Question: Required: Prepare the adjusting entries for April in Excel, using only the account titles shown in the unadjusted trial balance above. You are required to

Required:

Prepare the adjusting entries for April in Excel, using only the account titles shown in the unadjusted trial balance above. You are required to choose only FOUR (4) out of the 7 adjusting entries shown.

Identify the letter of transaction you choose by typing in the transaction letter in the Date column of the Excel worksheet.

You must show calculations in the Explanation where necessary.

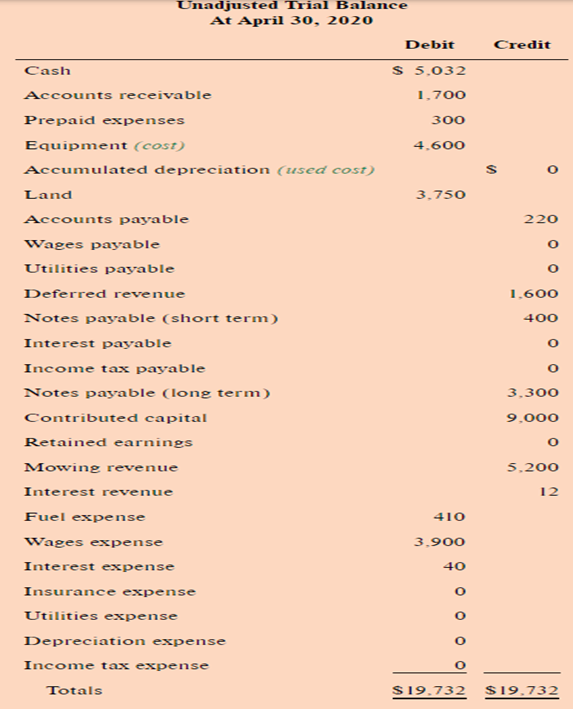

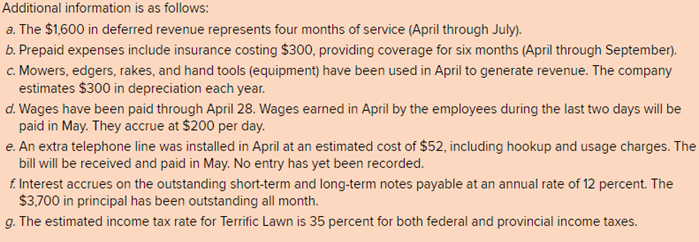

Unadiusted Trial Balance Additional information is as follows: a. The $1,600 in deferred revenue represents four months of service (April through July). b. Prepaid expenses include insurance costing $300, providing coverage for six months (April through September). c. Mowers, edgers, rakes, and hand tools (equipment) have been used in April to generate revenue. The company estimates $300 in depreciation each year. d. Wages have been paid through April 28. Wages earned in April by the employees during the last two days will be paid in May. They accrue at $200 per day. e. An extra telephone line was installed in April at an estimated cost of \$52, including hookup and usage charges. The bill will be received and paid in May. No entry has yet been recorded. f. Interest accrues on the outstanding short-term and long-term notes payable at an annual rate of 12 percent. The $3,700 in principal has been outstanding all month. g. The estimated income tax rate for Terrific Lawn is 35 percent for both federal and provincial income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts