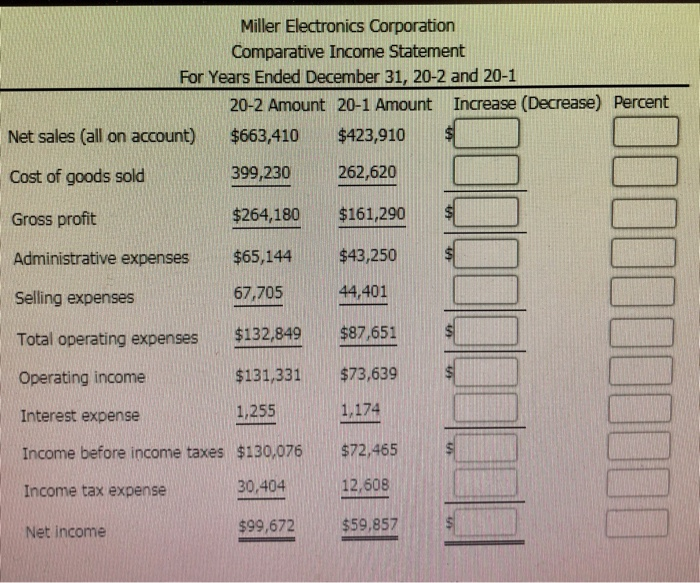

Question: Prepare a horizontal analysis. Add columns to show the amount of increase (decrease) and the percentage change. Round percentages to one decimal place. Do not

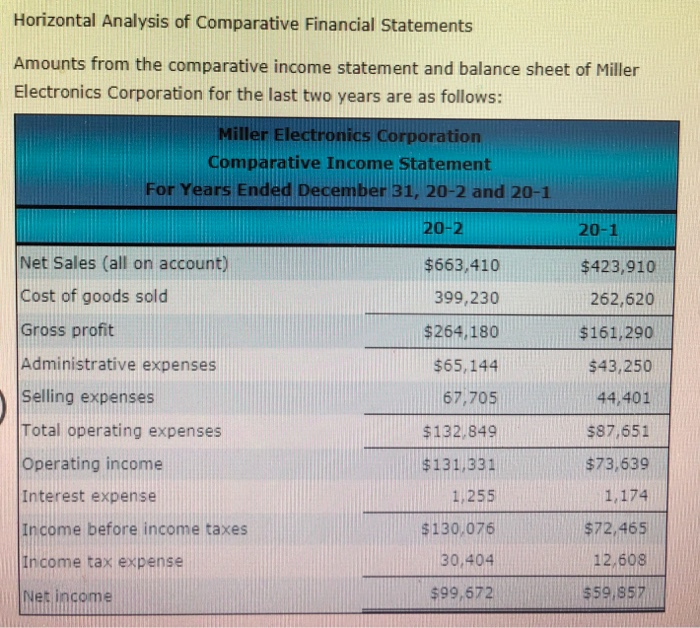

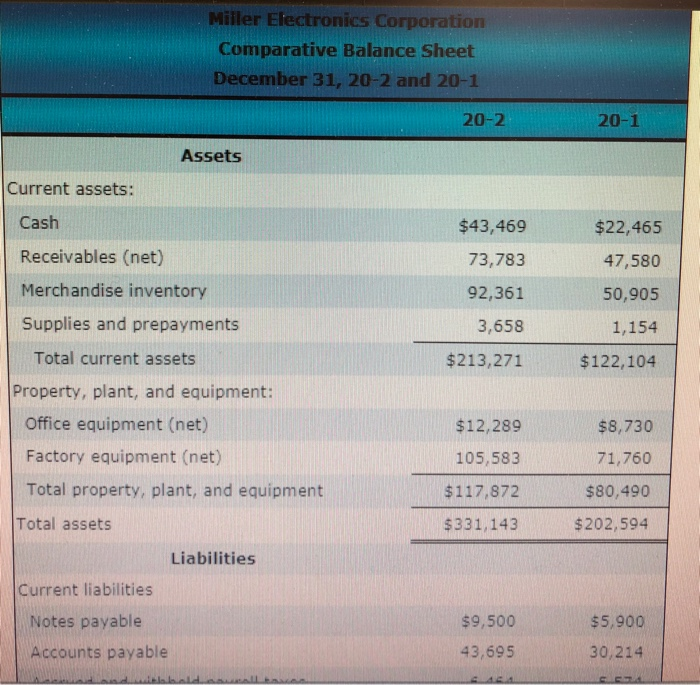

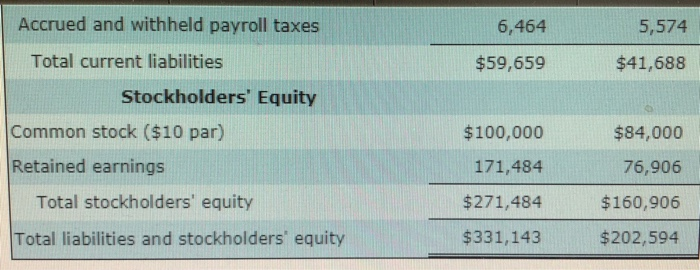

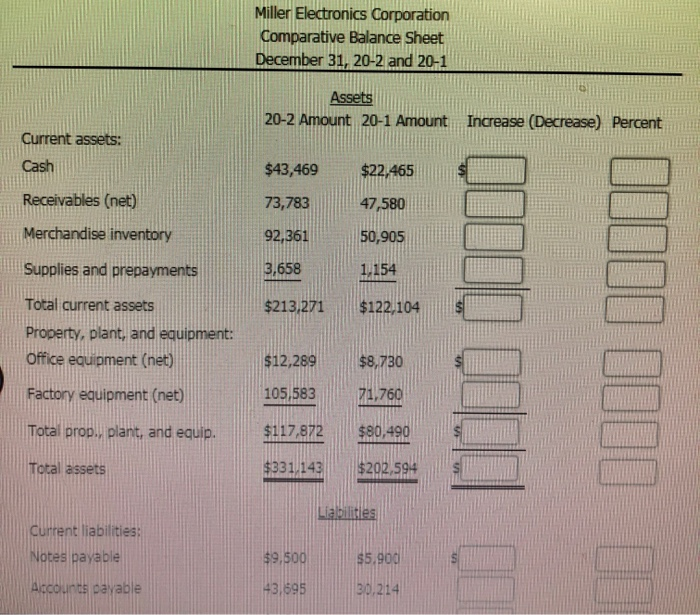

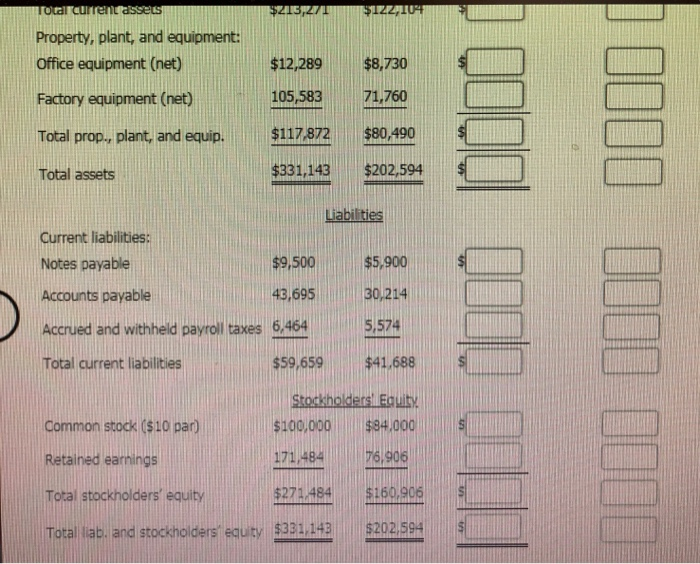

Horizontal Analysis of Comparative Financial Statements Amounts from the comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are as follows: Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Net Sales (all on account) Cost of goods sold Gross profit Administrative expenses Selling expenses Total operating expenses Operating income Interest expense Income before income taxes Income tax expense Net income $663. 410 399,230 $264,180 $65,144 67,705 $132,849 $131,331 1,255 $130,076 30.404 $99,572 $423,910 262,620 $161,290 $43,250 44,401 $87,651 $73,639 1,174 $72,465 12,608 $59,857 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Assets Current assets: Cash Receivables (net) Merchandise inventory Supplies and prepayments $43,469 73,783 92,361 3,658 $213,271 $22,465 47,580 50,905 1,154 $122,104 Total current assets Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment $12,289 105,583 $117,872 $331,143 $8,730 71,760 $80,490 $202,594 Total assets Liabilities Current liabilities $5,900 30,214 Notes payable $9,500 Accounts payable 43,695 Accrued and withheld payroll taxes 6,464 5,574 Total current liabilities $59,659 $41,688 Stockholders' Equity Common stock ($10 par) Retained earnings $100,000 171,484 $271,484 $331,143 $84,000 76,906 $160,906 $202,594 Total stockholders' equity Total liabilities and stockholders equity Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 Amount 20-1 Amount Increase (Decrease) Percent $663,410$423,910 Net sales (all on account) Cost of goods sold399,230 262,620 Gross profit Administrative expenses$65,144 $43,250s Selling expenses Total operating expenses $132,849 $87,651 $ Operating income Interest expense Income before income taxes $130,076$72,465 Income tax expense Net income $264,180$161,290$ 67,705 44,401 $131331 $73,639 S 1,255 1,174 30,404 12,608 $99,672$59,857 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 Assets 20-2 Amount 20-1 Amount Increase (Decrease) Percent Current assets: $43,469$22.465 Receivables (net) 73,78347,580 Merchandisel iventory2361 50,905 Supplies and prepayments Total current assets Property, plant, and equipment Office equipment (net) Factory equipment (net) Total prop., plant, and equip. Total ssets 3.658 $213.271 $122/104 $12,289$8,730 105,583 $117,872 $80,490 $331/143$202,594 71760 C plant, and equip.$117.872 s80 49d Labalities current liabilities Notes payable Arcouints payable 9,500$5.900 3.69501214 Property, plant, and equipment Office equipment (net) Factory equipment (net) Total prop, plant, and equip.$117.82 $80.490 $12,289$8,730 105,58371,760 Total assets $331,143$202,594 Liabilities Current liabilities: Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities $9,500$5,900 43,695 30/214 6,4645,574 $59,659$41,688 leitites459 41.4898C Common srock (s t0 par $0.0o $94,000 OC $100,000$84/000 17148476.906 $271.484$160.906 Retained eamings Total stocmolder au$275484 S:o0 30 Total liab, and stockhoilders eauty 331.14 $202 594

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts