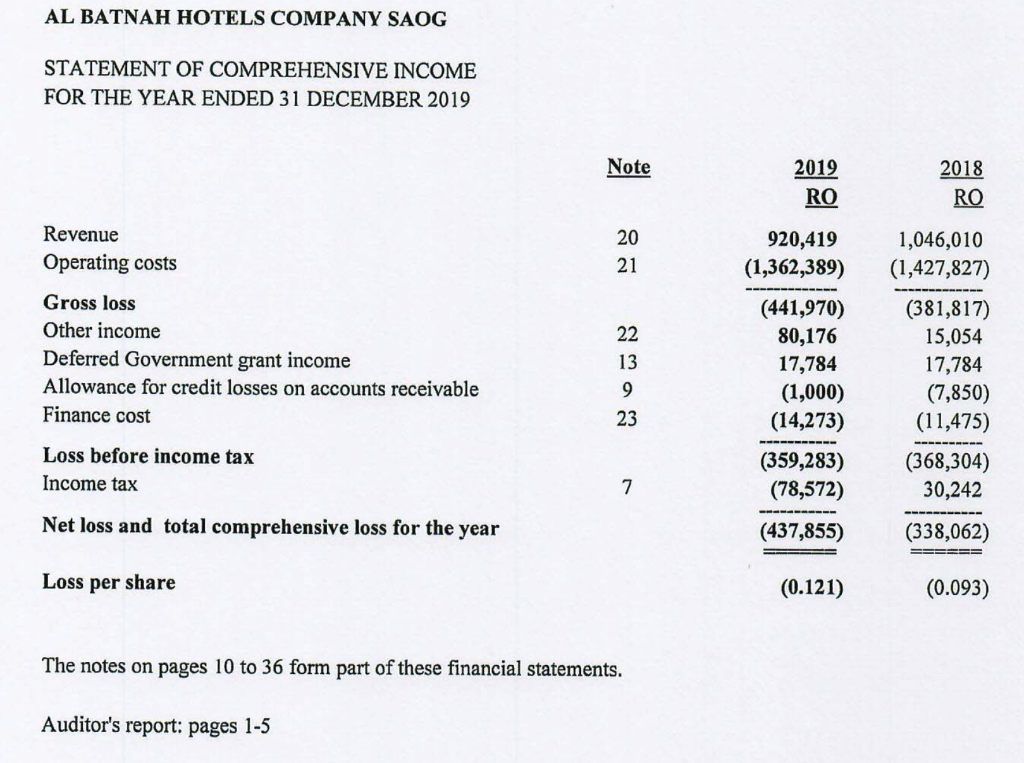

Question: Prepare the supplementary income statement for 2018 by applying CPP approach. Use the following index: Opening 100 Closing 200 Average: 160 AL BATNAH HOTELS COMPANY

- Prepare the supplementary income statement for 2018 by applying CPP approach.

- Use the following index: Opening 100 Closing 200 Average: 160

AL BATNAH HOTELS COMPANY SAOG STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 Note 2019 RO 2018 RO Revenue Operating costs 20 21 920,419 (1,362,389) Gross loss Other income Deferred Government grant income Allowance for credit losses on accounts receivable Finance cost 22 13 9 23 (441,970) 80,176 17,784 (1,000) (14,273) (359,283) (78,572) 1,046,010 (1,427,827) (381,817) 15,054 17,784 (7,850) (11,475) (368,304) 30,242 Loss before income tax Income tax 7 Net loss and total comprehensive loss for the year (437,855) (338,062) ====== Loss per share (0.121) (0.093) The notes on pages 10 to 36 form part of these financial statements. Auditor's report: pages 1-5 AL BATNAH HOTELS COMPANY SAOG STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 Note 2019 RO 2018 RO Revenue Operating costs 20 21 920,419 (1,362,389) Gross loss Other income Deferred Government grant income Allowance for credit losses on accounts receivable Finance cost 22 13 9 23 (441,970) 80,176 17,784 (1,000) (14,273) (359,283) (78,572) 1,046,010 (1,427,827) (381,817) 15,054 17,784 (7,850) (11,475) (368,304) 30,242 Loss before income tax Income tax 7 Net loss and total comprehensive loss for the year (437,855) (338,062) ====== Loss per share (0.121) (0.093) The notes on pages 10 to 36 form part of these financial statements. Auditor's report: pages 1-5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts