Question: Prepare cash flow statement using the indirect method to report operating activities. Note any additional disclosures that are required. Required 1. Prepare Jackson Ltd.'s cash

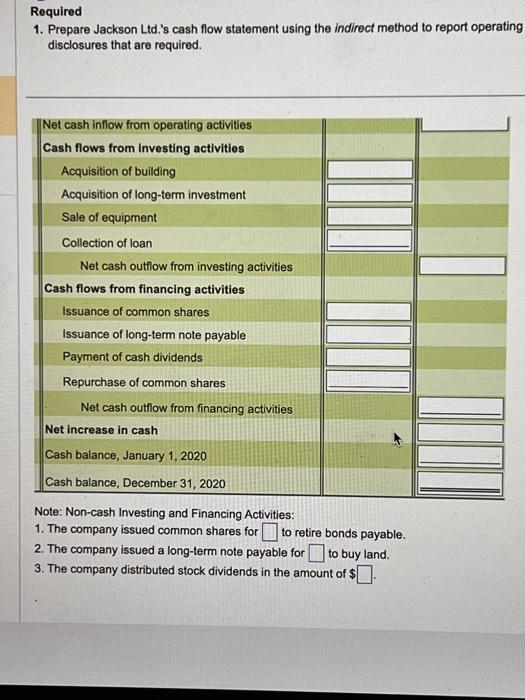

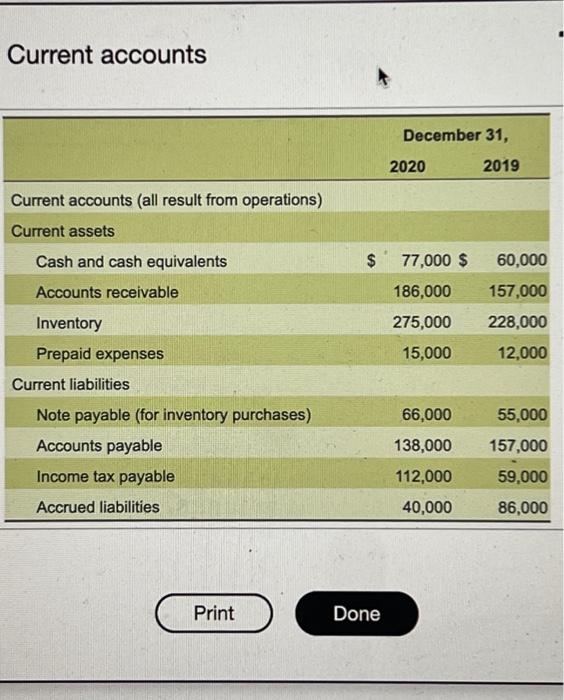

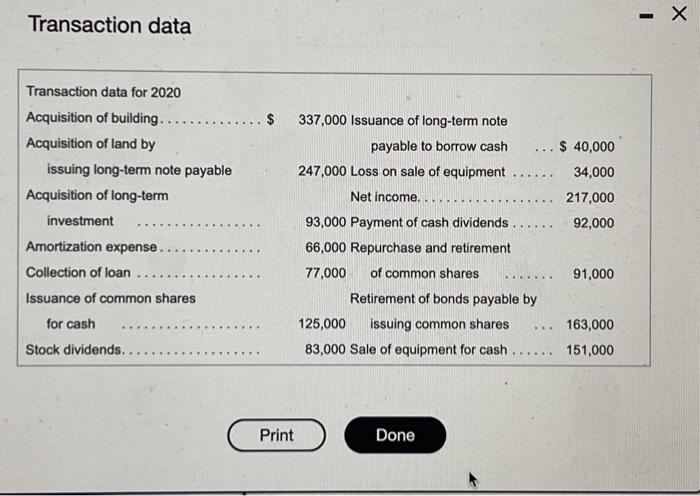

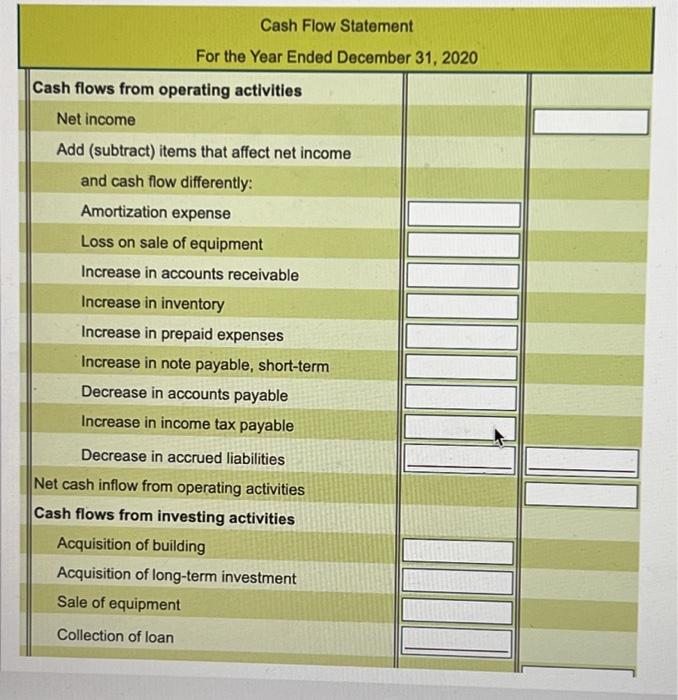

Required 1. Prepare Jackson Ltd.'s cash flow statement using the indirect method to report operating disclosures that are required. Note: Non-cash Investing and Financing Activities: 1. The company issued common shares for to retire bonds payable. 2. The company issued a long-term note payable for to buy land. 3. The company distributed stock dividends in the amount of $ Current accounts \begin{tabular}{lccc} \hline & \multicolumn{2}{c}{ December 31, } \\ & 2020 & 2019 \\ \hline Current accounts (all result from operations) & & \\ \hline Current assets & & \\ \hline Cash and cash equivalents & & \\ \hline Accounts receivable & 77,000$ & 60,000 \\ \hline Inventory & 186,000 & 157,000 \\ \hline Prepaid expenses & 275,000 & 228,000 \\ \hline \end{tabular} Current liabilities \begin{tabular}{lrr} Note payable (for inventory purchases) & 66,000 & 55,000 \\ Accounts payable & 138,000 & 157,000 \\ Income tax payable & 112,000 & 59,000 \\ Accrued liabilities & 40,000 & 86,000 \\ \hline \end{tabular} Print Done Transaction data Cash Flow Statement For the Year Ended December 31, 2020 Cash flows from operating activities Net income Add (subtract) items that affect net income and cash flow differently: Amortization expense Loss on sale of equipment Increase in accounts receivable Increase in inventory Increase in prepaid expenses Increase in note payable, short-term Decrease in accounts payable Increase in income tax payable Decrease in accrued liabilities Net cash inflow from operating activities Cash flows from investing activities Acquisition of building Acquisition of long-term investment Sale of equipment Collection of loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts