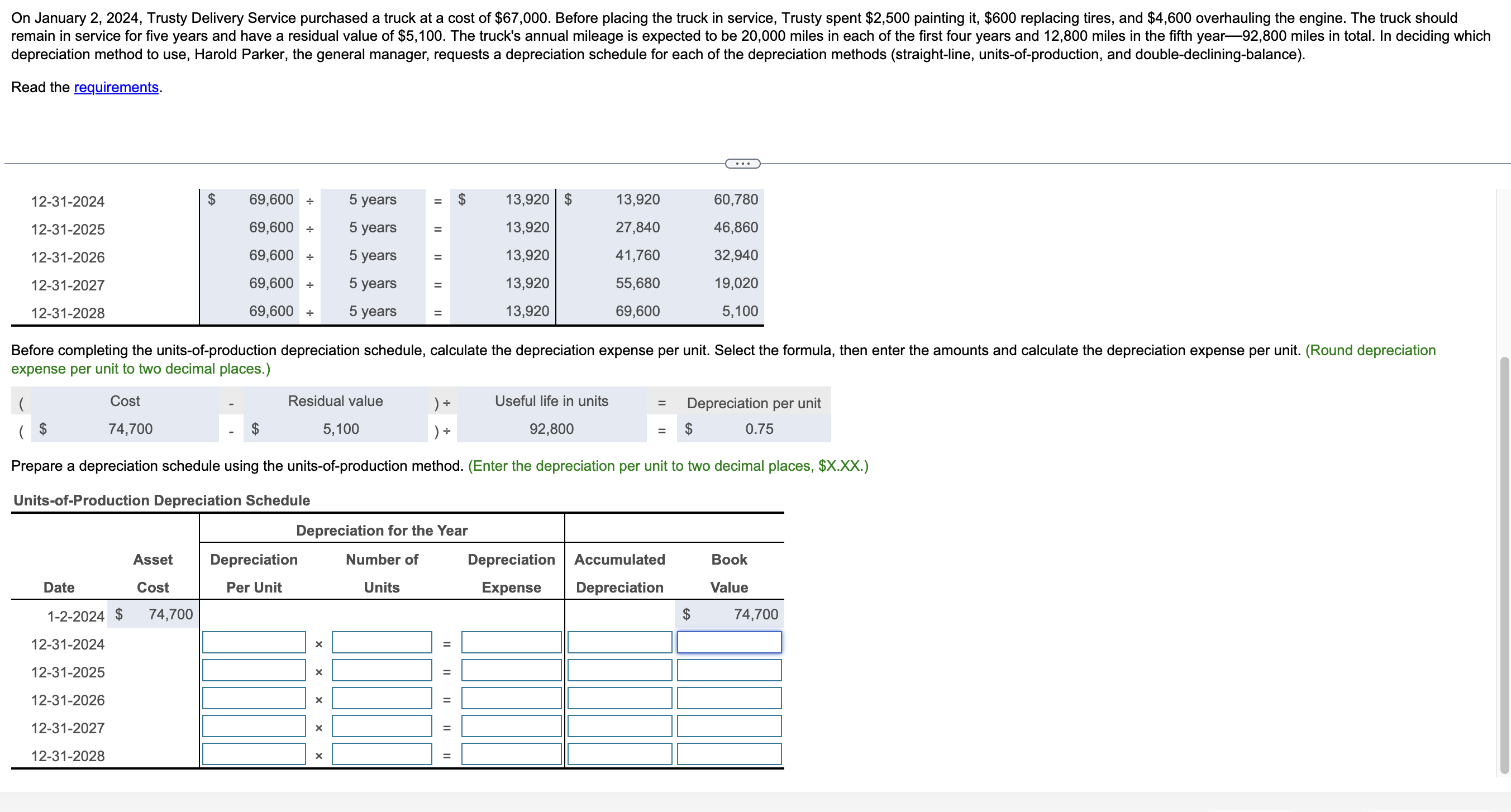

Question: Read the requirements. expense per unit to two decimal places.) Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two

Read the requirements. expense per unit to two decimal places.) Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, \$X.XX.) Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. Trusty prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Trusty uses the truck. Identify the depreciation method that meets the company's objectives

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock