Question: Prepare the adjusting entries for April in Excel, using only the account titles shown in the unadjusted trial balance above. You are required to choose

Prepare the adjusting entries for April in Excel, using only the account titles shown in the unadjusted trial balance above. You are required to choose only FOUR (4) out of the 7 adjusting entries shown.

Identify the letter of transaction you choose by typing in the transaction letter in the Date column of the Excel worksheet.

You must show calculations in the Explanation where necessary.

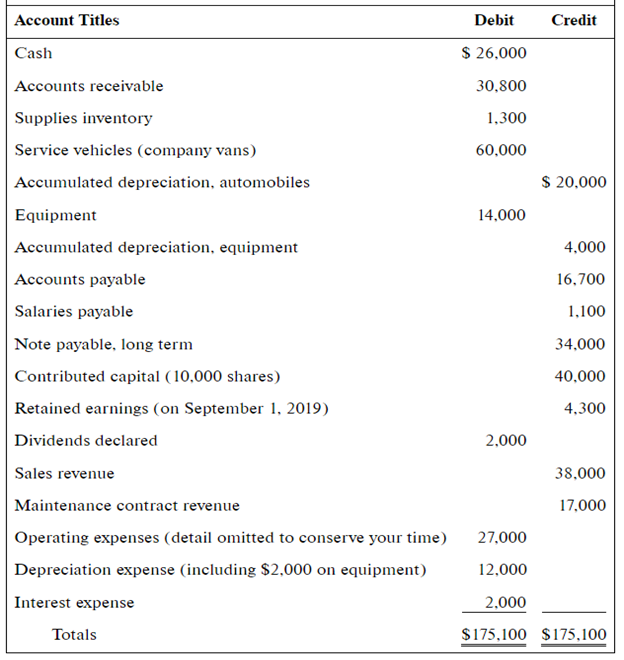

\begin{tabular}{|c|c|c|} \hline Account Titles & Debit & Credit \\ \hline Cash & $26,000 & \\ \hline Accounts receivable & 30,800 & \\ \hline Supplies inventory & 1,300 & \\ \hline Service vehicles (company vans) & 60,000 & \\ \hline Accumulated depreciation, automobiles & & $20,000 \\ \hline Equipment & 14,000 & \\ \hline Accumulated depreciation, equipment & & 4,000 \\ \hline Accounts payable & & 16,700 \\ \hline Salaries payable & & 1,100 \\ \hline Note payable, long term & & 34,000 \\ \hline Contributed capital ( 10,000 shares) & & 40,000 \\ \hline Retained earnings (on September 1, 2019) & & 4,300 \\ \hline Dividends declared & 2,000 & \\ \hline Sales revenue & & 38,000 \\ \hline Maintenance contract revenue & & 17,000 \\ \hline Operating expenses (detail omitted to conserve your time) & 27,000 & \\ \hline Depreciation expense (including $2,000 on equipment) & 12,000 & \\ \hline Interest expense & 2,000 & \\ \hline Totals & $175,100 & $175,100 \\ \hline \end{tabular} Required: 1. Prepare a statement of earnings for the reporting year ended August 31, 2020. Include income tax expense, assuming a 30 percent tax rate. Use the following major captions: revenues, expenses, net earnings before income tax, income tax, net earnings, and earnings per share (list each item under these captions as appropriate). 2. Prepare the journal entry to record income taxes for the year (not yet paid). 3. Prepare a statement of financial position at the end of the reporting year, August 31, 2020. Use the following captions (list each under these captions as appropriate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts