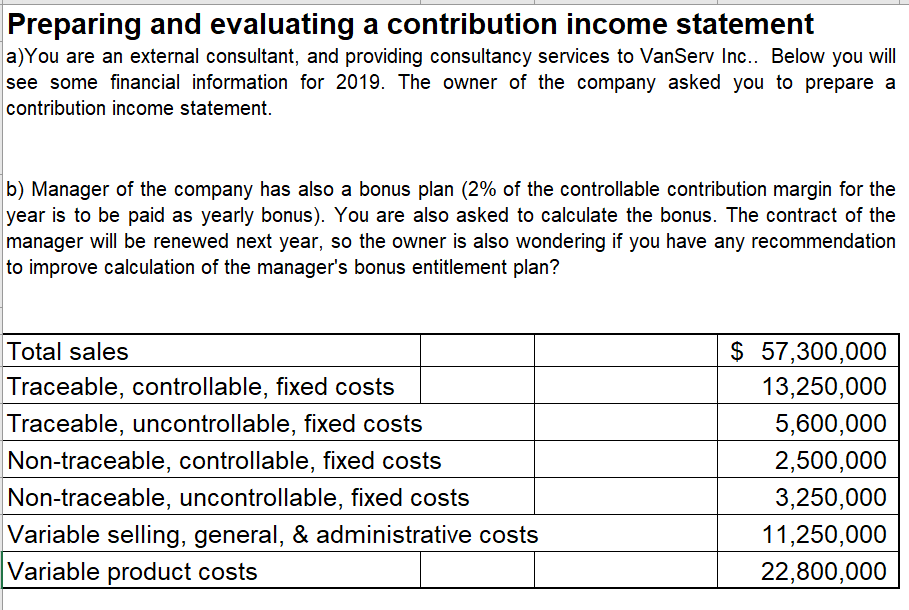

Question: Preparing and evaluating a contribution income statement a) You are an external consultant, and providing consultancy services to VanServ Inc.. Below you will see some

Preparing and evaluating a contribution income statement a) You are an external consultant, and providing consultancy services to VanServ Inc.. Below you will see some financial information for 2019. The owner of the company asked you to prepare a contribution income statement. b) Manager of the company has also a bonus plan (2% of the controllable contribution margin for the year is to be paid as yearly bonus). You are also asked to calculate the bonus. The contract of the manager will be renewed next year, so the owner is also wondering if you have any recommendation to improve calculation of the manager's bonus entitlement plan? Total sales Traceable, controllable, fixed costs Traceable, uncontrollable, fixed costs Non-traceable, controllable, fixed costs Non-traceable, uncontrollable, fixed costs Variable selling, general, & administrative costs Variable product costs $ 57,300,000 13,250,000 5,600,000 2,500,000 3,250,000 11,250,000 22,800,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts