Question: Prepare operating income statements for both years based on absorption costing. LEHIGHTON CHALK COMPANY Income Statement Year 1 Year 2 Sales revenue $67,200 $67,200 Cost

Prepare operating income statements for both years based on absorption costing.

| ||||||||||||||||||||||||||||||||||||||||

Prepare operating income statements for both years based on variable costing.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

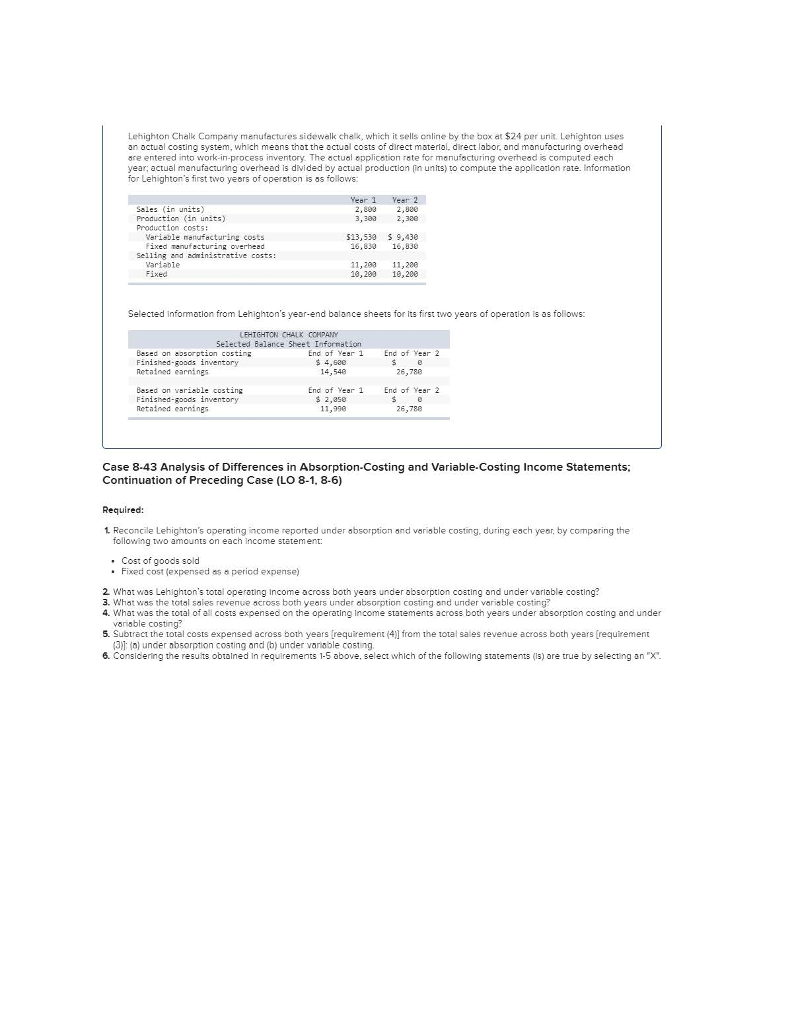

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $24 per unit. Lehighton uses an octual costing system, which means thot the actual costs of direct msterlal direct labor, ond manufocturing overhead ore entered into work-in-process inventory. The actual opplication rete for menufecturing overhead is computed each year; actual manufacturing overnead is divided oy actual production (in units to compute the application rate. Information for Lehighton's first tvo yeors ofoperation is as follows Sales (in units) Production in units) Production costs: 2,893 3,30a 2,920 2,32e eriable nenufacturing costs ixed Tenufacturing overhead 513,53 S 9,430 6,830 16,838 selling and acministrative costs: artable Fixed 11, 1,20 18,2 18,288 Selected infomation from Lehighton's year-end balance sheets for its first two years of operation is as follows: LEHTGHTON CHALK 5elected Balance Sheet Information End of Yeer 1nd of Yeer 2 Based on absorption costing Finished-goods inventory Retained earnings Based on variable costing Finished-goods inventory Retained carnings 14,540 End of Yeer 1 11,990 6,788 End of Yeer 2 6,788 Case 8-43 Analysis of Differences in Absorption-Costing and Variable-Costing Income Statements Continuation of Preceding Case (LO 8-1, 8-6) Required: 1 Reconcile Lehighton's operating income reported under absorption and varisble costing, during each yeor, by comporing the following two amounts on each income statem ent: . Cost of goods sold Fixed cost (expensed as a period expense) 2 What was Lehighton's total opereting Income across both years under absorption costing ond under varlable costing? 3. What was the total sales revenue across both years under absorption costing and under variable costing? 4. What was the total of al costs expensed on the operating income statements across both years under absorption costing and under varisble costing? S. Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3() under absorption costing and (b) under variable costing. 6. Considering the resuts obtalned In requirements 1-5 above, select which of the following statements (s) are true by selecting an "x. Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $24 per unit. Lehighton uses an octual costing system, which means thot the actual costs of direct msterlal direct labor, ond manufocturing overhead ore entered into work-in-process inventory. The actual opplication rete for menufecturing overhead is computed each year; actual manufacturing overnead is divided oy actual production (in units to compute the application rate. Information for Lehighton's first tvo yeors ofoperation is as follows Sales (in units) Production in units) Production costs: 2,893 3,30a 2,920 2,32e eriable nenufacturing costs ixed Tenufacturing overhead 513,53 S 9,430 6,830 16,838 selling and acministrative costs: artable Fixed 11, 1,20 18,2 18,288 Selected infomation from Lehighton's year-end balance sheets for its first two years of operation is as follows: LEHTGHTON CHALK 5elected Balance Sheet Information End of Yeer 1nd of Yeer 2 Based on absorption costing Finished-goods inventory Retained earnings Based on variable costing Finished-goods inventory Retained carnings 14,540 End of Yeer 1 11,990 6,788 End of Yeer 2 6,788 Case 8-43 Analysis of Differences in Absorption-Costing and Variable-Costing Income Statements Continuation of Preceding Case (LO 8-1, 8-6) Required: 1 Reconcile Lehighton's operating income reported under absorption and varisble costing, during each yeor, by comporing the following two amounts on each income statem ent: . Cost of goods sold Fixed cost (expensed as a period expense) 2 What was Lehighton's total opereting Income across both years under absorption costing ond under varlable costing? 3. What was the total sales revenue across both years under absorption costing and under variable costing? 4. What was the total of al costs expensed on the operating income statements across both years under absorption costing and under varisble costing? S. Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3() under absorption costing and (b) under variable costing. 6. Considering the resuts obtalned In requirements 1-5 above, select which of the following statements (s) are true by selecting an "x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts