Question: Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1 , Stealth Company sold a machine (classified

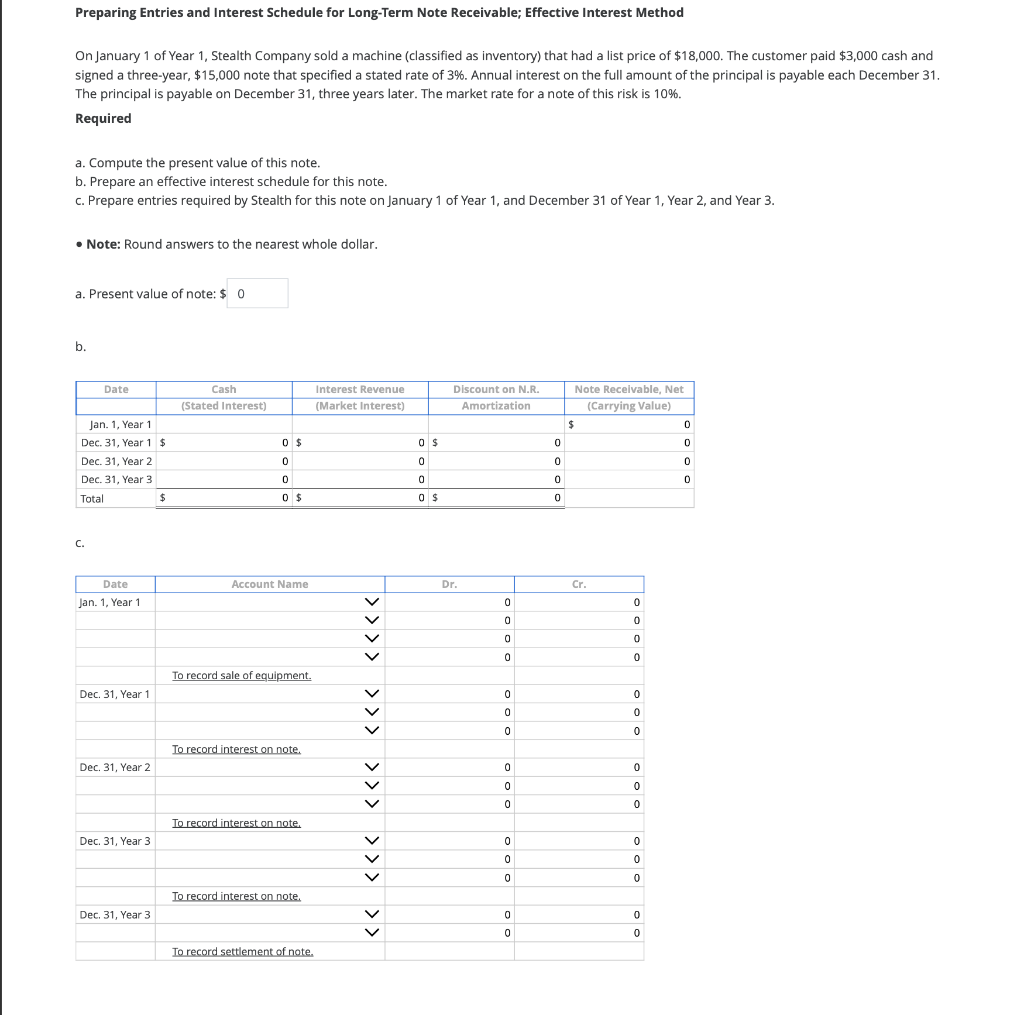

Preparing Entries and Interest Schedule for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1 , Stealth Company sold a machine (classified as inventory) that had a list price of $18,000. The customer paid $3,000 cash and signed a three-year, $15,000 note that specified a stated rate of 3%. Annual interest on the full amount of the principal is payable each 31 . The principal is payable on December 31 , three years later. The market rate for a note of this is 10%. Required a. Compute the present value of this note. b. Prepare an effective interest schedule for this note. c. Prepare entries required by Stealth for this note on January 1 of Year 1, and December 31 of Year 1, Year 2, and Year 3. - Note: Round answers to the nearest whole dollar. a. Present value of note: $ Cash Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Receivable from Factor Note Receivable Discount on Note Receivable Payable to Seller of Receivables Refund Liability Recourse Liability Note Payable Sales Revenue Sales Returns Sales Discount Sales Discount Forfeited Financing Revenue Interest Revenue Cost of Goods Sold Bad Debt Expense Finance Expense Interest Expense Loss on Sale of Note Loss on Sale of Receivables N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts