Question: prepare a statement of cash flows using the provided balance sheet. (I believe i have the accounts right but im not sure) 12 & 13

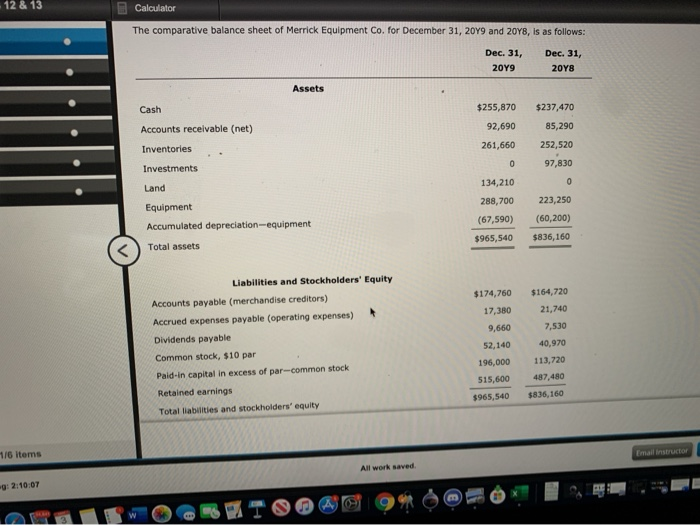

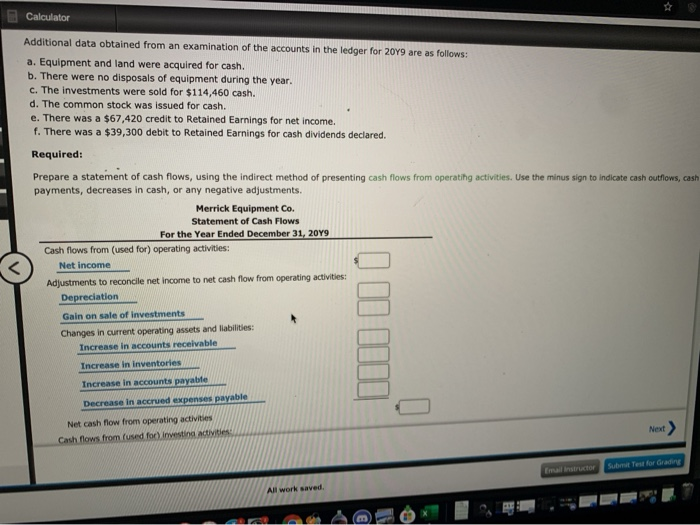

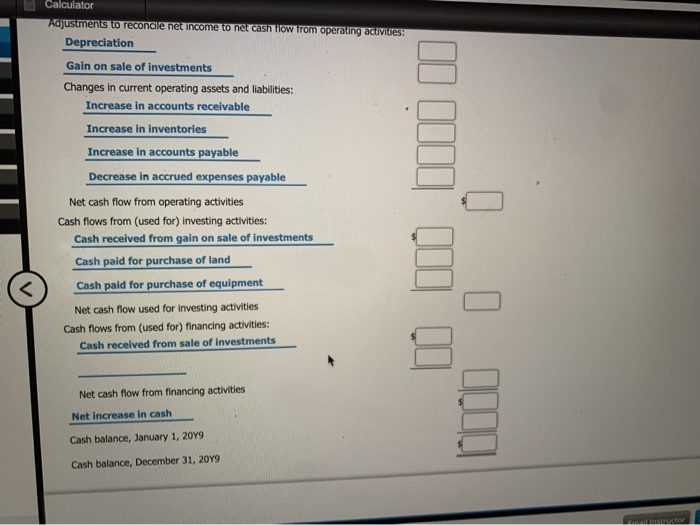

12 & 13 Calculator The comparative balance sheet of Merrick Equipment Co. for December 31, 2049 and 2048, is as follows: Dec. 31, 2019 Dec. 31, 2018 Assets Cash Accounts receivable (net) Inventories Investments $255,870 92,690 261,660 $237,470 85,290 252,520 97,830 0 223,250 (60,200) $836,160 Land Equipment Accumulated depreciation-equipment 134,210 288,700 (67,590) $965,540 Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable Common stock, $10 par Pald-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $174,760 17,380 9,660 52,140 196,000 515,600 $965,540 $164,720 21,740 7,530 40,970 113,720 487,480 5836,160 116 Items mal instructor All work saved 2:10:07 Calculator Additional data obtained from an examination of the accounts in the ledger for 2049 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $114,460 cash. d. The common stock was issued for cash. e. There was a $67,420 credit to Retained Earnings for net income. f. There was a $39,300 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2049 Cash flows from (used for) operating activities: Net Income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of investments Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Increase in accounts payable Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from (used for investing activities Next > Email instructor Su Test for Grading All work saved Calculator Adjustments to reconcie net income to net cash flow from operating activities: Depreciation Gain on sale of investments Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Increase in accounts payable Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from (used for) investing activities: Cash received from gain on sale of investments u II DO DO Cash paid for purchase of land Cash paid for purchase of equipment Net cash flow used for investing activities Cash flows from (used for) financing activities: Cash received from sale of investments Net cash flow from financing activities Net Increase in cash Cash balance, January 1, 2049 Cash balance, December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts