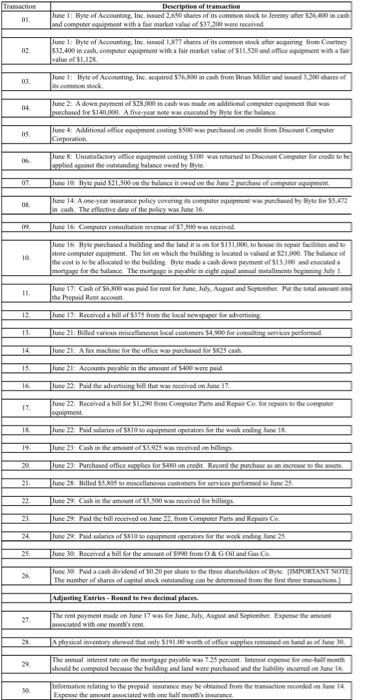

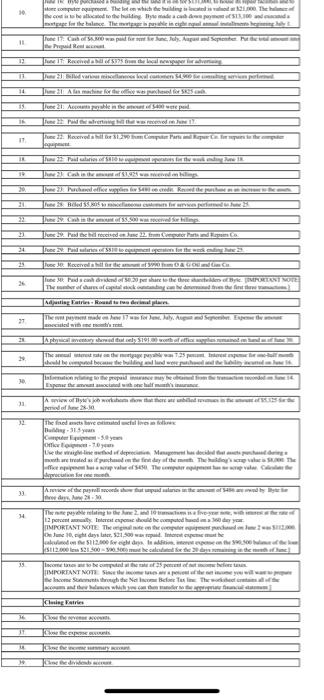

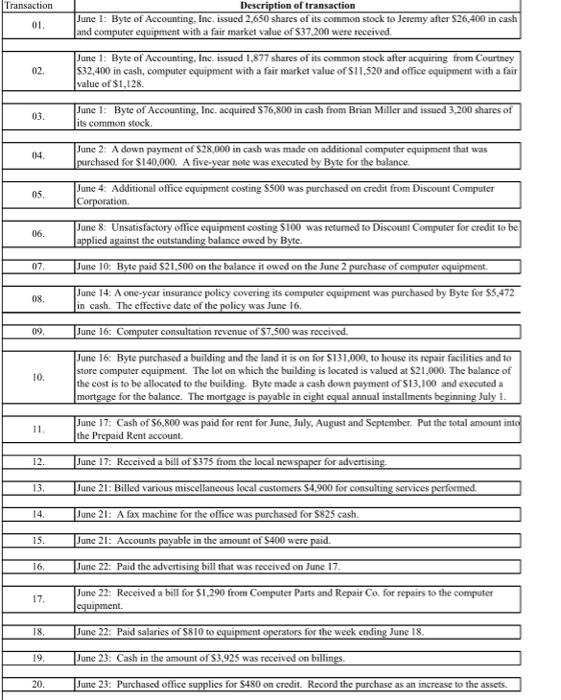

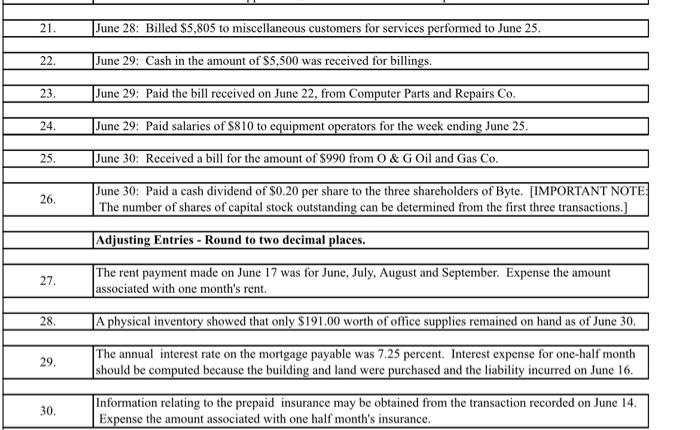

Question: Prepare a General Journal Need Help Hope this make it more clear Introduction FAQ Welcome Chart of Accounts Transaction Number Name 1110 Cash 1120 Accounts

Introduction FAQ Welcome Chart of Accounts Transaction Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip 1311 Computer Equip 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 3400 Income Summary 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Income Tax Expense Normal Balance Debit Debit Debit Debit Debit Debit Credit Debit Credit Debit Credit Debit Credit Credit Credit Credit Credit Credit Credit Credit Credit Debit Credit Credit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Tratins Description of transaction Tue 1: Byte al engine, insaed 2,666 care of its comestico Jeremyer 2.0 and competent with a market value of $17.200 were received 02 line 1: Byte of Accounting, Inc. 1.377 of its comme song from Court 52.400 in canh.computer equip with a fair market value of SIL.500 and office equipment with value of St.12 03 Fanc 1: Tyte ed AccountingIn acquired 57.00 in cadrum Bran Miller and 30 sore tock 04 fuse 2. A dowi payton of 528,000 in cash was made to add computer that was chased for $120.000. A five years was executed by By for the one Pune : Additional dice que conting Soo was purchased on credit from Deco Complet 05 Tue 8: Unanifactory dice equipment costing $100 was renamed to Deco Computer for credit to be esplied at the outstanding balance oued by Byte OT use to Rye paid $21.500 on the balance it was on the land se after gett le 14 A one-year insurance policy covering computer qument was pushed by Byte 55,473 a cash. The effective done of the polisy was June 16 OS Rune I6 Computer Cotton event of $2.500 was ved June 16 Hyte purchased a building and the land it is un for 5131.060. 10 how pair fasilities and store computer equipment. The on which the building is located is valued 521.000 Thence of the cost is to be allocated to the building Bytemadecades of 11.100 deceda mostrage for the balance. The most poble sist gulanmalamuts bones y 10 11 Tee 171 Cash of $6,00 was paid for forent, July August September that the Pool acco 13 un 12 Reconda do trans the local and adverts 13 Ture 21: Billed various molestial customers 54,900 forestilling services performed June 21 Alex machine for the office w purchased for 25 cash 14 15 Nunc 2 Accounts her in the software paid 16. luse 22 Paid the advertising is that was recented on June 17 17 Tune 22 Received a bill for $1.290 from Computer Parts and Repar Co. for repairs to the compte equipment 13 June 22 Paid sales of SEO equipment operates for the weekendeng Sun 19 Pune 33 Cash in the 1995 ex his 2 211 June 23: Purchased office supplies for S450 on credit Record the purchase Tee 20 the Tunced to meet comes for services pormed the 25 fue. Cash in the moon was recente billige 23. Pure 3. Pas de bill received on June 22, fross Corruter Parts and Repassa June raid wit of 10 toegan sport for the working and 24 25. luse 30: Recened a bill for the amount of 900 from O&Golden 26 27 Pune 39 da casa diviend of 50.20 pershare to the tree shareholder of Bye EMPORTANT NOTE The number of shares of capital socke standing can be determined from the first the transactions Ndjusting Feries - Round to we decimal place. The payment made on June 17 was for June, Mly, August September. Expense e amount sted with one manchestent A physical my showed that my S191.00 dolara remained on and some The anal interest rate on the mortgage payable 7.25 percent interesen for en hulle should be computed because the building and land were purchmed and the lady in June 16 Information relating to the prepaid strane may be damned from the reaction recorded on 14 Baxpose the amount tociated with one halfmas tance 30 30 Ww o comp. The laten we buildingsThe to heal to the building Ty at the balance Theme 11 one 17. Cabo paid toone. Jo Aap Sepetu id Real el Races the learners 11 14 de les se 55 ruse 21. Arten ere paid e vode 11 Hovedh Pauli Gin the US me hiddel van een center 20 22 use Pad 34 26 e Nova Tune Hedschendor 0.20 persone to the cheated By TNT NOTE member of charafcapital cameras the first three duting Paris Read to toe diet The one was for Jewe. Jagan SE 27 21 2 JA produtos secundadores The me the most held be como become the building and land worden prepare sp them with 11 view of them were while 141 33 The findents lave edilen Hulingan Cey for you use the age of depi Mee has decided the wered eft day of them. The the er laval The compare www 33 4 A the periode padure dom Tengo 2 porcentary Internt poc habe copiedad TIMPORTANT NOITE The Jeight days later, 52100 dipecat 5112.000 forint St12.000 a $1.500 a clothes Income to become the moment IMPORTANT NITE SE elcome to the Nation Time The 33 Chasing Fair CER 27 Transaction 01 Description of transaction June 1: Byte of Accounting, Inc. issued 2,650 shares of its common stock to Jeremy after $26.400 in cash and computer equipment with a fair market value of $37.200 were received June 1: Byte of Accounting, Inc. issued 1,877 shares of its common stock after acquiring from Courtney $32,400 in cash, computer equipment with a fair market value of S11,520 and office equipment with a fair value of $1,128 June 1: Byte of Accounting, Inc. acquired 576,800 in cash from Brian Miller and issued 3.200 shares of its common stock 02 03. 04. June 2: A down payment of $28,000 in cash was made on additional computer equipment that was purchased for $140,000. A five-year note was executed by Byte for the balance 05. 06. 07 June 4. Additional office equipment costing $500 was purchased on credit from Discount Computer Corporation June 8 Unsatisfactory office equipment costing $100 was retumed to Discount Computer for credit to be applied against the outstanding balance owed by Byte June 10: Byte paid $21,500 on the balance it owed on the June 2 purchase of computer equipment. June 14. A one-year insurance policy covering its computer equipment was purchased by Byte for $5,472 in cash. The effective date of the policy was June 16. June 16: Computer consultation revenue of S7.500 was received June 16: Byte purchased a building and the land it is on for $131,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $21.000. The balance of the cost is to be allocated to the building Byte made a cash down payment of $13,100 and executed a mortgage for the balance. The mortgage is payable in cight cqual annual installments beginning July 1. 09 10. 11 June 17: Cash of 56,800 was paid for rent for June, July, August and September. Put the total amount into the Prepaid Rent account 12. June 17: Received a bill of $375 from the local newspaper for advertising 13 14. 15. June 21: Billed various miscellaneous local customers 54,900 for consulting services performed June 21: A fax machine for the office was purchased for $825 cash. June 21: Accounts payable in the amount of S400 were paid. June 22: Paid the advertising bill that was received on June 17 June 22: Received a bill for $1,290 from Computer Parts and Repair Co. for repairs to the computer equipment 16, 17. 18 June 22: Paid salaries of $810 to equipment operators for the week ending June 18. 19, June 23: Cash in the amount of $3.925 was received on billines 20. June 23: Purchased office supplies for 480 on credit. Record the purchase as an increase to the assets. 21. June 28: Billed $5,805 to miscellaneous customers for services performed to June 25. 22 June 29: Cash in the amount of $5,500 was received for billings. 23. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $810 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $990 from O & G Oil and Gas Co. 26. June 30: Paid a cash dividend of $0.20 per share to the three shareholders of Byte. [IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions.] Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June, July, August and September. Expense the amount associated with one month's rent. JA physical inventory showed that only $191,00 worth of office supplies remained on hand as of June 30, 28 29. The annual interest rate on the mortgage payable was 7.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,125 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,000. The office equipment has a scrap value of $450. The computer equipment has no scrap value. Calculate the depreciation for one month. 33. A review of the payroll records show that unpaid salaries in the amount of S486 are owed by Byte for three days, June 28 - 30. 34 The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year (IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $112.000, On June 10, eight days later, $21,500 was repaid. Interest expense must be calculated on the $112,000 for eight days. In addition, interest expense on the $90,500 balance of the loan ($112,000 less $21,500 - $90,500) must be calculated for the 20 days remaining in the month of June.] 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. (IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. Introduction FAQ Welcome Chart of Accounts Transaction Number Name 1110 Cash 1120 Accounts Receivable 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip 1311 Computer Equip 1312 Accum. Depr.-Computer Equip. 1411 Building Cost 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3200 Retained Earnings 3300 Dividends 3400 Income Summary 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Income Tax Expense Normal Balance Debit Debit Debit Debit Debit Debit Credit Debit Credit Debit Credit Debit Credit Credit Credit Credit Credit Credit Credit Credit Credit Debit Credit Credit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Tratins Description of transaction Tue 1: Byte al engine, insaed 2,666 care of its comestico Jeremyer 2.0 and competent with a market value of $17.200 were received 02 line 1: Byte of Accounting, Inc. 1.377 of its comme song from Court 52.400 in canh.computer equip with a fair market value of SIL.500 and office equipment with value of St.12 03 Fanc 1: Tyte ed AccountingIn acquired 57.00 in cadrum Bran Miller and 30 sore tock 04 fuse 2. A dowi payton of 528,000 in cash was made to add computer that was chased for $120.000. A five years was executed by By for the one Pune : Additional dice que conting Soo was purchased on credit from Deco Complet 05 Tue 8: Unanifactory dice equipment costing $100 was renamed to Deco Computer for credit to be esplied at the outstanding balance oued by Byte OT use to Rye paid $21.500 on the balance it was on the land se after gett le 14 A one-year insurance policy covering computer qument was pushed by Byte 55,473 a cash. The effective done of the polisy was June 16 OS Rune I6 Computer Cotton event of $2.500 was ved June 16 Hyte purchased a building and the land it is un for 5131.060. 10 how pair fasilities and store computer equipment. The on which the building is located is valued 521.000 Thence of the cost is to be allocated to the building Bytemadecades of 11.100 deceda mostrage for the balance. The most poble sist gulanmalamuts bones y 10 11 Tee 171 Cash of $6,00 was paid for forent, July August September that the Pool acco 13 un 12 Reconda do trans the local and adverts 13 Ture 21: Billed various molestial customers 54,900 forestilling services performed June 21 Alex machine for the office w purchased for 25 cash 14 15 Nunc 2 Accounts her in the software paid 16. luse 22 Paid the advertising is that was recented on June 17 17 Tune 22 Received a bill for $1.290 from Computer Parts and Repar Co. for repairs to the compte equipment 13 June 22 Paid sales of SEO equipment operates for the weekendeng Sun 19 Pune 33 Cash in the 1995 ex his 2 211 June 23: Purchased office supplies for S450 on credit Record the purchase Tee 20 the Tunced to meet comes for services pormed the 25 fue. Cash in the moon was recente billige 23. Pure 3. Pas de bill received on June 22, fross Corruter Parts and Repassa June raid wit of 10 toegan sport for the working and 24 25. luse 30: Recened a bill for the amount of 900 from O&Golden 26 27 Pune 39 da casa diviend of 50.20 pershare to the tree shareholder of Bye EMPORTANT NOTE The number of shares of capital socke standing can be determined from the first the transactions Ndjusting Feries - Round to we decimal place. The payment made on June 17 was for June, Mly, August September. Expense e amount sted with one manchestent A physical my showed that my S191.00 dolara remained on and some The anal interest rate on the mortgage payable 7.25 percent interesen for en hulle should be computed because the building and land were purchmed and the lady in June 16 Information relating to the prepaid strane may be damned from the reaction recorded on 14 Baxpose the amount tociated with one halfmas tance 30 30 Ww o comp. The laten we buildingsThe to heal to the building Ty at the balance Theme 11 one 17. Cabo paid toone. Jo Aap Sepetu id Real el Races the learners 11 14 de les se 55 ruse 21. Arten ere paid e vode 11 Hovedh Pauli Gin the US me hiddel van een center 20 22 use Pad 34 26 e Nova Tune Hedschendor 0.20 persone to the cheated By TNT NOTE member of charafcapital cameras the first three duting Paris Read to toe diet The one was for Jewe. Jagan SE 27 21 2 JA produtos secundadores The me the most held be como become the building and land worden prepare sp them with 11 view of them were while 141 33 The findents lave edilen Hulingan Cey for you use the age of depi Mee has decided the wered eft day of them. The the er laval The compare www 33 4 A the periode padure dom Tengo 2 porcentary Internt poc habe copiedad TIMPORTANT NOITE The Jeight days later, 52100 dipecat 5112.000 forint St12.000 a $1.500 a clothes Income to become the moment IMPORTANT NITE SE elcome to the Nation Time The 33 Chasing Fair CER 27 Transaction 01 Description of transaction June 1: Byte of Accounting, Inc. issued 2,650 shares of its common stock to Jeremy after $26.400 in cash and computer equipment with a fair market value of $37.200 were received June 1: Byte of Accounting, Inc. issued 1,877 shares of its common stock after acquiring from Courtney $32,400 in cash, computer equipment with a fair market value of S11,520 and office equipment with a fair value of $1,128 June 1: Byte of Accounting, Inc. acquired 576,800 in cash from Brian Miller and issued 3.200 shares of its common stock 02 03. 04. June 2: A down payment of $28,000 in cash was made on additional computer equipment that was purchased for $140,000. A five-year note was executed by Byte for the balance 05. 06. 07 June 4. Additional office equipment costing $500 was purchased on credit from Discount Computer Corporation June 8 Unsatisfactory office equipment costing $100 was retumed to Discount Computer for credit to be applied against the outstanding balance owed by Byte June 10: Byte paid $21,500 on the balance it owed on the June 2 purchase of computer equipment. June 14. A one-year insurance policy covering its computer equipment was purchased by Byte for $5,472 in cash. The effective date of the policy was June 16. June 16: Computer consultation revenue of S7.500 was received June 16: Byte purchased a building and the land it is on for $131,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $21.000. The balance of the cost is to be allocated to the building Byte made a cash down payment of $13,100 and executed a mortgage for the balance. The mortgage is payable in cight cqual annual installments beginning July 1. 09 10. 11 June 17: Cash of 56,800 was paid for rent for June, July, August and September. Put the total amount into the Prepaid Rent account 12. June 17: Received a bill of $375 from the local newspaper for advertising 13 14. 15. June 21: Billed various miscellaneous local customers 54,900 for consulting services performed June 21: A fax machine for the office was purchased for $825 cash. June 21: Accounts payable in the amount of S400 were paid. June 22: Paid the advertising bill that was received on June 17 June 22: Received a bill for $1,290 from Computer Parts and Repair Co. for repairs to the computer equipment 16, 17. 18 June 22: Paid salaries of $810 to equipment operators for the week ending June 18. 19, June 23: Cash in the amount of $3.925 was received on billines 20. June 23: Purchased office supplies for 480 on credit. Record the purchase as an increase to the assets. 21. June 28: Billed $5,805 to miscellaneous customers for services performed to June 25. 22 June 29: Cash in the amount of $5,500 was received for billings. 23. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $810 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $990 from O & G Oil and Gas Co. 26. June 30: Paid a cash dividend of $0.20 per share to the three shareholders of Byte. [IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions.] Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June, July, August and September. Expense the amount associated with one month's rent. JA physical inventory showed that only $191,00 worth of office supplies remained on hand as of June 30, 28 29. The annual interest rate on the mortgage payable was 7.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,125 for the period of June 28-30. 32. The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $8,000. The office equipment has a scrap value of $450. The computer equipment has no scrap value. Calculate the depreciation for one month. 33. A review of the payroll records show that unpaid salaries in the amount of S486 are owed by Byte for three days, June 28 - 30. 34 The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year (IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $112.000, On June 10, eight days later, $21,500 was repaid. Interest expense must be calculated on the $112,000 for eight days. In addition, interest expense on the $90,500 balance of the loan ($112,000 less $21,500 - $90,500) must be calculated for the 20 days remaining in the month of June.] 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. (IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account

Step by Step Solution

There are 3 Steps involved in it

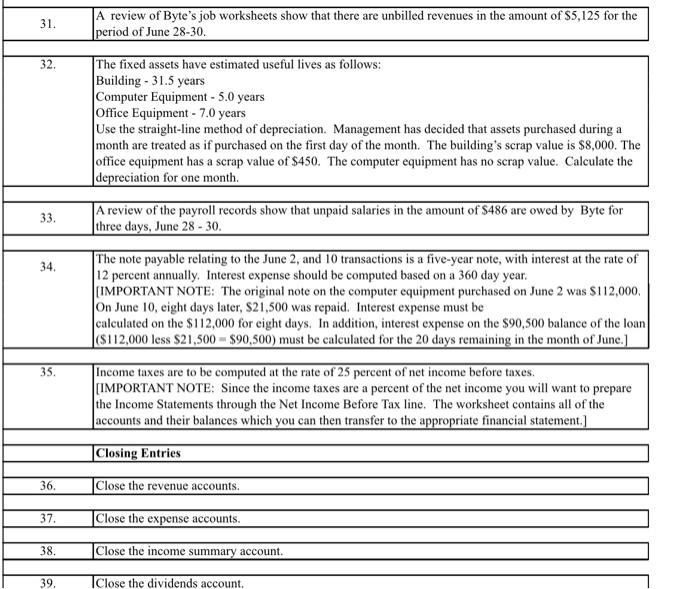

Get step-by-step solutions from verified subject matter experts