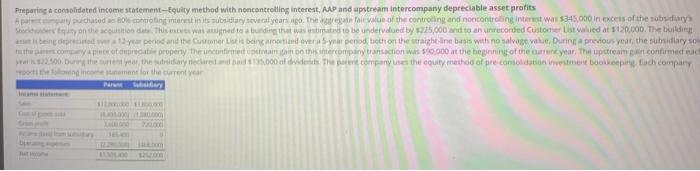

Question: Preparing a consolidated income statement-Equity method with no controlling interest, AAP and upstream Intercompany depreciable asset profits Spare puted to contingents subsidiary several years. The

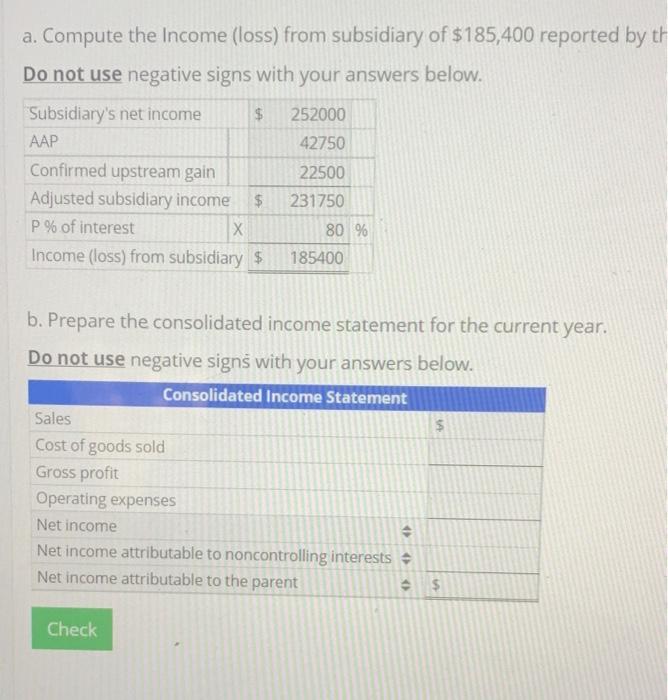

Preparing a consolidated income statement-Equity method with no controlling interest, AAP and upstream Intercompany depreciable asset profits Spare puted to contingents subsidiary several years. The We of the controlling and conting interest was 5345.000 in excess of the subsidiary Society on the soutien da. This entrenamed to a tu dia that was estand to be undervalued by 3235,000 and to an unrecorded Customer salued at $120.000. The build bende tyear pered and the Customer Liste bancarcomand over your period beth on the straight line bes with no salvage valut, During precious year, the subsidiaryo r.com directive property then this intercompany action was 50.000 at the beginning of the current year. The upitrean gain confirmedad 132.500.urteen year the war eclareda.000 add the parent company uses the equity method of pre-consolidament booking, tech company ment for the current year Par a. Compute the income (loss) from subsidiary of $185,400 reported by th Do not use negative signs with your answers below. Subsidiary's net income $ 252000 42750 Confirmed upstream gain 22500 Adjusted subsidiary income $ 231750 P % of interest 80 % Income (loss) from subsidiary $ 185400 $ $ b. Prepare the consolidated income statement for the current year. Do not use negative signs with your answers below. Consolidated Income Statement Sales Cost of goods sold Gross profit Operating expenses Net income Net income attributable to noncontrolling interests Net income attributable to the parent $ ) Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts