Question: Prepare the adjusting entry to record bad debts expense on December 31 of the current year assuming that the accounts receivable written off this year

Prepare the adjusting entry to record bad debts expense on December 31 of the current year assuming that the accounts receivable written off this year exceeded the Allowance for Doubtful Accounts by 2,200

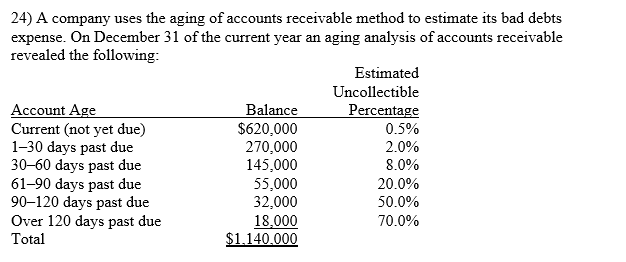

24) A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following: Estimated Uncollectible Account Age Balance Percentage Current (not yet due) $620,000 0.5% 1-30 days past due 270,000 2.0% 30-60 days past due 145,000 8.0% 61-90 days past due 55.000 20.0% 90120 days past due 32,000 50.0% Over 120 days past due 18,000 70.0% Total $1,140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts