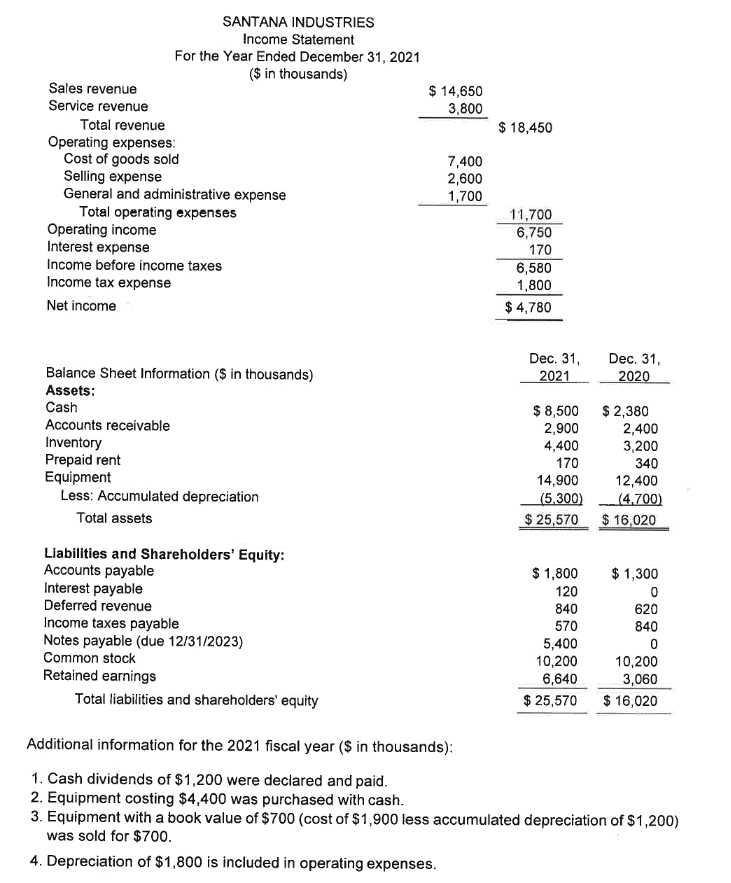

Question: Prepare a Statement of Cash Flow using the Direct Method. $ 14,650 3,800 $ 18,450 SANTANA INDUSTRIES Income Statement For the Year Ended December 31,

Prepare a Statement of Cash Flow using the Direct Method.

$ 14,650 3,800 $ 18,450 SANTANA INDUSTRIES Income Statement For the Year Ended December 31, 2021 ($ in thousands) Sales revenue Service revenue Total revenue Operating expenses: Cost of goods sold Selling expense General and administrative expense Total operating expenses Operating income Interest expense Income before income taxes Income tax expense Net income 7,400 2,600 1,700 11,700 6,750 170 6,580 1,800 $ 4,780 Dec. 31, 2021 Dec. 31 2020 Balance Sheet Information ($ in thousands) Assets: Cash Accounts receivable Inventory Prepaid rent Equipment Less: Accumulated depreciation Total assets $ 8,500 2,900 4,400 170 14,900 (5.300) $ 25,570 $ 2,380 2,400 3,200 340 12,400 14.700) $ 16,020 Liabilities and Shareholders' Equity: Accounts payable Interest payable Deferred revenue Income taxes payable Notes payable (due 12/31/2023) Common stock Retained earnings Total liabilities and shareholders' equity $ 1,800 120 840 570 5,400 10,200 6,640 $ 25,570 $ 1,300 0 620 840 0 10,200 3,060 $ 16,020 Additional information for the 2021 fiscal year ($ in thousands): 1. Cash dividends of $1,200 were declared and paid. 2. Equipment costing $4,400 was purchased with cash. 3. Equipment with a book value of $700 (cost of $1,900 less accumulated depreciation of $1,200) was sold for $700. 4. Depreciation of $1,800 is included in operating expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts