Question: Prepare a worksheet with the 13 ratios for AMAT. Please highlight any ratios that the are (good or bad) red flags with respect to the

Prepare a worksheet with the 13 ratios for AMAT. Please highlight any ratios that the are (good or bad) red flags with respect to the companys financial performance and position.

Ratios:

Current Ratio

Acid Test Ratio

Accounts Receivable Turnover

Inventory Turnover

Times Interest Earned

Debt to Equity

Earnings per Share

Dividend Yield

Dividend Payout

Price Earnings

Return on Assets

Return on Equity

Gross Margin

- From AMATs 10k and Internet sources, please provide a description of AMATs revenue segments. Limit your description to 2 or 3 sentences for each segment.

- Which segment presents the greatest opportunity for the companys future growth.

- Please briefly describe trends in Analysts estimates of the companys EPS.

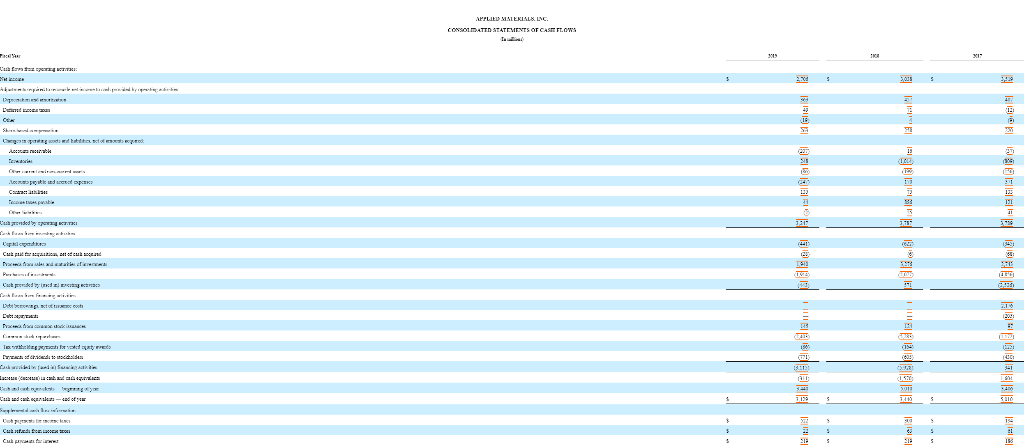

- Please see the companys statement of cash flows. Does the company seem to have enough cash flows from operations to cover its CAPEX.

- Based on this rather cursory analysis, would you consider AMAT a buy, hold, or sell. Briefly describe your rationale in two sentences.

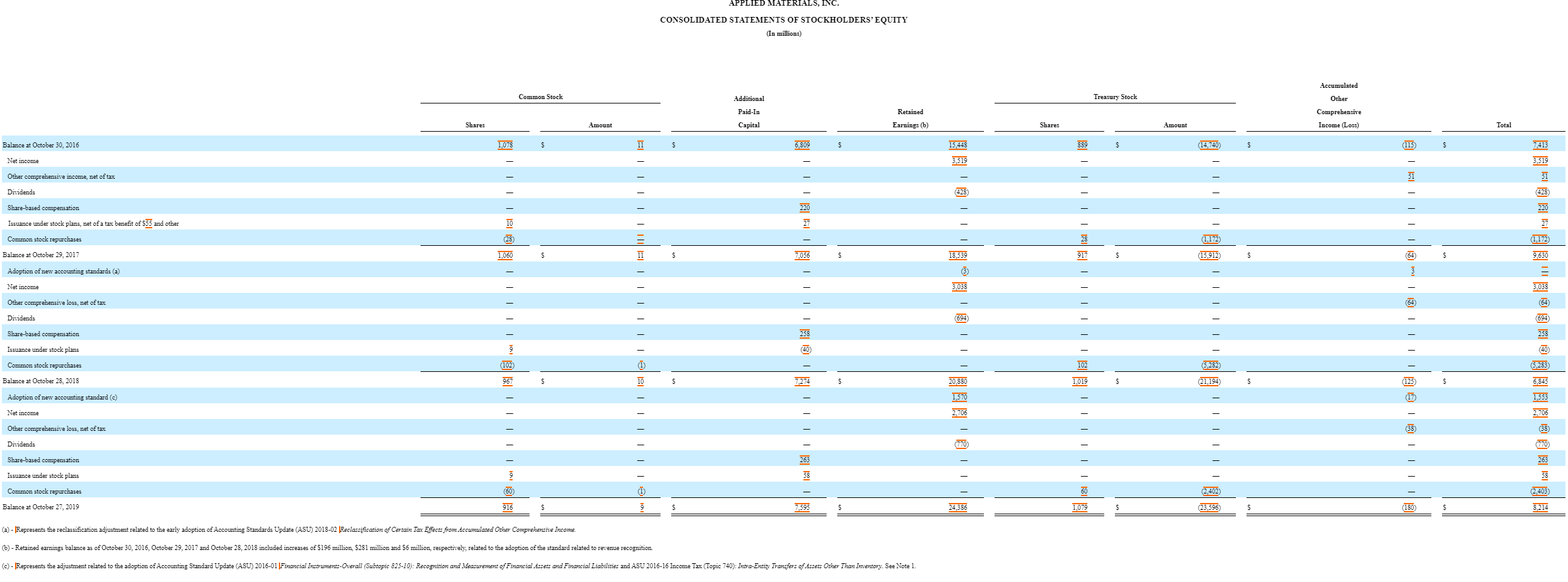

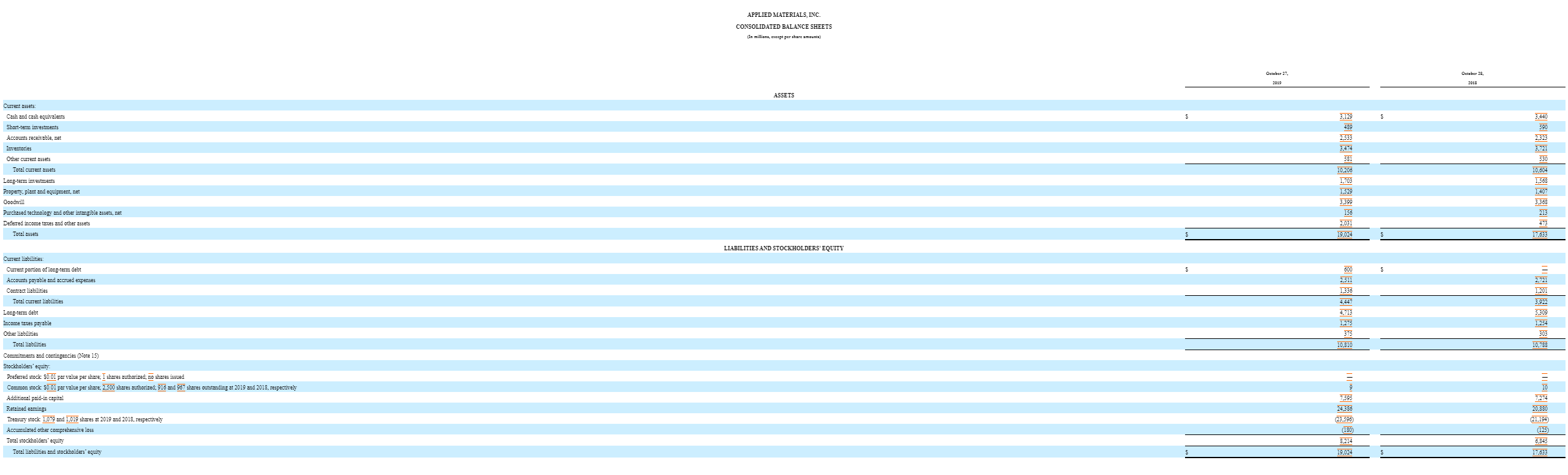

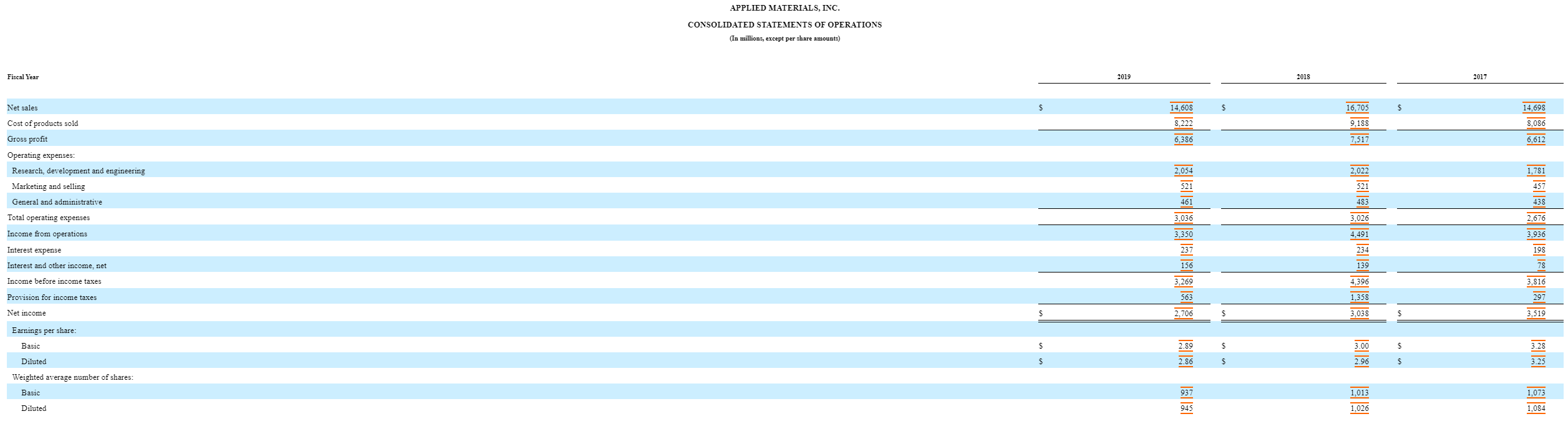

APPLIED MATERIALS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions) Accumulated Common Stock Additional Treasury Stock Other Paid-In Retained Earnings (b) Comprehensive Income (Loss) Shares Amount Capital Shares Amount Total Balance at October 30, 2016 1,078 S 115 S 889 $ (14,740) $ S 7413 @ Net income 15,448 3,319 - 3,519 | 9! !! Other comprehensive income net of tax | Dividends | Share-based compensation 220 II Issuance under stock plans, net of a tax benefit of $55 and other !! Common stock repurchases 1.172) (15,912) II III ICHI ILI 1,172) 9,630 Balance at October 29, 2017 18,539 13) Adoption of new accounting standards (a) Net income 3,038 3,038 - !!!! Other comprehensive loss, net of tax ELII II III II III III Dividends , 13011 Share-based compensation 258 Issuance under stock plans Common stock repurchases 102 5,282) 21,194) Balance at October 28, 2018 $ 1,019 $ 20,880 1.570 2,706 @ @ 5,283) 6,845 1,553 2,706 Adoption of new accounting standard (0) | Net income | Other comprehensive loss, net of tax !!!! | @ 101 III Dividends | Share-based compensation 263 | Issuance under stock plans | 181 2,402) 2.403) Common stock repurchases Balance at October 27, 2019 976 (23,596 @ 8.214 (a) - Represents the reclassification adjustment related to the early adoption of Accounting Standards Update (ASU) 2018-02 Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. 6) - Retained earnings balance as of October 30, 2016 October 29, 2017 and October 28, 2018 included increases of $196 million $281 million and $6 million respectively, related to the adoption of the standard related to revenue recognition. - Represents the adjustment related to the adoption of Accounting Standard Update (ASU) 2016-01 |Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities and ASU 2016-16 Income Tax (Topic 740): Intra-Entir Transfers of Assets Other Than Inventory. See Note 1. APPLIED MATERIALS, INC. CONSOLIDATED BALANCE SHEETS (Is millies, except per share amounta October 27, October 25, 2019 2015 ASSETS 3.129 $ 3.440 Current assets: Cash and cash equivalents Short-term investments Accounts receivable.net Inventories Other current assets Total current assets Long-term investments Property, plant and equipment, net Goodwill Purchased technology and other intangible assets.net Deferred income taxes and other assets Total assets 2,533 3.474 581 10.206 1,703 1.529 3.399 156 2,031 19,024 2.323 3.721 530 10.604 1,568 1.407 3.368 475 5 17,633 LIABILITIES AND STOCKHOLDERS' EQUITY $ 2,721 1201 600 2.511 1.336 4.447 4,713 1.275 375 10.810 3.922 5.309 1.254 10.788 Current liabilities Current portion of long-term debt Accounts payable and accrued expenses Contract liabilities Total current liabilities Long-term debt Income taxes payable Other liabilities Total liabilities Commitments and contingencies (Note 15) Stockholders' equity Preferred stock: 90.01 par value per share; I shares authorized, no shares issued Common stock: $0.01 per value per share: 2.500 shares authorized: 916 and 967 shares outstanding at 2019 and 2018, respectively Additional paid-in capital Retained eamings Treasury stock 1.079 and 1,019 shares at 2019 and 2018, respectively Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity 7.595 24,386 (23,596) (180) 7:274 20.880 (21,194) (125) 6.845 17.633 APPLIED MALEKIALS, INC. CONSOLIDATED STATEMENTS OF CASE FLOW L et und es pas 10 GIORGIOEDE Fushe XI F Nada Castres Dosto La ca. 4 tel Cube EOS IFE APPLIED MATERIALS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) Fiscal Year 2019 2018 2017 Net sales 5 14,698 14,608 8.222 6,386 Cost of products sold Gross profit 8,086 6,612 2,054 1,781 457 Operating expenses: Research, development and engineering Marketing and selling General and administrative Total operating expenses Income from operations 461 438 3,036 2.676 3,350 936 Interest expense 237 156 3.269 816 Interest and other income, net Income before income taxes Provision for income taxes Net income 563 297 2,706 3,519 Earnings per share: Basic Diluted 5 5 Weighted average number of shares: Basic Diluted 1,073 6131 1,084 APPLIED MATERIALS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions) Accumulated Common Stock Additional Treasury Stock Other Paid-In Retained Earnings (b) Comprehensive Income (Loss) Shares Amount Capital Shares Amount Total Balance at October 30, 2016 1,078 S 115 S 889 $ (14,740) $ S 7413 @ Net income 15,448 3,319 - 3,519 | 9! !! Other comprehensive income net of tax | Dividends | Share-based compensation 220 II Issuance under stock plans, net of a tax benefit of $55 and other !! Common stock repurchases 1.172) (15,912) II III ICHI ILI 1,172) 9,630 Balance at October 29, 2017 18,539 13) Adoption of new accounting standards (a) Net income 3,038 3,038 - !!!! Other comprehensive loss, net of tax ELII II III II III III Dividends , 13011 Share-based compensation 258 Issuance under stock plans Common stock repurchases 102 5,282) 21,194) Balance at October 28, 2018 $ 1,019 $ 20,880 1.570 2,706 @ @ 5,283) 6,845 1,553 2,706 Adoption of new accounting standard (0) | Net income | Other comprehensive loss, net of tax !!!! | @ 101 III Dividends | Share-based compensation 263 | Issuance under stock plans | 181 2,402) 2.403) Common stock repurchases Balance at October 27, 2019 976 (23,596 @ 8.214 (a) - Represents the reclassification adjustment related to the early adoption of Accounting Standards Update (ASU) 2018-02 Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. 6) - Retained earnings balance as of October 30, 2016 October 29, 2017 and October 28, 2018 included increases of $196 million $281 million and $6 million respectively, related to the adoption of the standard related to revenue recognition. - Represents the adjustment related to the adoption of Accounting Standard Update (ASU) 2016-01 |Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities and ASU 2016-16 Income Tax (Topic 740): Intra-Entir Transfers of Assets Other Than Inventory. See Note 1. APPLIED MATERIALS, INC. CONSOLIDATED BALANCE SHEETS (Is millies, except per share amounta October 27, October 25, 2019 2015 ASSETS 3.129 $ 3.440 Current assets: Cash and cash equivalents Short-term investments Accounts receivable.net Inventories Other current assets Total current assets Long-term investments Property, plant and equipment, net Goodwill Purchased technology and other intangible assets.net Deferred income taxes and other assets Total assets 2,533 3.474 581 10.206 1,703 1.529 3.399 156 2,031 19,024 2.323 3.721 530 10.604 1,568 1.407 3.368 475 5 17,633 LIABILITIES AND STOCKHOLDERS' EQUITY $ 2,721 1201 600 2.511 1.336 4.447 4,713 1.275 375 10.810 3.922 5.309 1.254 10.788 Current liabilities Current portion of long-term debt Accounts payable and accrued expenses Contract liabilities Total current liabilities Long-term debt Income taxes payable Other liabilities Total liabilities Commitments and contingencies (Note 15) Stockholders' equity Preferred stock: 90.01 par value per share; I shares authorized, no shares issued Common stock: $0.01 per value per share: 2.500 shares authorized: 916 and 967 shares outstanding at 2019 and 2018, respectively Additional paid-in capital Retained eamings Treasury stock 1.079 and 1,019 shares at 2019 and 2018, respectively Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity 7.595 24,386 (23,596) (180) 7:274 20.880 (21,194) (125) 6.845 17.633 APPLIED MALEKIALS, INC. CONSOLIDATED STATEMENTS OF CASE FLOW L et und es pas 10 GIORGIOEDE Fushe XI F Nada Castres Dosto La ca. 4 tel Cube EOS IFE APPLIED MATERIALS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) Fiscal Year 2019 2018 2017 Net sales 5 14,698 14,608 8.222 6,386 Cost of products sold Gross profit 8,086 6,612 2,054 1,781 457 Operating expenses: Research, development and engineering Marketing and selling General and administrative Total operating expenses Income from operations 461 438 3,036 2.676 3,350 936 Interest expense 237 156 3.269 816 Interest and other income, net Income before income taxes Provision for income taxes Net income 563 297 2,706 3,519 Earnings per share: Basic Diluted 5 5 Weighted average number of shares: Basic Diluted 1,073 6131 1,084

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts