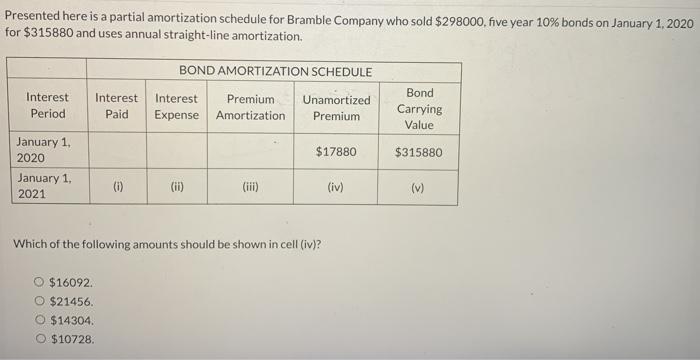

Question: ------------------------ Presented here is a partial amortization schedule for Bramble Company who sold $298000, five year 10% bonds on January 1, 2020 for $315880 and

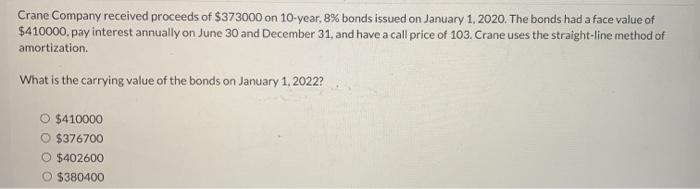

Presented here is a partial amortization schedule for Bramble Company who sold $298000, five year 10% bonds on January 1, 2020 for $315880 and uses annual straight-line amortization. Interest Period Interest Paid BOND AMORTIZATION SCHEDULE Interest Premium Unamortized Expense Amortization Premium Bond Carrying Value $17880 $315880 January 1, 2020 January 1 2021 (0) () (iv) W Which of the following amounts should be shown in cell (iv)? O $16092 O $21456. O $14304 $10728 Crane Company received proceeds of $373000 on 10-year, 8% bonds issued on January 1, 2020. The bonds had a face value of $410000, pay interest annually on June 30 and December 31, and have a call price of 103. Crane uses the straight-line method of amortization What is the carrying value of the bonds on January 1, 2022? O $410000 O $376700 O $402600 $380400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts