Answered step by step

Verified Expert Solution

Question

1 Approved Answer

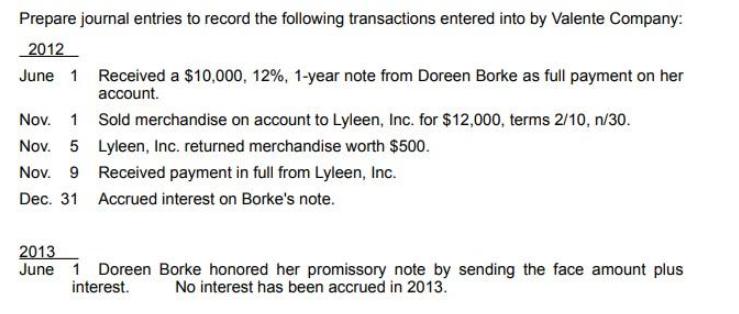

Prepare journal entries to record the following transactions entered into by Valente Company: 2012 June 1 Received a $10,000, 12%, 1-year note from Doreen

Prepare journal entries to record the following transactions entered into by Valente Company: 2012 June 1 Received a $10,000, 12%, 1-year note from Doreen Borke as full payment on her account. Nov. 1 Sold merchandise on account to Lyleen, Inc. for $12,000, terms 2/10, n/30. Nov. 5 Lyleen, Inc. returned merchandise worth $500. Nov. 9 Received payment in full from Lyleen, Inc. Dec. 31 Accrued interest on Borke's note. 2013 June 1 Doreen Borke honored her promissory note by sending the face amount plus interest. No interest has been accrued in 2013.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Date General Journal Debit Credit June 1 2012 Notes Receivable 100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dcc1eb704f_178951.pdf

180 KBs PDF File

635dcc1eb704f_178951.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started