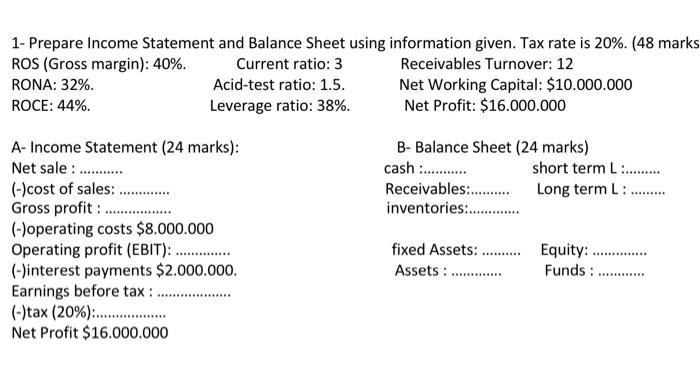

Question: - Prepare Income Statement and Balance Sheet using information given. Tax rate is 20%. ROS (Gross margin): 40%. RONA: 32%. ROCE: 44%. Current ratio: 3

1- Prepare Income Statement and Balance Sheet using information given. Tax rate is 20%. (48 marks ROS (Gross margin): 40%. Current ratio: 3 Receivables Turnover: 12 RONA: 32%. Acid-test ratio: 1.5. Net Working Capital: $10.000.000 ROCE: 44%. Leverage ratio: 38%. Net Profit: $16.000.000 A- Income Statement ( 24 marks): B- Balance Sheet ( 24 marks) Net sale : cash :.......... short term L: (-)cost of sales: Receivables:......... Long term L: Gross profit : . inventories: (-)operating costs $8.000.000 Operating profit (EBIT): fixed Assets: Equity: (-)interest payments $2.000.000. Assets : Funds : Earnings before tax : (-) tax (20\%):... Net Profit \$16.000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts