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts