Question: Present value with periodic rates. Cooley Landscaping needs to borrow $30,000 for a new front-end dirt loader. The bank is willing to loan the money

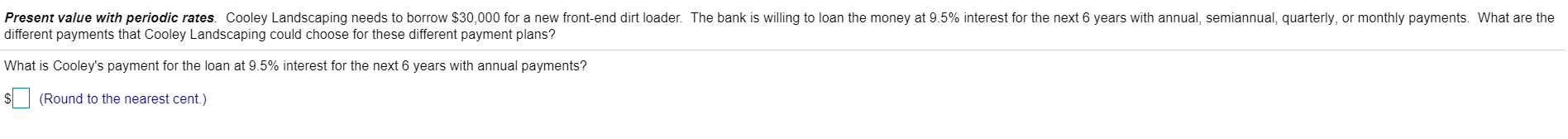

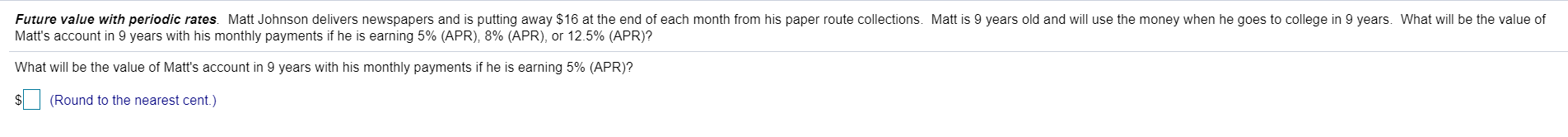

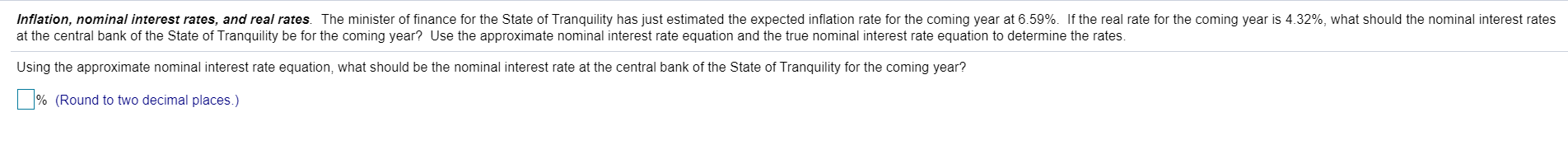

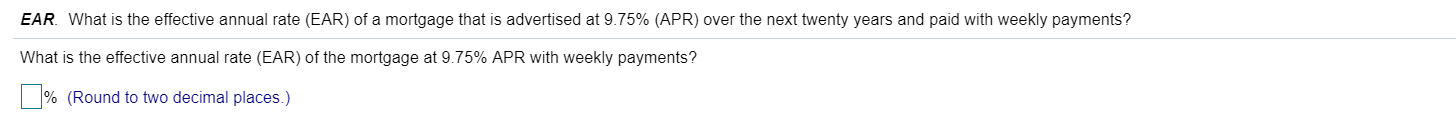

Present value with periodic rates. Cooley Landscaping needs to borrow $30,000 for a new front-end dirt loader. The bank is willing to loan the money at 9.5% interest for the next 6 years with annual, semiannual, quarterly, or monthly payments. What are the different payments that Cooley Landscaping could choose for these different payment plans? What is Cooley's payment for the loan at 9.5% interest for the next 6 years with annual payments? (Round to the nearest cent.) Future value with periodic rates. Matt Johnson delivers newspapers and is putting away $16 at the end of each month from his paper route collections. Matt is 9 years old and will use the money when he goes to college in 9 years. What will be the value of Matt's account in 9 years with his monthly payments if he is earning 5% (APR), 8% (APR), or 12.5% (APR)? What will be the value of Matt's account in 9 years with his monthly payments if he is earning 5% (APR)? $ (Round to the nearest cent.) Inflation, nominal interest rates, and real rates. The minister of finance for the State of Tranquility has just estimated the expected inflation rate for the coming year at 6.59%. If the real rate for the coming year is 4.32%, what should the nominal interest rates at the central bank of the State of Tranquility be for the coming year? Use the approximate nominal interest rate equation and the true nominal interest rate equation to determine the rates. Using the approximate nominal interest rate equation, what should be the nominal interest rate at the central bank of the State of Tranquility for the coming year? % (Round to two decimal places.) EAR. What is the effective annual rate (EAR) of a mortgage that is advertised at 9.75% (APR) over the next twenty years and paid with weekly payments? What is the effective annual rate (EAR) of the mortgage at 9.75% APR with weekly payments ? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts