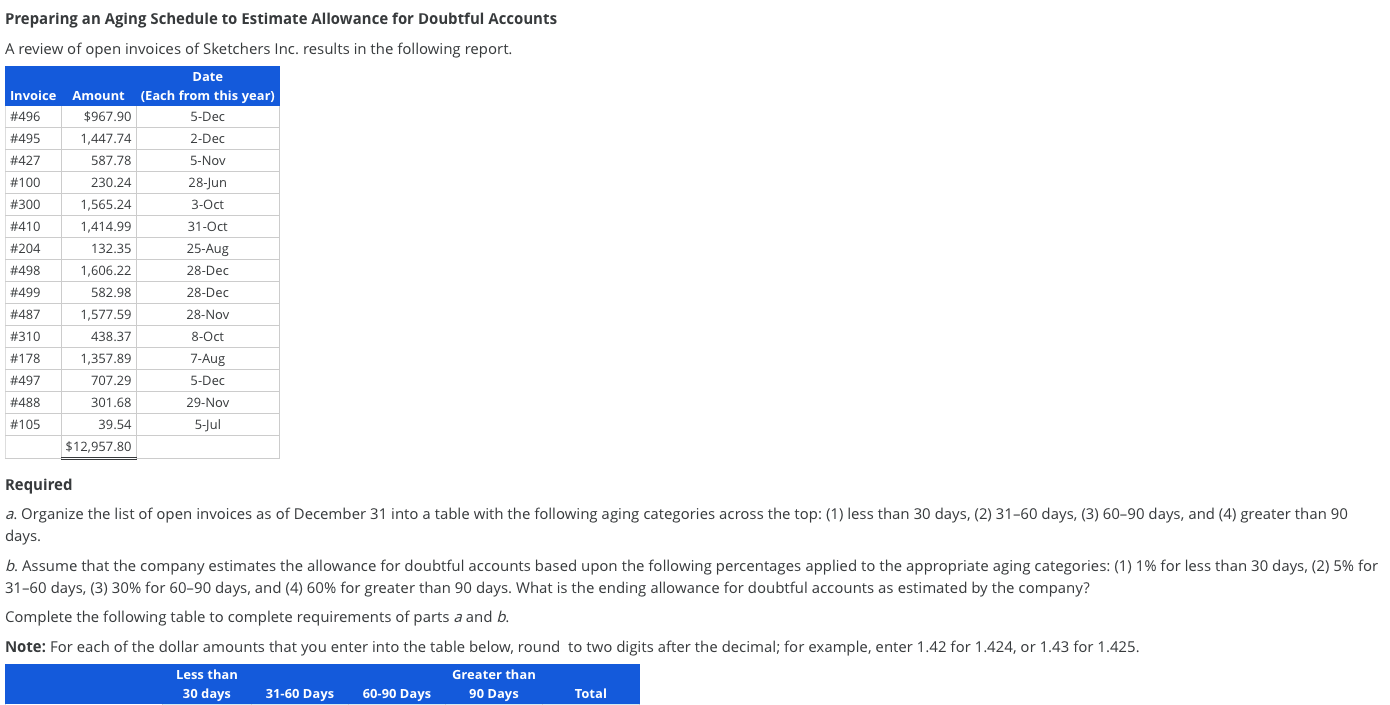

Question: Preparing an Aging Schedule to Estimate Allowance for Doubtful Accounts A review of open invoices of Sketchers Inc. results in the following report. Date Invoice

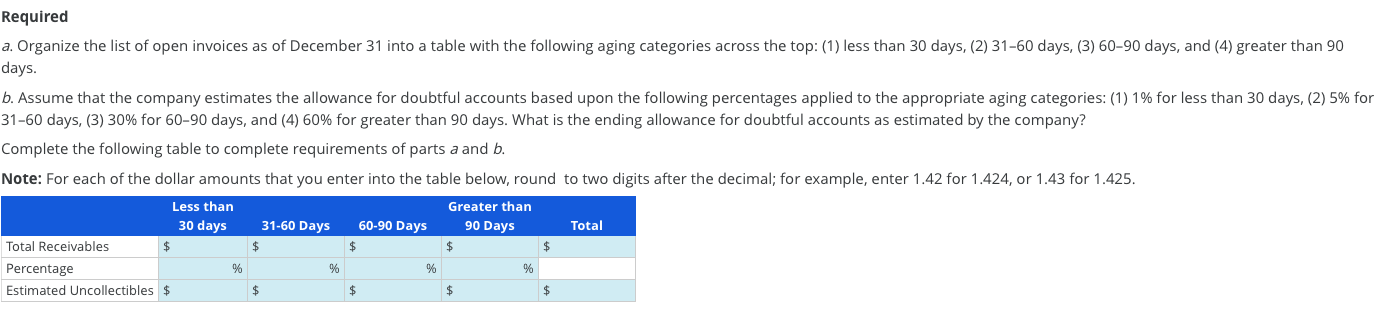

Preparing an Aging Schedule to Estimate Allowance for Doubtful Accounts A review of open invoices of Sketchers Inc. results in the following report. Date Invoice Amount (Each from this year) #496 $967.90 5-Dec #495 1,447.74 2-Dec #427 587.78 5-Nov #100 230.24 28-Jun #300 1,565.24 3-Oct #410 1,414.99 31-Oct #204 132.35 25-Aug #498 1,606.22 28-Dec #499 582.98 28-Dec #487 1,577.59 28-Nov #310 438.37 8-Oct #178 1,357.89 7-Aug #497 707.29 5-Dec #488 301.68 29-Nov #105 39.54 5-Jul $12,957.80 Required a. Organize the list of open invoices as of December 31 into a table with the following aging categories across the top: (1) less than 30 days, (2) 31-60 days, (3) 60-90 days, and (4) greater than 90 days. b. Assume that the company estimates the allowance for doubtful accounts based upon the following percentages applied to the appropriate aging categories: (1) 1% for less than 30 days, (2) 5% for 31-60 days, (3) 30% for 60-90 days, and (4) 60% for greater than 90 days. What is the ending allowance for doubtful accounts as estimated by the company? Complete the following table to complete requirements of parts a and b. Note: For each of the dollar amounts that you enter into the table below, round to two digits after the decimal; for example, enter 1.42 for 1.424, or 1.43 for 1.425. Less than 30 days 31-60 Days Greater than 90 Days 60-90 Days Total Required a. Organize the list of open invoices as of December 31 into a table with the following aging categories across the top: (1) less than 30 days, (2) 31-60 days, (3) 60-90 days, and (4) greater than 90 days. b. Assume that the company estimates the allowance for doubtful accounts based upon the following percentages applied to the appropriate aging categories: (1) 1% for less than 30 days, (2) 5% for 31-60 days, (3) 30% for 60-90 days, and (4) 60% for greater than 90 days. What is the ending allowance for doubtful accounts as estimated by the company? Complete the following table to complete requirements of parts a and b. Note: For each of the dollar amounts that you enter into the table below, round to two digits after the decimal; for example, enter 1.42 for 1.424, or 1.43 for 1.425. Less than Greater than 31-60 Days 60-90 Days 90 Days Total Total Receivables $ Percentage Estimated Uncollectibles $ 30 days $ % % % % $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts