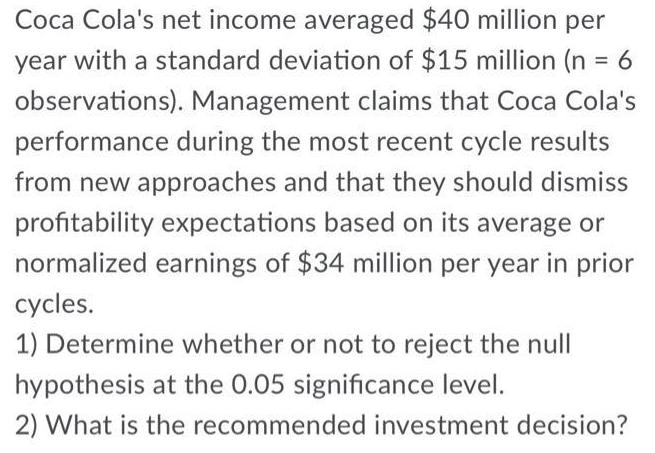

Question: Coca Cola's net income averaged $40 million per year with a standard deviation of $15 million (n = 6 %3D observations). Management claims that

Coca Cola's net income averaged $40 million per year with a standard deviation of $15 million (n = 6 %3D observations). Management claims that Coca Cola's performance during the most recent cycle results from new approaches and that they should dismiss profitability expectations based on its average or normalized earnings of $34 million per year in prior cycles. 1) Determine whether or not to reject the null hypothesis at the 0.05 significance level. 2) What is the recommended investment decision?

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

x sample mean sample standard deviation n sample size Population me... View full answer

Get step-by-step solutions from verified subject matter experts