Question: Prepare a physical flow schedule and compute the equivalent units for all inputs, assuming the weighted-average method. Using the EOQ determined in requirement 1, calculate:

- Prepare a physical flow schedule and compute the equivalent units for all inputs, assuming the weighted-average method.

- Using the EOQ determined in requirement 1, calculate:

- Total annual ordering costs, and

- Total annual carrying costs.

Round your answer to the nearest dollar.

- Using FIFO method, calculate the costs per equivalent unit for all inputs.

- Using FIFO method, calculate:

- The total costs of goods transferred out of the Finishing Department; and

- The cost of ending Work in Process: Finishing Department.

- Prepare journal entries (narrations are not required) to record the following transactions:

- Transferred-in costs incurred;

- Transferred-out costs of good completed.

- Explain the difference in the equivalent units for WA method compared to the FiFO method.

- Why are journal entries not required for the beginning balance in the Work-in-process account.

Can I have some formulas when you answer? Thank you,

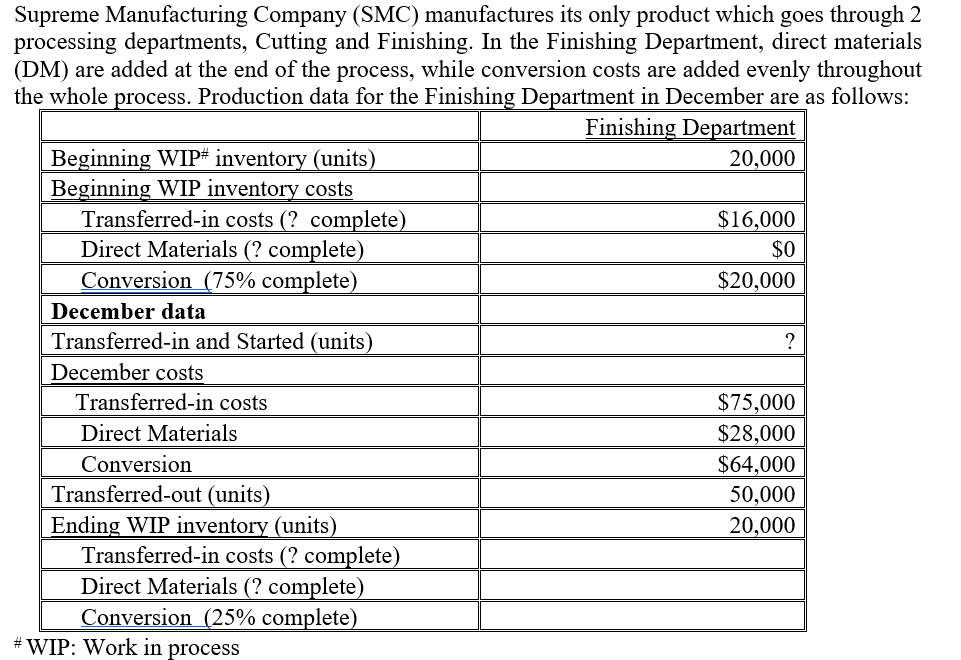

Supreme Manufacturing Company (SMC) manufactures its only product which goes through 2 processing departments, Cutting and Finishing. In the Finishing Department, direct materials (DM) are added at the end of the process, while conversion costs are added evenly throughout the whole process. Production data for the Finishing Department in December are as follows: Finishing Department Beginning WIP* inventory (units) 20,000 Beginning WIP inventory costs Transferred-in costs (? complete) $16,000 Direct Materials (? complete) $0 Conversion (75% complete) $20,000 December data Transferred-in and Started (units) ? December costs Transferred-in costs $75,000 Direct Materials $28,000 Conversion $64,000 Transferred-out (units) 50,000 Ending WIP inventory (units) 20,000 Transferred-in costs (? complete) Direct Materials (? complete) Conversion (25% complete) #WIP: Work in process Supreme Manufacturing Company (SMC) manufactures its only product which goes through 2 processing departments, Cutting and Finishing. In the Finishing Department, direct materials (DM) are added at the end of the process, while conversion costs are added evenly throughout the whole process. Production data for the Finishing Department in December are as follows: Finishing Department Beginning WIP* inventory (units) 20,000 Beginning WIP inventory costs Transferred-in costs (? complete) $16,000 Direct Materials (? complete) $0 Conversion (75% complete) $20,000 December data Transferred-in and Started (units) ? December costs Transferred-in costs $75,000 Direct Materials $28,000 Conversion $64,000 Transferred-out (units) 50,000 Ending WIP inventory (units) 20,000 Transferred-in costs (? complete) Direct Materials (? complete) Conversion (25% complete) #WIP: Work in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts