Question: In 2017, Michael Basket created Basket Industries which creates storage solutions for the garment industry. During 2017, the following transactions were completed: 1. 1/1/2017 Stockholders

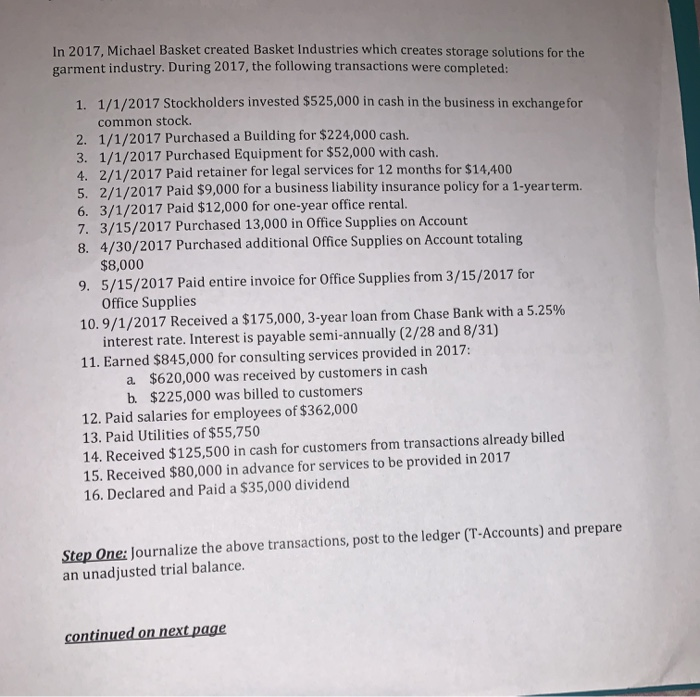

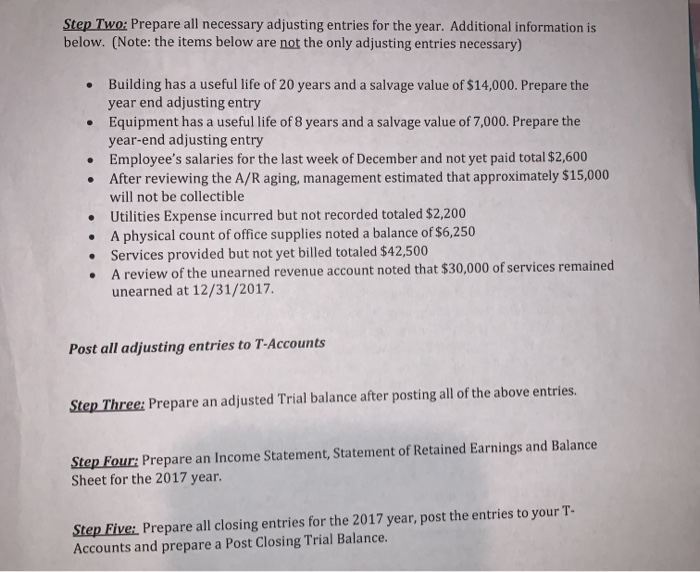

In 2017, Michael Basket created Basket Industries which creates storage solutions for the garment industry. During 2017, the following transactions were completed: 1. 1/1/2017 Stockholders invested $525,000 in cash in the business in exchange for common stock. 2. 1/1/2017 Purchased a Building for $224,000 cash. 3. 1/1/2017 Purchased Equipment for $52,000 with cash. 4. 2/1/2017 Paid retainer for legal services for 12 months for $14,400 5. 2/1/2017 Paid $9,000 for a business liability insurance policy for a 1-year term. 6. 3/1/2017 Paid $12,000 for one-year office rental. 7. 3/15/2017 Purchased 13,000 in Office Supplies on Account 8. 4/30/2017 Purchased additional Office Supplies on Account totaling $8,000 9. 5/15/2017 Paid entire invoice for Office Supplies from 3/15/2017 for Office Supplies 10. 9/1/2017 Received a $175,000, 3-year loan from Chase Bank with a 5.25% interest rate. Interest is payable semi-annually (2/28 and 8/31) 11. Earned $845,000 for consulting services provided in 2017: a $620,000 was received by customers in cash b. $225,000 was billed to customers 12. Paid salaries for employees of $362,000 13. Paid Utilities of $55,750 14. Received $125,500 in cash for customers from transactions already billed 15. Received $80,000 in advance for services to be provided in 2017 16. Declared and Paid a $35,000 dividend Step One: Journalize the above transactions, post to the ledger (T-Accounts) and prepare an unadjusted trial balance. continued on next page Step Two: Prepare all necessary adjusting entries for the year. Additional information is below. (Note: the items below are not the only adjusting entries necessary) Building has a useful life of 20 years and a salvage value of $14,000. Prepare the year end adjusting entry Equipment has a useful life of 8 years and a salvage value of 7,000. Prepare the year-end adjusting entry Employee's salaries for the last week of December and not yet paid total $2,600 After reviewing the A/R aging, management estimated that approximately $15,000 will not be collectible Utilities Expense incurred but not recorded totaled $2,200 A physical count of office supplies noted a balance of $6,250 Services provided but not yet billed totaled $42,500 A review of the unearned revenue account noted that $30,000 of services remained unearned at 12/31/2017. Post all adjusting entries to T-Accounts Step Three: Prepare an adjusted Trial balance after posting all of the above entries. Step Four: Prepare an Income Statement, Statement of Retained Earnings and Balance Sheet for the 2017 year. Step Five: Prepare all closing entries for the 2017 year, post the entries to your T- Accounts and prepare a Post Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts