Question: Prepare the Income Statement and Partial Statement of Changes in Equity for Year Ended 31 Dec 20x1 Consolidation Adjustment Consolidation Parent Subsidiary Dr Cr Total

Prepare the Income Statement and Partial Statement of Changes in Equity for Year Ended 31 Dec 20x1

| Consolidation Adjustment | Consolidation | ||||||||

| Parent | Subsidiary | Dr | Cr | Total | |||||

| $ | $ | $ | $ | $ | |||||

| Net profit before tax | 550,000 | 100,000 | |||||||

| (including dividend income) | |||||||||

| Less tax expense | 110,000 | 20,000 | |||||||

| Net profit after tax | 440,000 | 80,000 | |||||||

| Profit attributable to non-controlling interests | |||||||||

| Profit attributable to owners of parent | |||||||||

| Dividends declared | 100,000 | 24,000 | |||||||

| Profit retained for the year | 340,000 | 56,000 | |||||||

| Retained earnings, 1 January | 1,000,000 | 250,000 | |||||||

| Retained earnings, 31 December | 1,340,000 | 306,000 |

Please also provide the excel formula, thank you

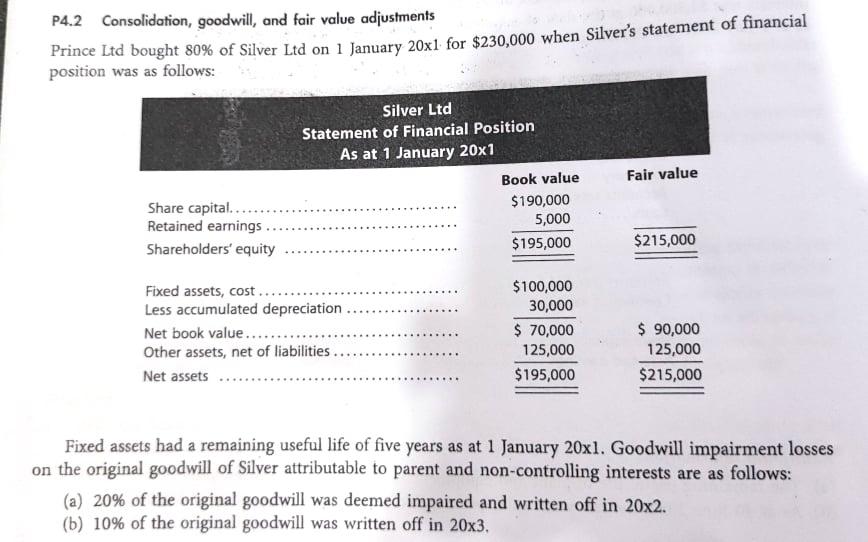

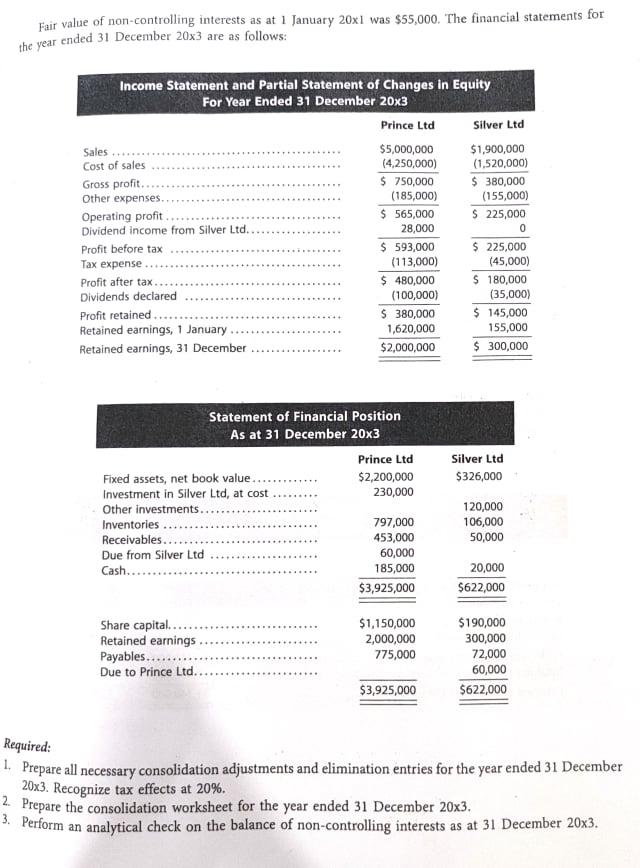

P4.2 Consolidation, goodwill, and fair value adjustments Prince Ltd bought 80% of Silver Ltd on 1 January 20x1 for $230,000 when Silver's statement of financial position was as follows: Fixed assets had a remaining useful life of five years as at 1 January 20x1. Goodwill impairment losses on the original goodwill of Silver attributable to parent and non-controlling interests are as follows: (a) 20% of the original goodwill was deemed impaired and written off in 202. (b) 10% of the original goodwill was written off in 203. Fair value of non-controlling interests as at 1 January 201 was $55,000. The financial statements for the year ended 31 December 203 are as follows: Required: 1. Prepare all necessary consolidation adjustments and elimination entries for the year ended 31 December 20x3. Recognize tax effects at 20%. 2. Prepare the consolidation worksheet for the year ended 31 December 203. 3. Perform an analytical check on the balance of non-controlling interests as at 31 December 203

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts