Question: prepare Net pay (excel working paper; Ill include ) (prepare General entries for salary only ) calculate net pay (ill unclude sheet ) Please help

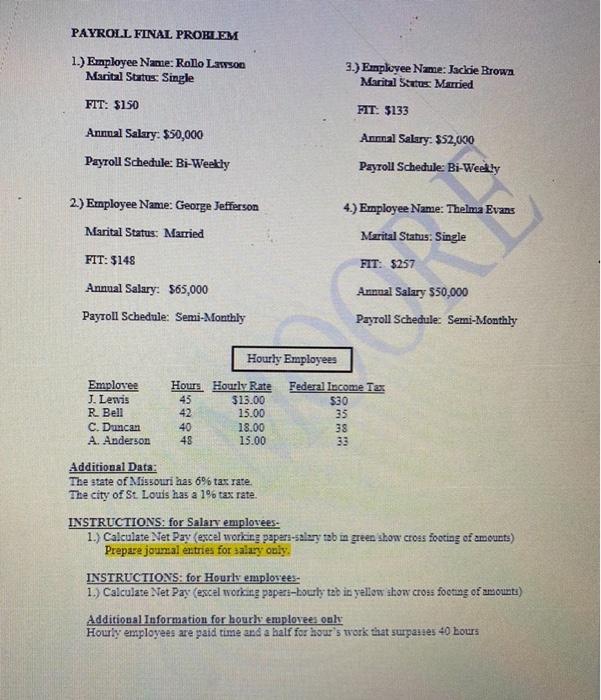

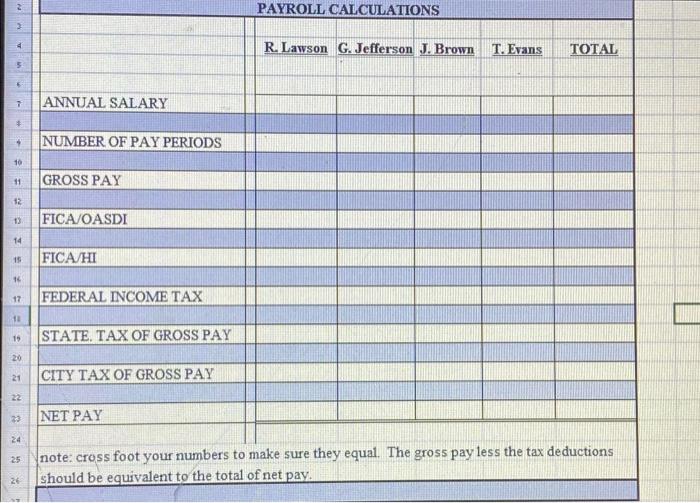

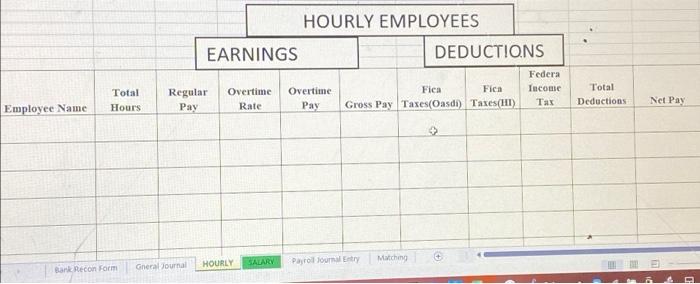

PAYROLL FINAL PROBLEM 1.) Employee Name: Rollo Lawson Marital Status: Single 3.) Employee Name: Jackie Brown Marital Status Married FIT: $150 FIT. $133 Annual Salary: $50,000 Payroll Schedule: Bi-Weekly Anmal Salary: $52,000 Payroll Schedule: Bi-Weekly 2) Employee Name: George Jefferson 4.) Employee Name: Thelma Evans Marital Status: Married Marital Status: Single FIT: $148 FIT: $257 Annual Salary: $65,000 Payroll Schedule: Semi-Monthly Annual Salary $50,000 Payroll Schedule: Semi-Monthly Hourly Employees Emplovee J. Lewis R. Bell C. Duncan A. Anderson Hours Hourly Rate 45 $13.00 42 15.00 40 18.00 48 15.00 Federal Income Tax $30 35 38 33 Additional Data: The state of Missouri has 6% tax rate The city of St Louis has a 1% tax rate. INSTRUCTIONS: for Salary emplovees- 1.) Calculate Net Pay (excel working papers-salary tab in green show cross footing of amounts) Prepare journal entries for salary only INSTRUCTIONS: for Hourly emplovees- 1.) Calculate Net Pay (excel working papers-hourly tab in yellow show cross foeting of amounts) Additional Information for hourly employees only Hourly employees are paid time and a half for hour's work that surpasses 40 hours 2 PAYROLL CALCULATIONS 3 4 R. Lawson G. Jefferson J. Brown T. Evans TOTAL 5 7 ANNUAL SALARY 9 NUMBER OF PAY PERIODS 10 11 GROSS PAY 12 FICA/OASDI 14 15 FICAHI 16 17 FEDERAL INCOME TAX 11 15 STATE. TAX OF GROSS PAY 20 21 CITY TAX OF GROSS PAY 22 23 NET PAY 24 25 note: cross foot your numbers to make sure they equal. The gross pay less the tax deductions should be equivalent to the total of net pay. HOURLY EMPLOYEES EARNINGS DEDUCTIONS Fica Total Hours Regular Pay Overtime Rate Overtime Pay Federa Income Tax Fica Gross Pay Taxes(Oasdi) Taxes(III) Total Deductions Employee Name Net Pay + HOURLY SALARY Gneral Journal Matching Parol Journal Bank Recon Form PAYROLL FINAL PROBLEM 1.) Employee Name: Rollo Lawson Marital Status: Single 3.) Employee Name: Jackie Brown Marital Status Married FIT: $150 FIT. $133 Annual Salary: $50,000 Payroll Schedule: Bi-Weekly Anmal Salary: $52,000 Payroll Schedule: Bi-Weekly 2) Employee Name: George Jefferson 4.) Employee Name: Thelma Evans Marital Status: Married Marital Status: Single FIT: $148 FIT: $257 Annual Salary: $65,000 Payroll Schedule: Semi-Monthly Annual Salary $50,000 Payroll Schedule: Semi-Monthly Hourly Employees Emplovee J. Lewis R. Bell C. Duncan A. Anderson Hours Hourly Rate 45 $13.00 42 15.00 40 18.00 48 15.00 Federal Income Tax $30 35 38 33 Additional Data: The state of Missouri has 6% tax rate The city of St Louis has a 1% tax rate. INSTRUCTIONS: for Salary emplovees- 1.) Calculate Net Pay (excel working papers-salary tab in green show cross footing of amounts) Prepare journal entries for salary only INSTRUCTIONS: for Hourly emplovees- 1.) Calculate Net Pay (excel working papers-hourly tab in yellow show cross foeting of amounts) Additional Information for hourly employees only Hourly employees are paid time and a half for hour's work that surpasses 40 hours 2 PAYROLL CALCULATIONS 3 4 R. Lawson G. Jefferson J. Brown T. Evans TOTAL 5 7 ANNUAL SALARY 9 NUMBER OF PAY PERIODS 10 11 GROSS PAY 12 FICA/OASDI 14 15 FICAHI 16 17 FEDERAL INCOME TAX 11 15 STATE. TAX OF GROSS PAY 20 21 CITY TAX OF GROSS PAY 22 23 NET PAY 24 25 note: cross foot your numbers to make sure they equal. The gross pay less the tax deductions should be equivalent to the total of net pay. HOURLY EMPLOYEES EARNINGS DEDUCTIONS Fica Total Hours Regular Pay Overtime Rate Overtime Pay Federa Income Tax Fica Gross Pay Taxes(Oasdi) Taxes(III) Total Deductions Employee Name Net Pay + HOURLY SALARY Gneral Journal Matching Parol Journal Bank Recon Form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts