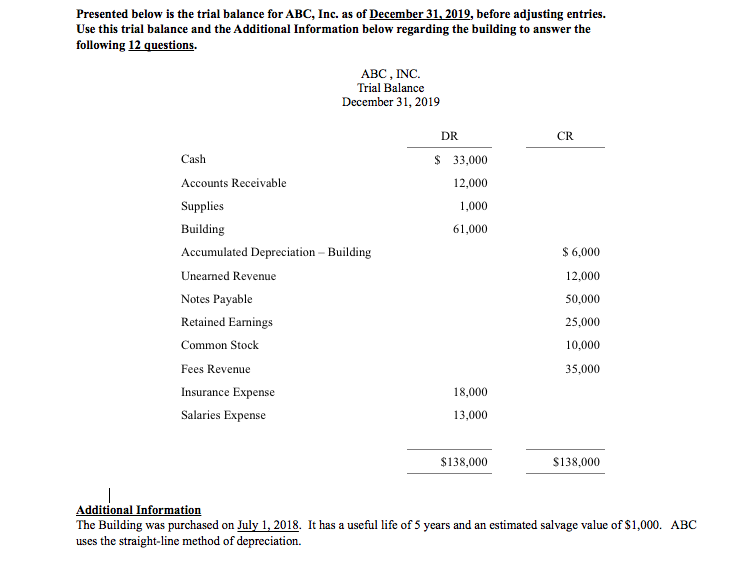

Question: Presented below is the trial balance for ABC, Inc. as of December 31, 2019, before adjusting entries. Use this trial balance and the Additional Information

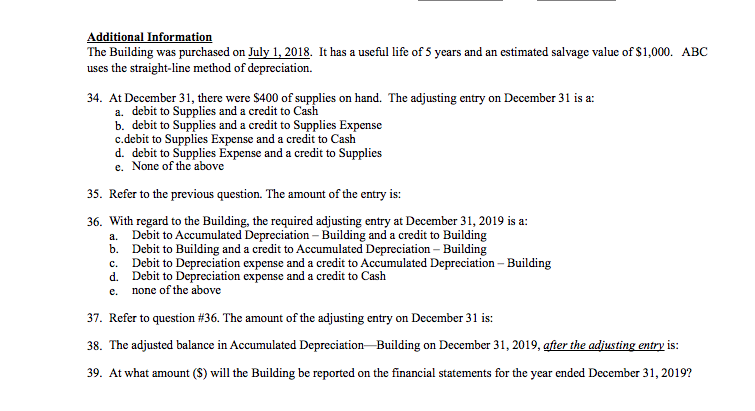

Presented below is the trial balance for ABC, Inc. as of December 31, 2019, before adjusting entries. Use this trial balance and the Additional Information below regarding the building to answer the following 12 questions. ABC, INC. Trial Balance December 31,2019 DR CR Cash Accounts Receivable Supplies Building Accumulated Depreciation Unearned Revenue Notes Payable Retained Earnings Common Stock Fees Revenue Insurance Expense Salaries Expense $ 33.000 12,000 1,000 61,000 Building 6,000 12,000 50,000 25,000 10,000 35,000 18,000 13,000 $138,000 S138,000 dditional Information The Building was purchased on July 1, 2018. It has a useful life of 5 years and an estimated salvage value of $1,000. uses the straight-line method of depreciation. ABC The Building was purchased on July 1, 2018. It has a useful life of 5 years and an estimated salvage value of $1,000. uses the straight-line method of depreciation. ABC 34. At December 31, there were S400 of supplies on hand. The adjusting entry on December 31 is a: a. debit to Supplies and a credit to Cash b. debit to Supplies and a credit to Supplies Expense c.debit to Supplies Expense and a credit to Cash d. debit to Supplies Expense and a credit to Supplies e. None of the above 35. Refer to the previous question. The amount of the entry is: 36. With regard to the Building, the required adjusting entry at December 31, 2019 is a: a. Debit to Accumulated Depreciation - Building and a credit to Building b. Debit to Building and a credit to Accumulated Depreciation- Building c. Debit to Depreciation expense and a credit to Accumulated Depreciation-Building d. Debit to Depreciation expense and a credit to Cash e. none of the above 37, Refer to question #36. The amount of the adjusting entry on December 31 is: 38. The adjusted balance in Accumulated Depreciation-Building on December 31, 2019, after the adiusting entr is: 39. At what amount (S) will the Building be reported on the financial statements for the year ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts