Question

Prepare a Statement of Cost of Goods Manufactured and an Income Statement for NewCo for the Year Ended December 31, 2023. Work in process

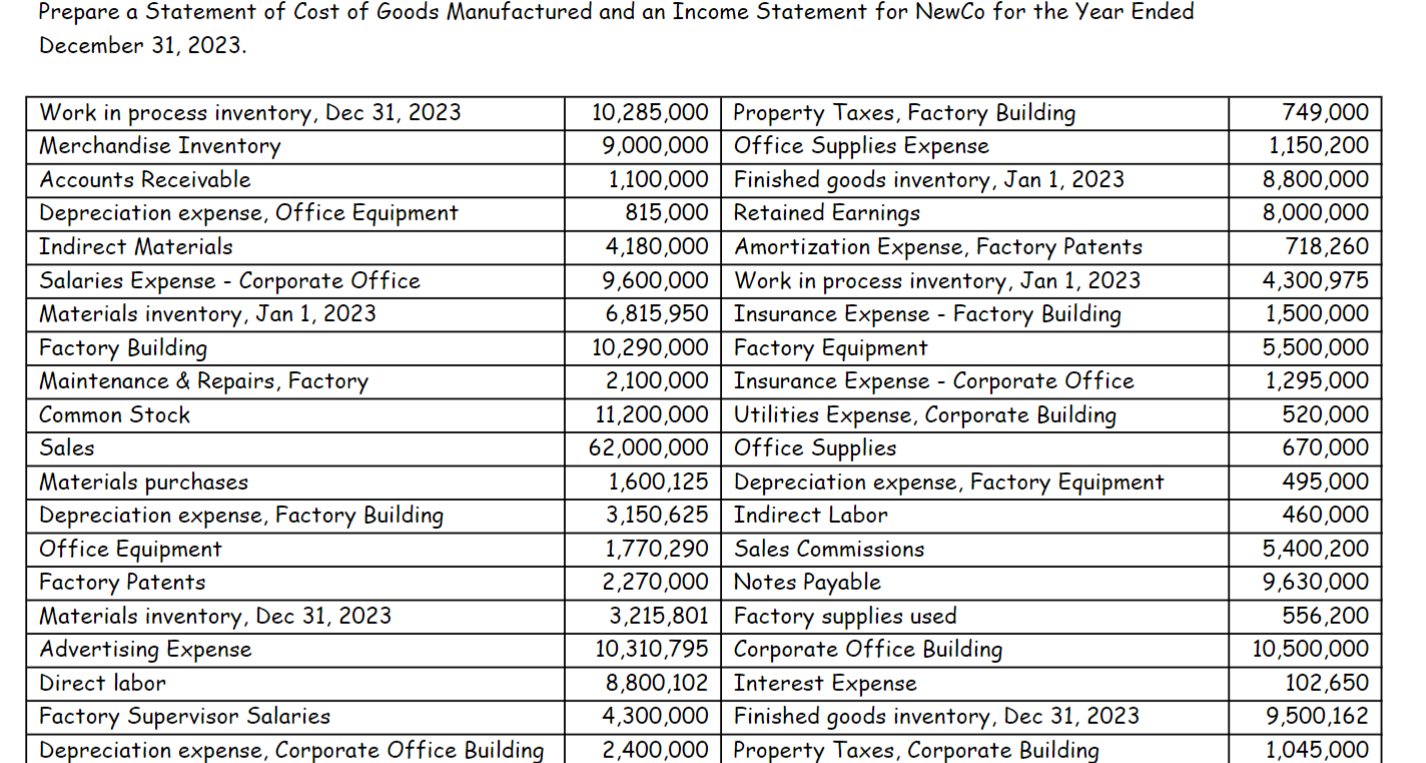

Prepare a Statement of Cost of Goods Manufactured and an Income Statement for NewCo for the Year Ended December 31, 2023. Work in process inventory, Dec 31, 2023 Merchandise Inventory Accounts Receivable Depreciation expense, Office Equipment Indirect Materials Salaries Expense - Corporate Office Materials inventory, Jan 1, 2023 Factory Building Maintenance & Repairs, Factory Common Stock Sales Materials purchases Depreciation expense, Factory Building Office Equipment Factory Patents Materials inventory, Dec 31, 2023 Advertising Expense Direct labor Factory Supervisor Salaries Depreciation expense, Corporate Office Building 10,285,000 Property Taxes, Factory Building 9,000,000 Office Supplies Expense 1,100,000 Finished goods inventory, Jan 1, 2023 815,000 Retained Earnings 4,180,000 Amortization Expense, Factory Patents 9,600,000 Work in process inventory, Jan 1, 2023 6,815,950 Insurance Expense - Factory Building 10,290,000 Factory Equipment 2,100,000 Insurance Expense - Corporate Office 11,200,000 Utilities Expense, Corporate Building 62,000,000 Office Supplies 1,600,125 3,150,625 Indirect Labor Depreciation expense, Factory Equipment 1,770,290 Sales Commissions 2,270,000 Notes Payable 3,215,801 Factory supplies used 10,310,795 Corporate Office Building 8,800,102 Interest Expense 4,300,000 Finished goods inventory, Dec 31, 2023 2,400,000 Property Taxes, Corporate Building 749,000 1,150,200 8,800,000 8,000,000 718,260 4,300,975 1,500,000 5,500,000 1,295,000 520,000 670,000 495,000 460,000 5,400,200 9,630,000 556,200 10,500,000 102,650 9,500,162 1,045,000

Step by Step Solution

3.25 Rating (117 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Cost of Goods Manufactured COGM and Income Statement for NewCo for the Y...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started