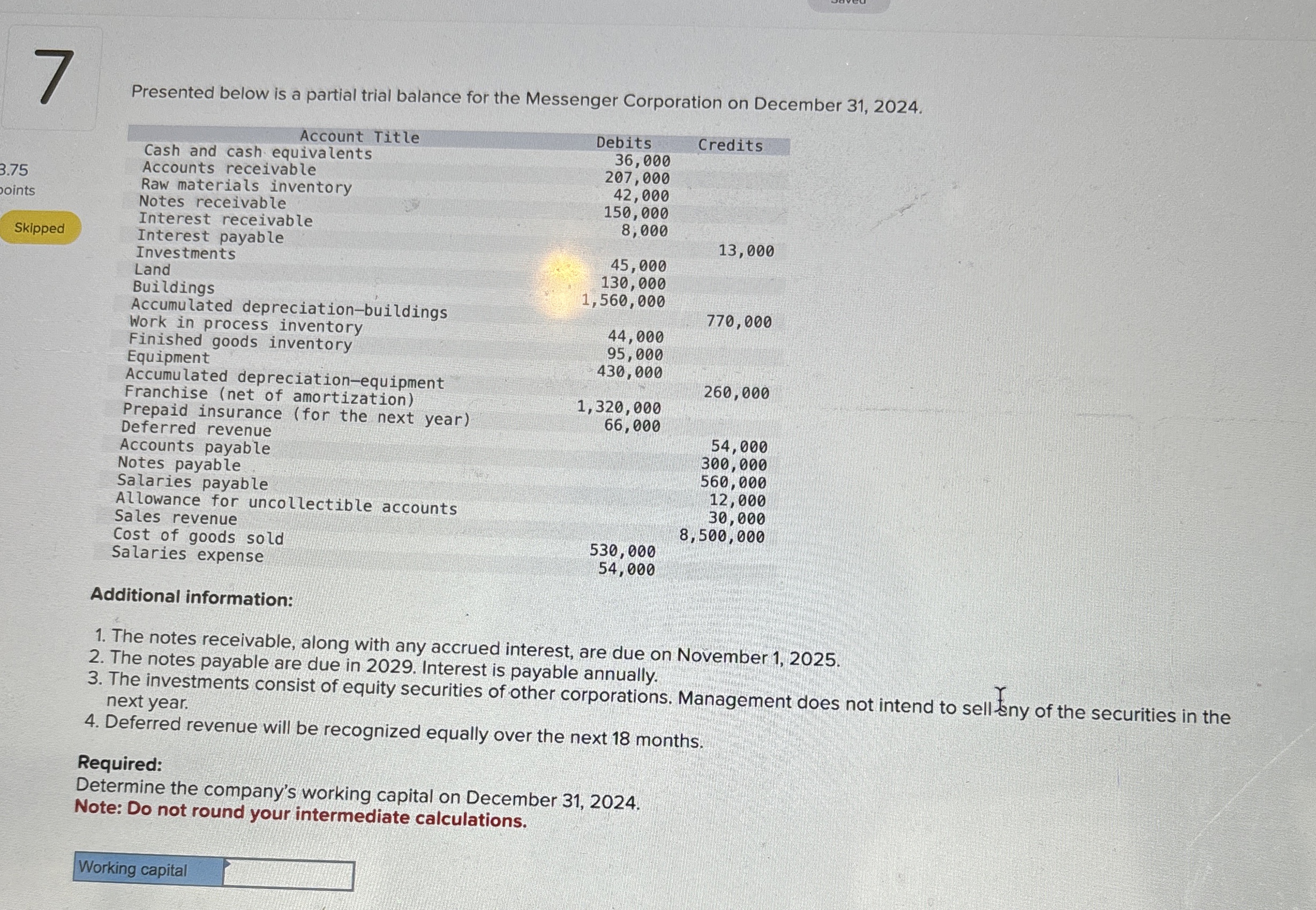

Question: Presented below is a partial trial balance for the Messenger Corporation on December 3 1 , 2 0 2 4 . table [ [

Presented below is a partial trial balance for the Messenger Corporation on December

tableCash and cash equivalents Title,Debits,CreditsAccounts receivable,Raw materials inventory,Notes receivable,Interest receivable,Interest payable,InvestmentsLandBuildingsAccumulated depreciationbuildings,Work in process inventory,Finished goods inventory,EquipmentAccumulated depreciationequipment,Franchise net of amortizationPrepaid insurance for the next yearDeferred revenue,Accounts payable,,Notes payable,,Salaries payable,Allowance for uncollectible accounts,Sales revenue,Cost of goods sold,,

Additional information:

The notes receivable, along with any accrued interest, are due on November

The notes payable are due in Interest is payable annually.

The investments consist of equity securities of other corporations. Management does not intend to sell Sny of the securities in the next year.

Deferred revenue will be recognized equally over the next months.

Required:

Determine the company's working capital on December

Note: Do not round your intermediate calculations.

Working capital

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock