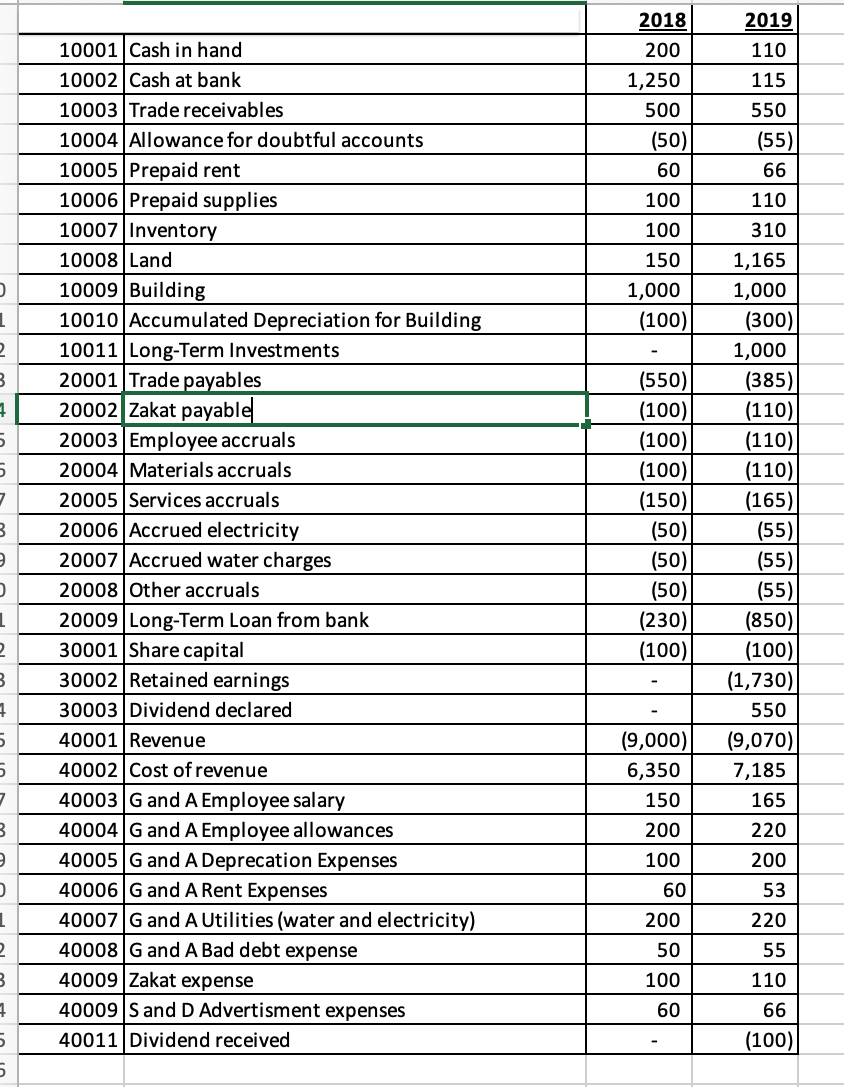

Question: Prepare free cash flow statement. 2018 200 2019 110 115 550 1,250 500 (50) 60 (55) 66 100 110 310 100 150 1,000 (100)

Prepare free cash flow statement.

\

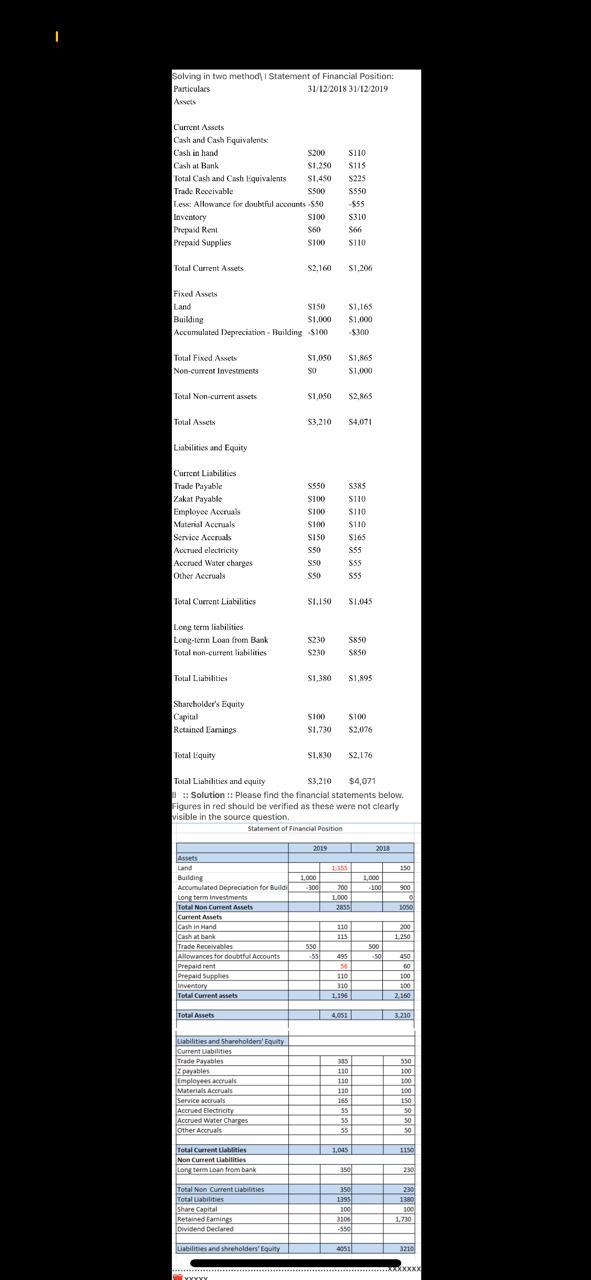

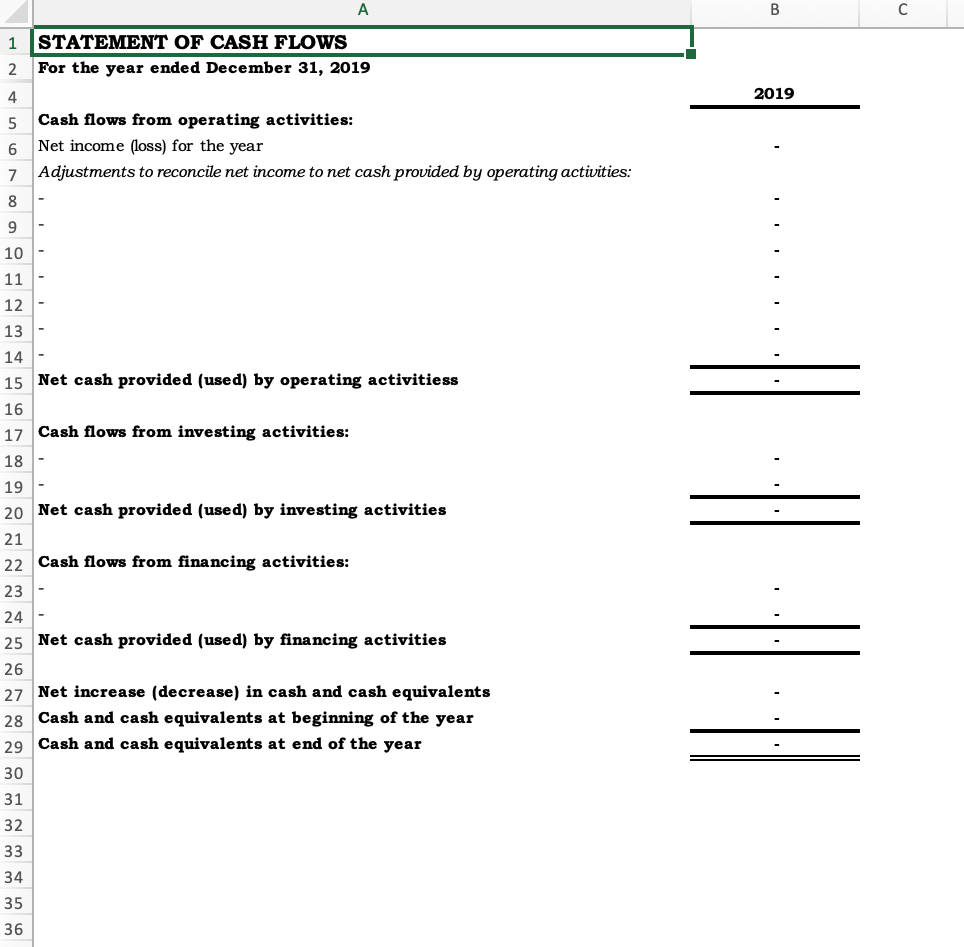

2018 200 2019 110 115 550 1,250 500 (50) 60 (55) 66 100 110 310 100 150 1,000 (100) 1 2 3 1 5 5 7 10001 Cash in hand 10002 Cash at bank 10003 Trade receivables 10004 Allowance for doubtful accounts 10005 Prepaid rent 10006 Prepaid supplies 10007 Inventory 10008 Land 10009 Building 10010 Accumulated Depreciation for Building 10011 Long-Term Investments 20001 Trade payables 20002 Zakat payable 20003 Employee accruals 20004 Materials accruals 20005 Services accruals 20006 Accrued electricity 20007 Accrued water charges 20008 Other accruals 20009 Long-Term Loan from bank 30001 Share capital 30002 Retained earnings 30003 Dividend declared 40001 Revenue 40002 Cost of revenue 40003 G and A Employee salary 40004 G and A Employee allowances 40005G and A Deprecation Expenses 40006 G and A Rent Expenses 40007G and A Utilities (water and electricity) 40008 G and A Bad debt expense 40009 Zakat expense 40009 S and D Advertisment expenses 40011 Dividend received (550) (100) (100) (100) (150) (50) (50) (50) (230) (100) 3 1,165 1,000 (300) 1,000 (385) (110) (110) (110) (165) (55) (55) (55) (850) (100) (1,730) 550 (9,070) 7,185 165 1 2 3 1 5 (9,000) 6,350 150 7 3 200 220 100 60 200 53 220 55 1 200 2 50 3 100 110 60 66 1 5 (100) Solving in two method Statement of Financial Position: Particulars 31/12/2018 31/12/2019 Assets Current Assets Cash and Cash Equivalents Cash in hand S200 Chat Bank S1.230 $ Total Cash and Cash liquivalents SI 450 Trade Receivable S500 Lesk: Allowance for doubtful accounts -550 Inventory S100 Prepaid Re Prepaid Supplies S100 5110 $115 5225 S550 -$55 S310 S66 S110 Total Current Assets S2.160 S1.206 Fixed Assets Land SISO Building $1,000 Accumulated Depreciation - Building $100 S1,165 $1.000 $300 Total Fixed Assets Non-current Investments $1,050 SO S1.865 $1,000 Total Non-current assets $1,050 $2.865 Total Assets $3,210 S4,071 Liabilities and Equity S385 5110 Current Liabilities Trade Payable Zakat Payable Employee Accruals Material Accruals Service Accruals Accued electricity Accrued Water charges Other Accruals S550 S100 S100 S100 SISO S50 $110 S110 $165 S55 SSS SSS SSO SSO Total Current Liabilities SI.150 $1.045 Long term liabilities Long-tern Loan from Bank Total non-current liabilities S230 S230 S850 S850 Total Liabilities S1.380 S1,895 Shareholder's Equity Capital Retained Eamings S100 S1,730 S100 $2.076 Total Equity $1,830 $ S2.176 Total Liabilities and equity S3,210 $4,071 1 Solution :: Please find the financial statements below. Figures in red should be verified as these were not clearly visible in the source question. Statement of Financial Position 2019 2013 1,000 2300 1.000 100 900 700 L000 2855 Borso Assets Land Building Accumulated Depreciation for Builde Long term investments Total Non Current Assets Current Assets Cash in Hand Cash bank Trade Receivables Allowances for doubtful Accounts Prepaid rent Prepaid Supplies Inventory Total Current assets 110 115 200 1.250 550 500 -50 495 450 110 Me 310 1.196 100 100 2 150 Total Assets 4.051 3.210 Liabilities and Shareholders' Equity Current Liabilities Trade Payables payables Employees actuals Materials Accruals Service accruals Acered Electricity Accrued Water Charges Other Accruals 110 110 110 155 55 35 55 550 100 100 100 150 50 90 50 1.045 Total Current Liabilities Non Current abilities Long term loan from bank 350 230 Total Non Current Liabilities Total Liabilities Share Capital Retained Earnings Dividend Declared 350 1395 100 3305 -550 230 1380 100 1.730 Liabilities and shreholders' Equity 4051 1210 XXXXXXX YYYY A B 1 STATEMENT OF CASH FLOWS For the year ended December 31, 2019 2 4 2019 5 6 Cash flows from operating activities: Net income (loss) for the year Adjustments to reconcile net income to net cash provided by operating activities: 7 8 9 10 - 11 12 13 14 - 15 Net cash provided (used) by operating activitiess 16 17 Cash flows from investing activities: 18 19 20 Net cash provided (used) by investing activities 21 22 Cash flows from financing activities: 23 24 25 Net cash provided (used) by financing activities 26 27 Net increase (decrease) in cash and cash equivalents 28 Cash and cash equivalents at beginning of the year 29 Cash and cash equivalents at end of the year 30 31 32 33 34 35 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts