Question: Present Value Finance Concept: The present value is the value today of a future cash flow. The formula is the reciprocal of the future value

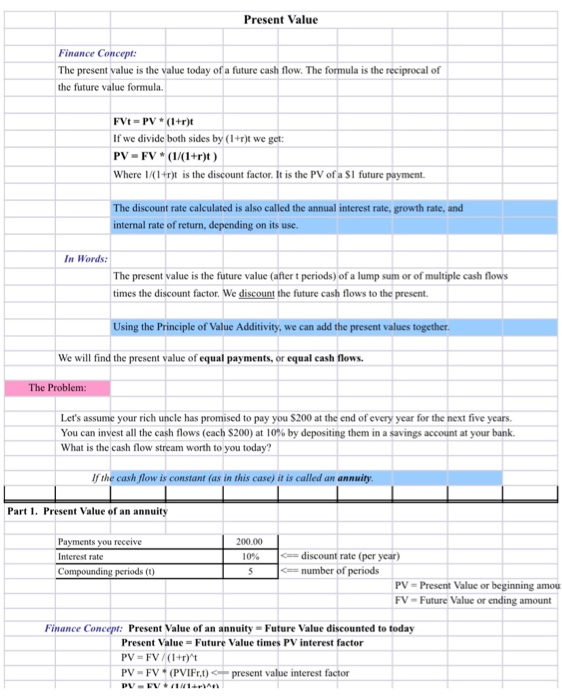

Present Value Finance Concept: The present value is the value today of a future cash flow. The formula is the reciprocal of the future value formula. FVt=PV *(1+r) If we divide both sides by (1+r)t we get: PV = FV (1/(1+r)) Where 1/(1+r)t is the discount factor. It is the PV of a S1 future payment. The discount rate calculated is also called the annual interest rate, growth rate, and internal rate of return, depending on its use. In Words: The present value is the future value (after t periods) of a lump sum or of multiple cash flows times the discount factor. We discount the future cash flows to the present. Using the Principle of Value Additivity, we can add the present values together. We will find the present value of equal payments, or equal cash flows. The Problem: Let's assume your rich uncle has promised to pay you $200 at the end of every year for the next five years. You can invest all the cash flows (each $200) at 10% by depositing them in a savings account at your bank. What is the cash flow stream worth to you today? If the cash flow is constant (as in this case) it is called an annuity. Part 1. Present Value of an annuity Payments you receive Interest rate Compounding periods (0) 200.00 10% 5 Cdiscount rate (per year) number of periods PV - Present Value or beginning amou FV-Future Value or ending amount Finance Concept: Present Value of an annuity - Future Value discounted to today Present Value = Future Value times PV interest factor PV - FV/(1+r)" PV - FV * (PVIFr.1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts