Question: Preparing a Classified Balance Sheet using Excel's SUM Function and Cell Referencing Lantana Company has opened its company and has recorded its first month of

Preparing a Classified Balance Sheet using Excel's SUM Function and Cell Referencing

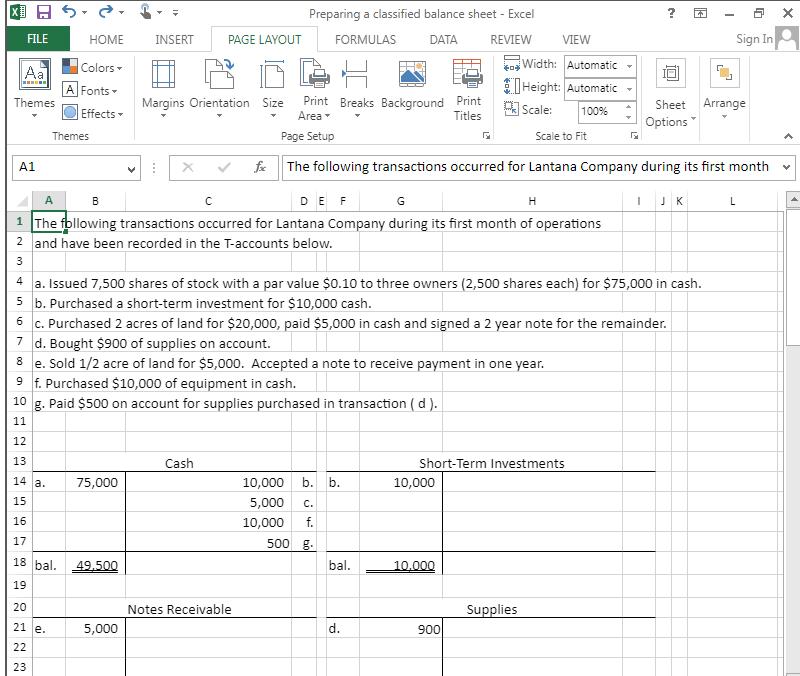

Lantana Company has opened its company and has recorded its first month of transactions in T-accounts. The Controller has asked you to prepare the companys classified balance sheet at the month end based on those transactions. Use the information included in the Excel Simulation and the Excel functions described below to complete the task.

- Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, =B14 was entered, the formula would output the result from cell B14, or 75,000 in this example.

- Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell =C14+C15 was entered, the formula would add the values from those cells and output the result, or 15,000 in this example. If using the other math symbols the result would output an appropriate answer for its function.

- SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell =SUM(C14,C15,C16) was entered, the formula would output the result of adding those three separate cells, or 25,000 in this example. Similarly, if in a blank cell =SUM(C14:C16) was entered, the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 25,000 in this example.

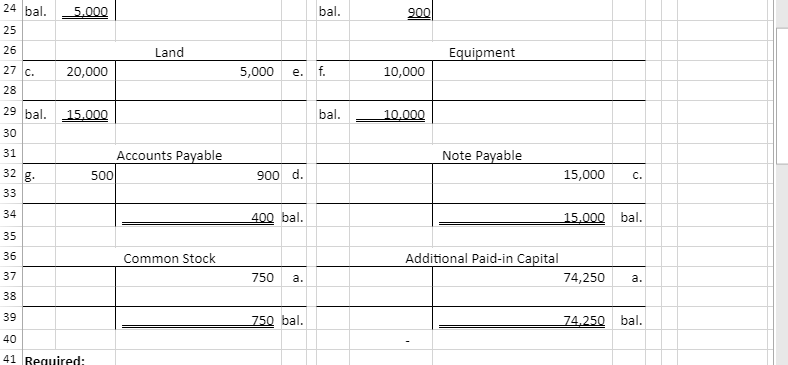

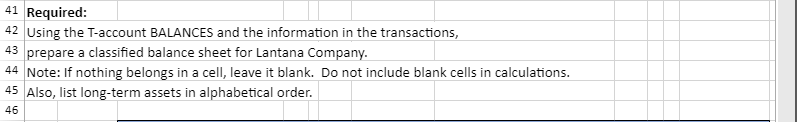

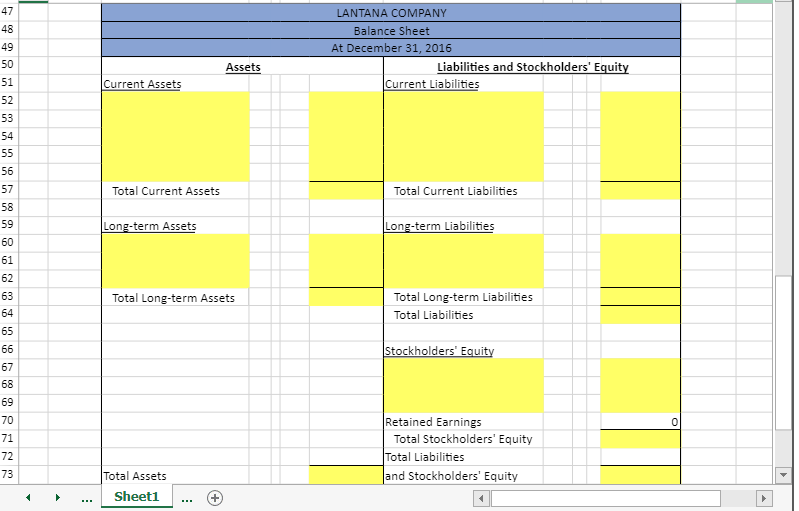

X S. X x FILE HOME Colors TO A Fonts Preparing a classified balance sheet - Excel INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Width: Automatic Height: Automatic Margins Orientation Size Print Breaks Background Print Scale: Sheet Arrange 100% Area Titles Options Page Setup Scale to Fit : X fic The following transactions occurred for Lantana Company during its first month Themes Effects Themes A1 H I J K L B DEF G 1 The following transactions occurred for Lantana Company during its first month of operations 2 and have been recorded in the T-accounts below. 3 4 a. Issued 7,500 shares of stock with a par value $0.10 to three owners (2,500 shares each) for $75,000 in cash. 5 b. Purchased a short-term investment for $10,000 cash. 6 C. Purchased 2 acres of land for $20,000, paid $5,000 in cash and signed a 2 year note for the remainder. 7 d. Bought $900 of supplies on account. e. Sold 1/2 acre of land for $5,000. Accepted a note to receive payment in one year. 9 f. Purchased $10,000 of equipment in cash. g. Paid $500 on account for supplies purchased in transaction(d). 8 10 11 12 13 Cash Short-Term Investments 10,000 14 a. 15 75,000 16 10,000 b. b. 5,000 C. 10,000 f. 500 g bal. 17 18 bal. 49.500 10.000 19 20 Notes Receivable Supplies 5,000 . d. 21 e. 22 900 23 24 bal. 5.000 bal. 900 25 26 Land Equipment 27 c. 20,000 5,000 e. f. 10,000 28 29 bal. 15.000 bal. 10.000 30 Note Payable 31 32 g. 33 Accounts Payable 500 900 d. 15,000 c. 34 400 bal. 15,000 bal. 3 35 36 Common Stock ww Additional Paid-in Capital 74,250 37 750 a. a. a. 38 39 750 bal. 74.250 bal. 40 41 Required: 41 Required: 42 Using the T-account BALANCES and the information in the transactions, 43 prepare a classified balance sheet for Lantana Company. 44 Note: If nothing belongs in a cell, leave it blank. Do not include blank cells in calculations. 45 Also, list long-term assets in alphabetical order. 46 47 48 49 50 51 LANTANA COMPANY Balance Sheet At December 31, 2016 Liabilities and Stockholders' Equity Current Liabilities Assets Current Assets 52 53 54 55 56 57 58 Total Current Assets Total Current Liabilities 59 Long-term Assets Long-term Liabilities 60 61 62 63 64 Total Long-term Assets Total Long-term Liabilities Total Liabilities 65 66 Stockholders' Equity 67 68 69 70 o 71 Retained Earnings Total Stockholders' Equity Total Liabilities land Stockholders' Equity 72 73 Total Assets Sheet1 ... ... + +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts