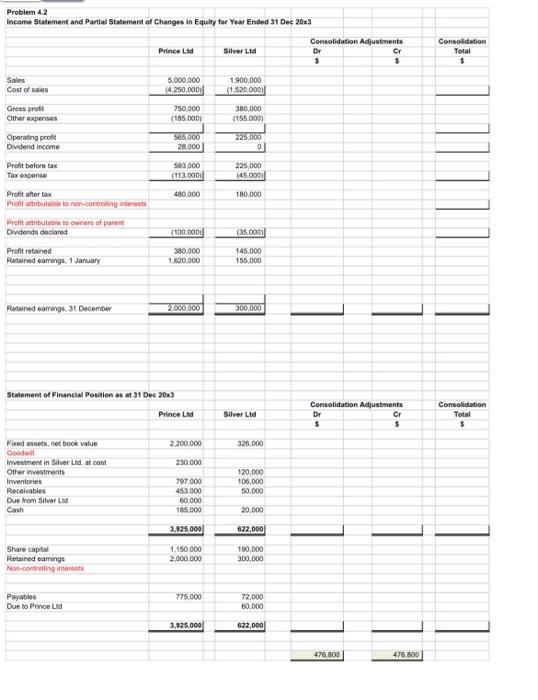

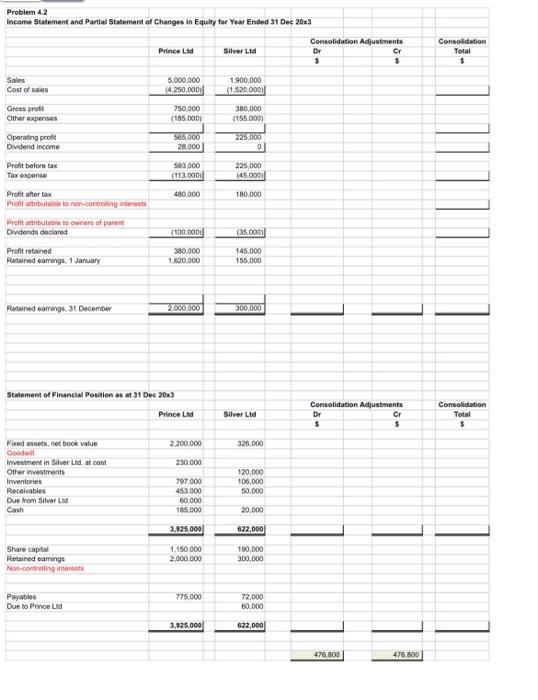

Problem 4.2 Income Statement and Partial Statement of Changes in Equity for Year Ended 31 Dec 20x3 Sales Cost of sales Gross profit Other expenses Operating profit Dividend income Profit before tax Tax expense Profit after tax Profit attributable to non-controlling interests Profit attributable to owners of parent Dividends declared Profit retained Retained earnings, 1 January Retained earnings, 31 December Fixed assets, net book value Goodwill Investment in Silver Ltd, at cost Other investments Inventories Receivables Due from Silver Ltd Cash Share capital Retained earnings Non-controlling interests Prince Ltd Payables Due to Prince Ltd 5,000,000 (4,250,000)| 750,000 (185,000) 565,000 28,000 593,000 (113,000) 480,000 Statement of Financial Position as at 31 Dec 20x3 (100,000) 380,000 1,620,000 2,000,000 Prince Ltd 2,200,000 230,000 797,000 453,000 60,000 185,000 3,925,000 1,150,000 2,000,000 775,000 3,925,000 Silver Ltd 1,900,000 (1,520,000) 380,000 (155,000) 225,000 0 225,000 (45,000) 180,000 (35,000) 145,000 155,000 300,000 Silver Ltd 326,000 120,000 106,000 50,000 20,000 622,000 190,000 300,000 72,000 60,000 622,000 Consolidation Adjustments Dr $ Dr $ Cr J 476,800 Consolidation Adjustments $ Cr $ 476,800 Consolidation Total $ Consolidation Total $

Problem 4.2 Incoms Statement and Partial Statement af Changes in Equity for Year Ended 31 Dec 203