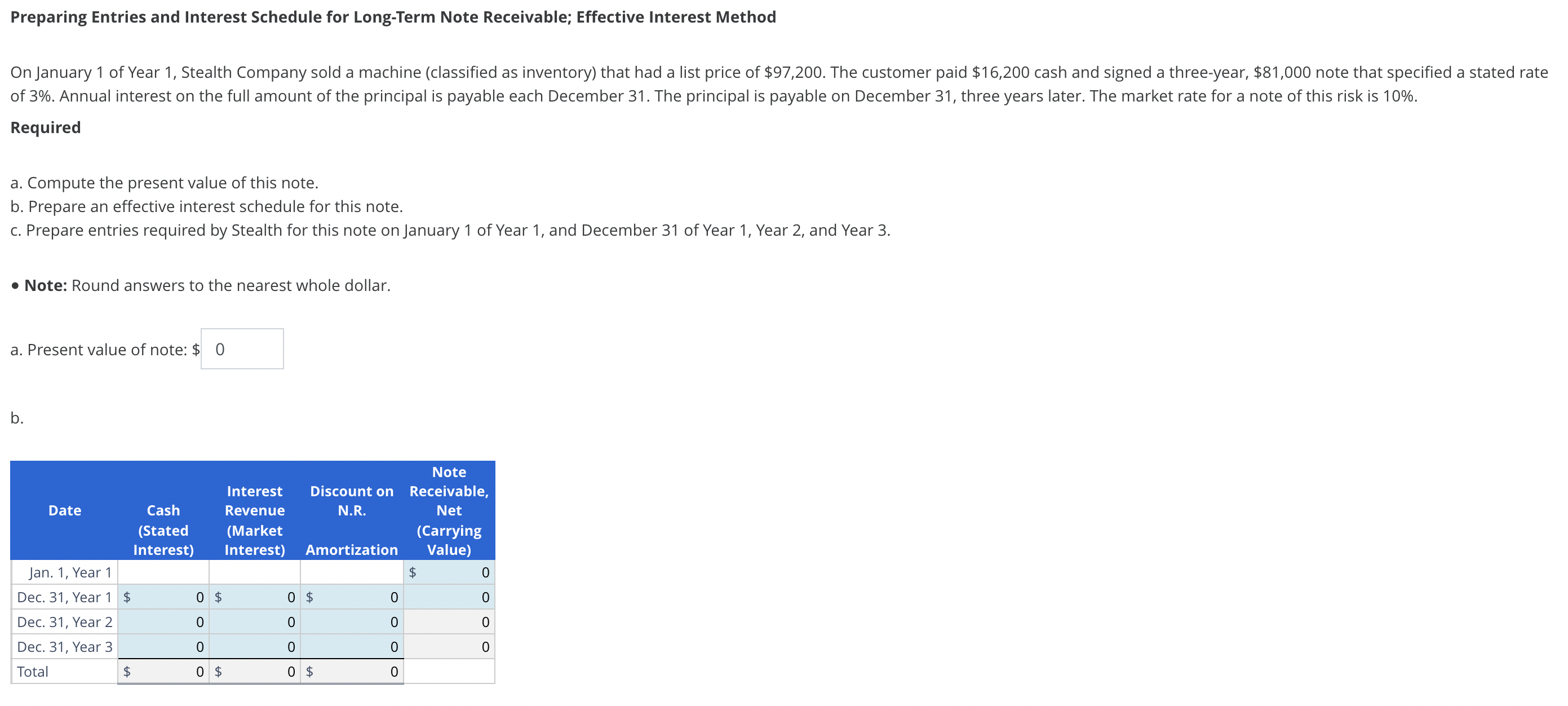

Question: Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method Required a. Compute the present value of this note. b. Prepare an effective

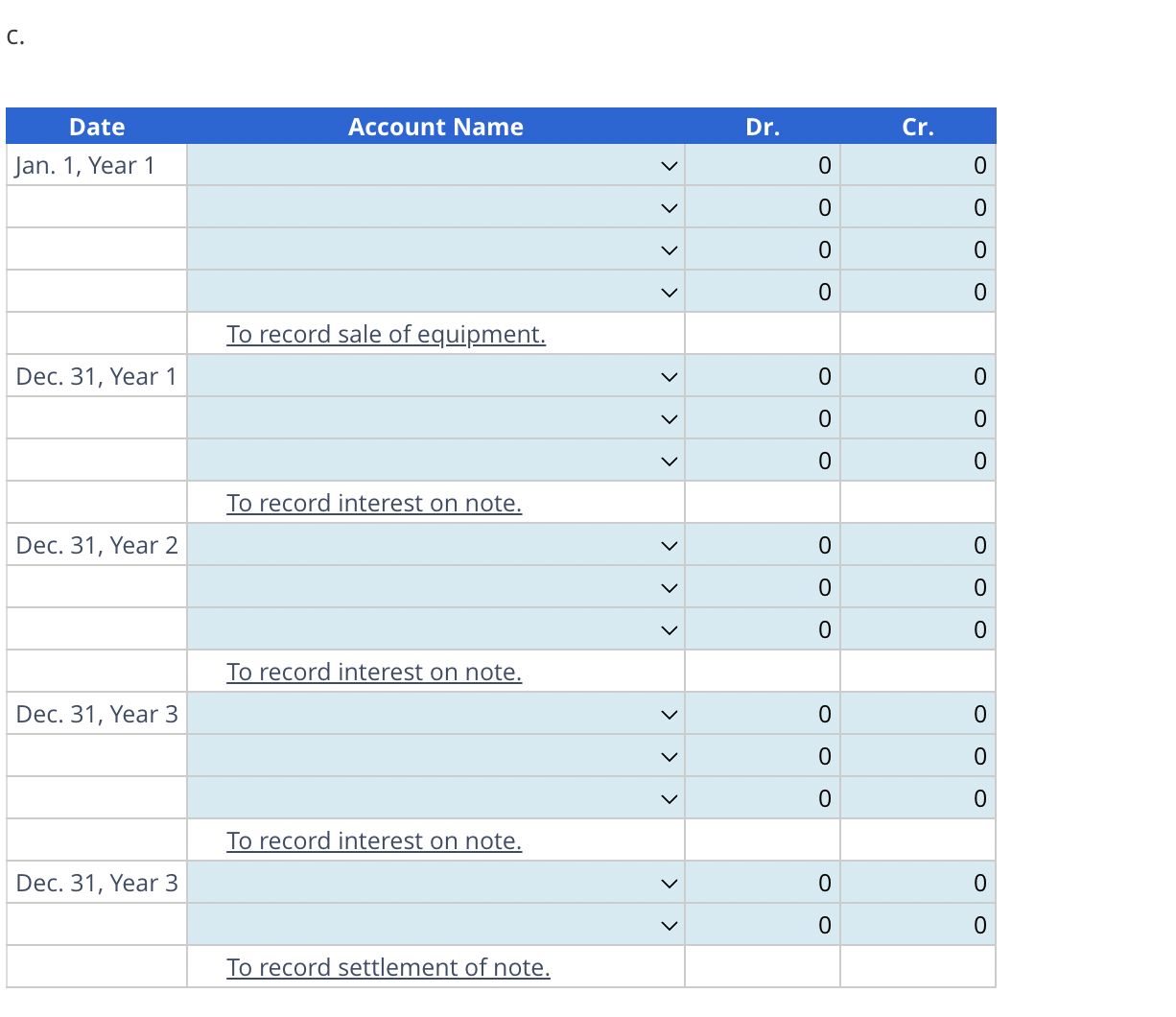

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method Required a. Compute the present value of this note. b. Prepare an effective interest schedule for this note. c. Prepare entries required by Stealth for this note on January 1 of Year 1, and December 31 of Year 1, Year 2, and Year 3. - Note: Round answers to the nearest whole dollar. C. \begin{tabular}{|c|c|c|c|} \hline Date & Account Name & Dr. & Cr. \\ \hline \multirow[t]{5}{*}{ Jan. 1, Year 1} & v & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & v & 0 & 0 \\ \hline & To record sale of equipment. & & \\ \hline \multirow[t]{4}{*}{ Dec. 31, Year 1} & & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & To record interest on note. & & \\ \hline \multirow[t]{4}{*}{ Dec. 31, Year 2} & v & 0 & 0 \\ \hline & v & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & To record interest on note. & & \\ \hline \multirow[t]{4}{*}{ Dec. 31, Year 3} & & 0 & 0 \\ \hline & v & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & To record interest on note. & & \\ \hline \multirow[t]{3}{*}{ Dec. 31, Year 3} & & 0 & 0 \\ \hline & & 0 & 0 \\ \hline & To record settlement of note. & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts