Question: Prepare journal entries for all activities. Calculate missing amounts direct materials, cost of goods manufactured, cost of goods sold, and actual overhead. The accounting

- Prepare journal entries for all activities. \

Calculate missing amounts direct materials, cost of goods manufactured, cost of goods sold, and actual overhead.

The accounting records indicated the following operations: Direct Materials Used $ 160,000; Direct Labor $ 500,000; Overhead applied $ 250,000; and Over Applied Overhead $ 750. The inventory records revealed the following amounts.

Date December 31 (ending) January 1 (beginning)

Inventory:

Direct Materials $ 24,000 $ 9,000

Work-in-Process 70,000 80,000

Finished Goods 95,000 100,000

Sales on account totaled $ 1,500,000

Payments on account to suppliers totaled 420,000

Bonus entries:

Collections on account totaled 1,352,000

Payment on wages payable 491,880

Post journal entries into the provided spreadsheet. \

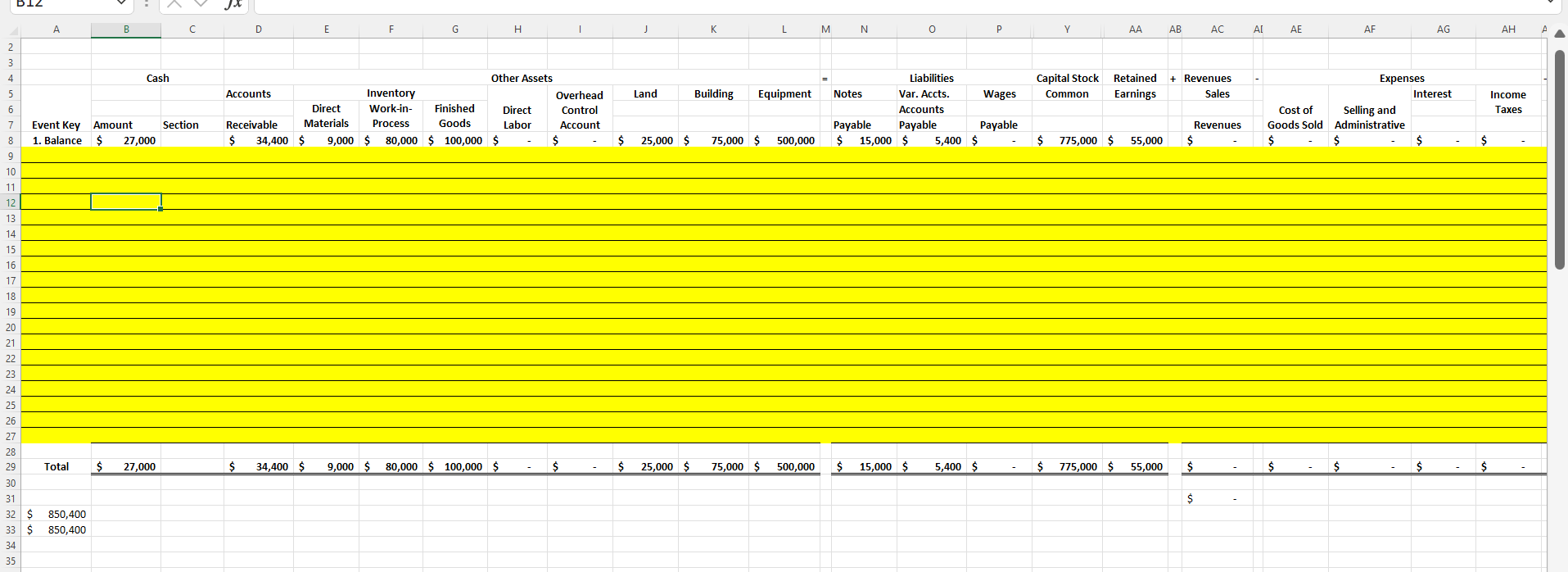

BIZ A B D E F G H | 1 J L M N 0 P Y AA AB AC AL AE AF AG 2 3 4 Cash Capital Stock Common Retained Earnings + Revenues Sales 5 Land Building Equipment Other Assets Accounts Inventory Overhead Direct Work-in- Finished Direct Control Receivable Materials Process Goods Labor Account $ 34,400 $ 9,000 $80,000 $100,000 $ $ 6 Liabilities Notes Var. Accts. Wages Accounts Payable Payable Payable $ 15,000 $ 5,400 $ Income Taxes Expenses Interest Cost of Selling and Goods Sold Administrative $ $ $ $ Section 7 8 Event Key Amount 1. Balance $ 27,000 Revenues $ $ 25,000 $ 75,000 $ 500,000 $ 775,000 $ 55,000 - $ $ 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Total $ 27,000 $ 34,400 $ 9,000 $80,000 $ 100,000 $ $ $ 25,000 $ 75,000 $ 500,000 $ 15,000 $ 5,400 $ $ 175,000 $ 55,000 $ $ $ $ $ $ 30 31 32 $ 33 $ 34 35 850,400 850,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts