Question: Prepare a T-account that for Fixed Manufacturing Overhead based on Absorption costing that shows: actual costs, applied costs, rate variance and production volume variance (this

Prepare a T-account that for Fixed Manufacturing Overhead based on Absorption costing that shows: actual costs, applied costs, rate variance and production volume variance (this account should be at zero at year-end)

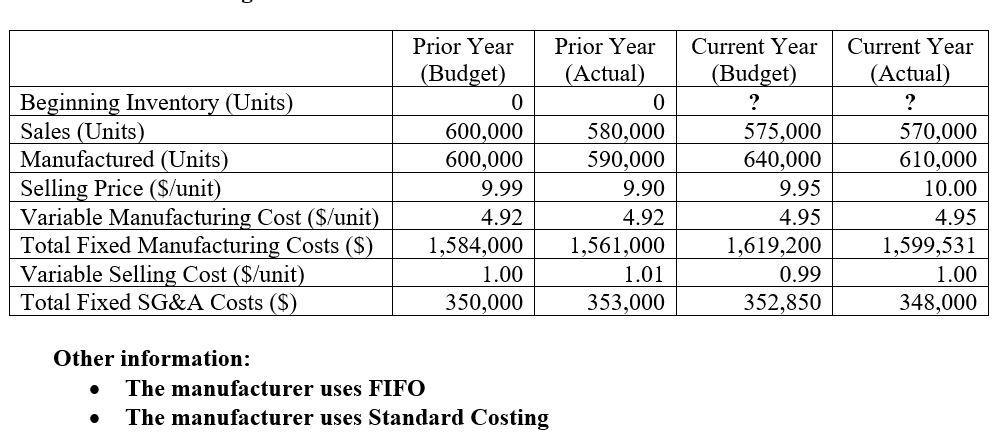

Prior Year Prior Year Current Year Current Year (Budget) (Actual) (Budget) (Actual) Beginning Inventory (Units) Sales (Units) Manufactured (Units) Selling Price (S/unit) Variable Manufacturing Cost (S/unit) Total Fixed Manufacturing Costs ($) Variable Selling Cost ($/unit) Total Fixed SG&A Costs ($) ? 600,000 600,000 580,000 590,000 575,000 640,000 570,000 610,000 9.99 9.90 9.95 10.00 4.92 4.92 4.95 4.95 1,584,000 1,561,000 1,619,200 1,599,531 1.00 1.01 0.99 1.00 350,000 353,000 352,850 348,000 Other information: The manufacturer uses FIFO The manufacturer uses Standard Costing

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Answer Answer A Preparation of Budgeted income statement of current year based on variable costing Particulars Amount Amount Sales 575000 units X 995 5721250 Less Variable cost Manufacturing Variable ... View full answer

Get step-by-step solutions from verified subject matter experts