Question: prepare an amortization schedule by the straight-line method On January 1,2024 , Reyes Recreational Products issued $160,000,8%, four-year bonds. Interest is paid semiannually on June

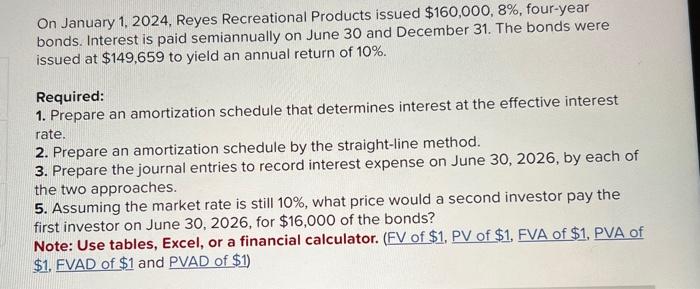

On January 1,2024 , Reyes Recreational Products issued $160,000,8%, four-year bonds. Interest is paid semiannually on June 30 and December 31 . The bonds were issued at $149,659 to yield an annual return of 10%. Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight-line method. 3. Prepare the journal entries to record interest expense on June 30,2026 , by each of the two approaches. 5. Assuming the market rate is still 10%, what price would a second investor pay the first investor on June 30,2026 , for $16,000 of the bonds? Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of $1, FVAD of $1 and PVAD of $1 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts