Question: Presented below are financial statements ( except cash flows ) for two not - for - profit organizations. ABC Not - for - ProfitXYZ Not

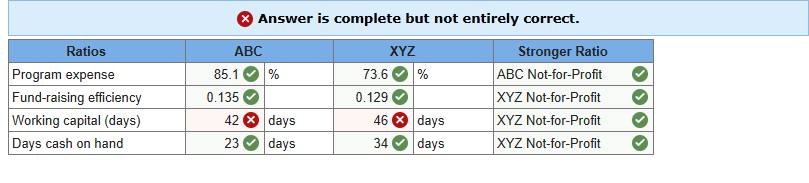

Presented below are financial statements except cash flows for two notforprofit organizations. ABC NotforProfitXYZ NotforProfitStatement of ActivitiesUnrestrictedDonorRestrictedUnrestrictedDonor RestrictedRevenuesProgram service revenue$ $ Contribution revenues$ Grant revenue$ Net gains on endowment investmentsNet assets released from restrictionSatisfaction of program restrictionsTotal revenuesExpensesEducation program expensesResearch program expenseTotal program service expensesFundraisingAdministrationTotal supporting service expensesTotal expensesIncrease in net assetsNet assets, January, Net assets, December, $ $ $ $ Statement of Net AssetsABC NotforProfitXYZ NotforProfitCurrent assetsCash$ $ Shortterm cash equivalentsSupplies inventoriesReceivablesTotal current assetsNoncurrent assetsNoncurrent pledges receivableEndowment investmentsLand buildings, and equipment netTotal noncurrent assetsTotal assets$ $ Current liabilitiesAccounts payable$ $ Total current liabilitiesNoncurrent liabilitiesNotes payableTotal noncurrent liabilitiesTotal liabilitiesNet AssetsUnrestrictedDonor restricted for purposeDonor restricted for endowmentTotal net assetsTotal liabilities and net assets$ $ Required: Calculate the following ratios assume depreciation expense is $ for both organizations and is allocated among program and supporting expenses: Program expense.Fundraising efficiency.Days cash on hand.Working capital expressed in days For each ratio, which of the two organizations has the stronger ratio. Note: Assume days in a year. Do not round intermediate calculations. Round "Program expense" answers to decimal place and "Fundraising efficiency" answers to decimal places and "Days cash on hand", "Working capital" answers to nearest whole number. Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock