Question: *** prepare ONLY 2017 Forms 4562 and 1040 12-54 lim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of

***prepare ONLY 2017 Forms 4562 and 1040

***prepare ONLY 2017 Forms 4562 and 1040

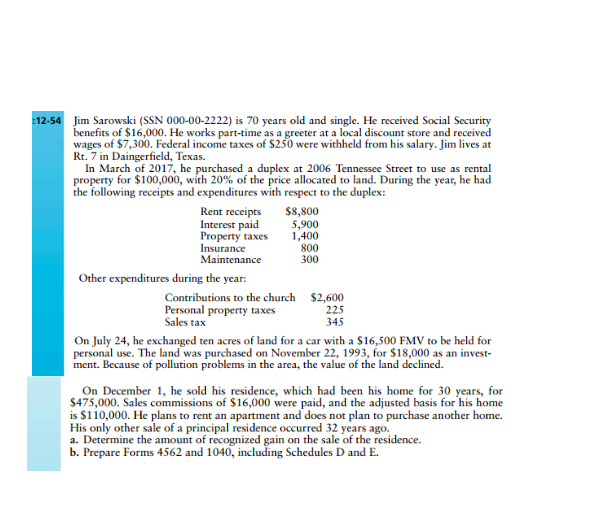

12-54 lim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of $16,000. He works part-time as a greeter at a local discount store and received wages of $7,300. Federal income taxes of $250 were withheld from his salary. Jim lives at Rt. 7 in Daingerfield, Texas. In March of 2017, he purchased a duplex at 2006 Tennessee Street to use as rental property for $100,000, with 20% of the price allocated to land. During the year, he had the following receipts and expenditures with respect to the duplex: Rent receipts $8,800 Interest paid 5,900 Property taxes 1,400 Insurance 800 Maintenance 300 Other expenditures during the year: Contributions to the church $2,600 Personal property taxes 225 Sales tax 345 On July 24, he exchanged ten acres of land for a car with a $16,500 FMV to be held for personal use. The land was purchased on November 22, 1993, for $18,000 as an invest- ment. Because of pollution problems in the area, the value of the land declined. On December 1, he sold his residence, which had been his home for 30 years, for $475,000. Sales commissions of $16,000 were paid, and the adjusted basis for his home is $110,000. He plans to rent an apartment and does not plan to purchase another home. His only other sale of a principal residence occurred 32 years ago. a. Determine the amount of recognized gain on the sale of the residence. b. Prepare Forms 4562 and 1040, including Schedules D and E. 12-54 lim Sarowski (SSN 000-00-2222) is 70 years old and single. He received Social Security benefits of $16,000. He works part-time as a greeter at a local discount store and received wages of $7,300. Federal income taxes of $250 were withheld from his salary. Jim lives at Rt. 7 in Daingerfield, Texas. In March of 2017, he purchased a duplex at 2006 Tennessee Street to use as rental property for $100,000, with 20% of the price allocated to land. During the year, he had the following receipts and expenditures with respect to the duplex: Rent receipts $8,800 Interest paid 5,900 Property taxes 1,400 Insurance 800 Maintenance 300 Other expenditures during the year: Contributions to the church $2,600 Personal property taxes 225 Sales tax 345 On July 24, he exchanged ten acres of land for a car with a $16,500 FMV to be held for personal use. The land was purchased on November 22, 1993, for $18,000 as an invest- ment. Because of pollution problems in the area, the value of the land declined. On December 1, he sold his residence, which had been his home for 30 years, for $475,000. Sales commissions of $16,000 were paid, and the adjusted basis for his home is $110,000. He plans to rent an apartment and does not plan to purchase another home. His only other sale of a principal residence occurred 32 years ago. a. Determine the amount of recognized gain on the sale of the residence. b. Prepare Forms 4562 and 1040, including Schedules D and E

Step by Step Solution

There are 3 Steps involved in it

To address the requirements lets break down the problem step by step a Recognized Gain on the Sale of the Residence Home Sale Exclusion Rule Since Jim ... View full answer

Get step-by-step solutions from verified subject matter experts