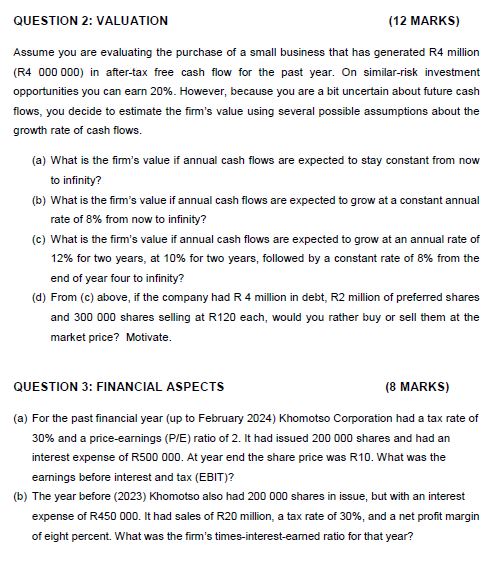

Question: QUESTION 2 : VALUATION ( 1 2 MARKS ) Assume you are evaluating the purchase of a small business that has generated R 4 million

QUESTION : VALUATION MARKS

Assume you are evaluating the purchase of a small business that has generated R million R in aftertax free cash flow for the past year. On similarrisk investment opportunities you can earn However, because you are a bit uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows.

a What is the firm's value if annual cash flows are expected to stay constant from now to infinity?

b What is the firm's value if annual cash flows are expected to grow at a constant annual rate of from now to infinity?

c What is the firm's value if annual cash flows are expected to grow at an annual rate of for two years, at for two years, followed by a constant rate of from the end of year four to infinity?

d From c above, if the company had R million in debt, R million of preferred shares and shares selling at R each, would you rather buy or sell them at the market price? Motivate.

QUESTION : FINANCIAL ASPECTS MARKS

a For the past financial year up to February Khomotso Corporation had a tax rate of and a priceearnings PE ratio of It had issued shares and had an interest expense of R At year end the share price was R What was the earnings before interest and tax EBIT

b The year before Khomotso also had shares in issue, but with an interest expense of R It had sales of R million, a tax rate of and a net profit margin of eight percent. What was the firm's timesinteresteamed ratio for that year?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock